From a tax perspective, a Solo 401(k) AKA Individual 401(k) is one of the most attractive retirement solutions for solopreneurs. The Solo 401(k) also allows you to cover your spouse, if you have other employees though, you have to consider other options, such as a more traditional 401(k) program, or something like a SEP-IRA or […]

Integrating an Accountable Plan with S Corp

An Accountable Plan is something that a company adopts in order to manage employee reimbursable items. In general, such a plan means that the employee’s expenses are not considered income, whereas in a non accountable plan system, they would be.If we consider the deduction of mileage as a business expense, some people might use Schedule […]

Section 179 Property, Bonus Depreciation and Regular Depreciation

This topic is particularly useful for those who run their own business, and particular boring for those who do not. Long story short, you might hear about how ‘businesses can deduct their costs’. Well, these three factors are a key part of that: Section 179 Property Bonus Depreciation Regular Depreciation What is depreciation, and how […]

Thoughts on Daily Portfolio Rebalancing with Robo’s

I like Robo’s, especially Betterment as they appear much more human than the wicked Wealthfront. As an advisor myself I find that the strategies they implement offer a lot of food for thought in terms of offering the very best to our clients.One thing that does bother me a trifle is the use of marketing […]

Social Security Restricted Application really exists

I’ve spoken about the changes to Social Security in the past, here’s a post on them. I’ve just spent the past hour on the phone with the Social Security Administration and out of frustration want to issue this PSA.Social Security Restricted Application STILL EXISTS for those born before 1954. The restricted application strategy is as […]

The Pattern

The Pattern is what I call the path of most efficiency, the order in which things should be done. Everything has a Pattern, here’s one you might understand and can apply to other things. For my morning coffee I sometimes have to wash a French Press. This means that I need water from the one […]

Introducing Guide Wealth Management

I created Guide Wealth Management to prove that you could offer exceptional quality of service for a reasonable cost. We launched almost a year ago in New York and I wanted to explain what the firm is about today, and how it dovetails into Saverocity Finance, and the Finance area of the Forum. Financial EmpowermentI’ve been […]

Private Pensions – know your options

Private Pensions offer the holder a multitude of options, in extreme cases I have reviewed plans with over a dozen different choices for the account holder. Here’s some key criteria that you should consider when reviewing your options: Make sure you are vestedBefore we look at the options, it is important to ensure you are […]

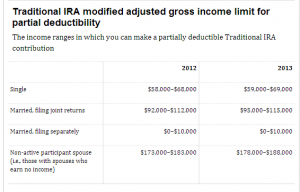

The Difference between a Rollover IRA and a Traditional IRA

A rollover IRA is used to receive funds rolled from outside custodians. This could be other IRAs, and also employer sponsored accounts like a 401(k). The Rollover IRA is essentially the same as a Traditional IRA, but there is one important factor to consider:If you roll in funds from employer accounts to a Rollover IRA […]

Basis reporting for Capital Gains and Losses

Whenever you close a position in a taxable account, a tax recognition event occurs in that year. When it comes to reporting this to the IRS,the process isn’t as smooth as it should be, errors occur at various stages of reporting, and whether you use a tax preparers such as CPA’s or EAs (Enrolled Agents) or […]