I know. The whole 1% thing is so negative, but bear with me. Personally, I am totally cool with people becoming super wealthy and going on to spend their money as they see fit. Having money itself never impressed me, so seeing people with their fancy boats and shiny American teeth has always been a […]

Invest in Gold?

People often ask me if investing in gold is a good idea. Having progressed through some of the finest financial planning education in the US, I like to give the answer ‘it depends’. I personally hold a position in gold, and this post will explore the logic behind it, some perils and pitfalls, and the savvy […]

Dave Ramsey

Dave Ramsey. Guru. I am still somewhat on the fence about this guy. Nick, over at PF Digest recently posited the question, Does the Debt Snowball Actually work? My answer would be yes, it does. I’d also go so far as to say that if with Dave’s giant marketing machine he can break through to […]

Basic Estate Planning

Estate planning is something that many people think of just for the wealthy. I would argue that at the very least, anyone who is about to become a parent needs an estate plan in place. Here are the minimums, and the minimum costs I could find for coverage: Last Will and TestamentThis document contains your […]

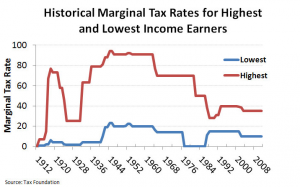

Barack Obama paid an effective rate of 20.4% Tax on his 2013 Return

As you read this post, wonder why I take this approach to the news. My motivations here are indicative as to my approach to Saverocity, and my approach to life in general. When I heard that Barack Obama had filed his tax returns and garnered an effective rate of 20.4% tax, and that I am […]

The story of my life- My resume

The saying, being a big fish in a small pool refers to someone who in the big scheme of things is pretty low down the ladder, but within their own small ecosystem of the workplace are more towards the top. I have broken away from this mindset many times in my ‘career’ and with seeing […]

The impact of future tax changes on your retirement accounts

Many people seem torn whether to contribute to a Roth or a Traditional IRA, this post explores some of the characteristics of both, and how even with the potential for future tax increases, deferring can still be a smarter move.There are two broad categories of retirement account in the US that you need to know […]

How to know when you are being screwed over by your Investment fees, and how to fix that

I’m a little disappointed with myself. We have a 401(k) and a 403(b) retirement plan through the employer of Mrs Saverocity, and they are kinda screwing us over for fees. When we set up the accounts we knew that the fees weren’t optimal, but we also decided that with the employer matching they offered, plus […]

Knowing when to break good financial habits

Installing strong financial habits to your routine is key to being master of your money. However, there are times when rigidity in your planning will cause more harm than good, this post will explore the concept of breaking good habits and throwing your risk profile completely off kilter for the betterment of your wealth. Before […]

Putting your wallet on The Gift Card Diet

I’ve been giving more thought to the post written by MilesAbound here, it challenges whether we should use Credit Cards for regular spend or purely for Manufactured Spend. The post is sound, and you should find time to read it if you own a credit card. In fact, reading it for me was one of the […]