Are You Paying The Right Income Taxes? Combining Tax Planning With Financial PlanningIt’s that time again! The mad rush to understand undecipherable tax forms, collect long-lost receipts, gather 1099s and decide how honest you or your accountant will be in your tax return preparation.Ah, but is that really the best approach? Are you paying the […]

The Magic of a Name – Becoming Master of your Money

When is a door not a door? ….. When it is ajar.I have long held an interest with stories of magic, from the Greek Tragedies to modern novels, I find the story telling a fascinating thing. One thing that I found throughout my time reading such novels has been the power of a name, from […]

Save Money with Apartment Group Rates for Cable/Internet

I cut the cord on Cable back when I thought it would be a cool blog post, and I like to practice what I preach, and somehow have managed to survive with a mix of Hulu and meditation. However, I can’t live without internet, and today found out that yet again, I have been over […]

Taxable Nature Of Rewards

The abridged answer to this question is: I don’t know for sure, and I am not a tax professional, and please don’t try to sue me for anything – thanks for stopping by!I was looking recently into the Upromise Program, it offers some of the most generous Online Shopping Portal bonuses available, if a store […]

Motif Investing Bonuses $100 for $1,000 Brokerage and $150 for $5,000 IRA

I wrote about Motif some time ago, and am enjoying their product, Motif Investing An Introduction and Review explores my experience opening up the product. Motif is currently offering two new account bonuses:$100 for each of us if you open an account using my link, fund with $1,000 and make 1 trade for $9.95$150 for […]

Bottles and Glasses – finding value from the human factor

I’ve really been interested lately by how much value can be created from leveraging the human factor in a transaction. The example that I think sums it up nicely is found, as ever, in Wine. And as they say, in vino veritas.I’m constantly calculating value equations, for one I enjoy it as a process, and […]

Chasing Alpha – how to optimize cash investments to beat the market

This post was motivated by two very different conversations that I have had in the past week. The first was an idiotic approach to Emergency Funds that people told me was savvy, and the second was a chat about returns from bank bonuses. What I like about keeping the conversation on the emergency fund/loose cash […]

Actually giving a crap about Fiduciary Responsibility

Certain people within professions are given ‘Fiduciary Responsibility’ and it has been my experience that they can use this to betray our trust. This post will explore what being a Fiduciary means, why it is flawed, and how it can be used against you.The term Fiduciary is given to people who act in a position […]

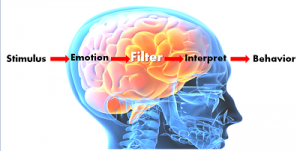

Emotional Finance – Two steps backwards, one step forward

I’ve been hearing a lot of the same questions recently when it comes to money and investment strategy, it is most evident in couples, but is equally present in single people. I’ll focus on the couple scenario since that is an easier way to highlight the battle which is present in everyone.The question I am […]

What is an Emergency Fund?

An Emergency Fund is arguably the single most important feature of your saving and investment plan. There are all manner of articles talking about the fund, and how to be savvy with it, but if you don’t under what is an Emergency Fund you will not have the knowledge to know when a strategy is […]