One of the biggest frustrations to high earning people is how to build retirement assets when their income precludes them. Due to salary phases outs many tax incentives do not qualify for such earners, including the Traditional and the Roth IRAs. However, there is a way to create Roth IRA accounts using the Backdoor Roth […]

Do you need an HSA account?

Health Savings Accounts, or HSA’s are a very important part of your financial planning process. They are particularly good for people with high incomes that are seeking to reduce taxation, and work towards that in several ways. Before we go on, we need to quickly differentiate a HSA from a FSA, as the two are […]

My Problem with Robo-Advisor Marketing

I’m in the middle of reviewing Wealthfront, a technology based, self proclaimed advisory firm based in California. I found my review was being distracted by more generic issues with Robo-Advisors in general, so in the effort to keep that review on point I thought to share the generic issues here. The term ‘Robo-Advisor’ is given […]

The Unethical Salesman?

As my frequent readers will know, I love to talk about Ethics and their interplay with established rules and laws. Today I thought to share a little more of my history, and my decision making process. Perhaps it will make you trust me less, or perhaps more and if nothing else I hope it will […]

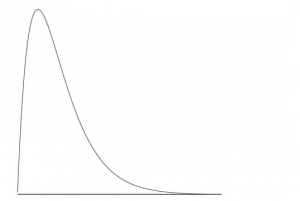

Asset Diversification and Skewing

The key to any sound financial plan is to create something that offers the highest level of reward, for the lowest level of risk. On the reward side optimization typically occurs by keeping costs low, costs most frequently come in the form of fees and taxes. Index funds are a great solution for this. On […]

American Express Fidelity Rewards vs. Ink Cash Card

The title for this post was inspired by the folk at Frugal Travel Guy. They wrote a post yesterday that made my eyes bleed, and I was so enraged that I wasted 14 seconds of my precious young life reading it that I thought to write a retort. For those of you unaware, and there […]

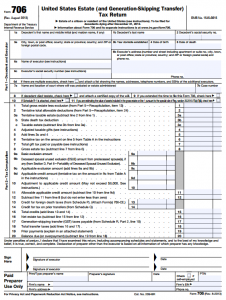

Portability in Estate Planning

I brought some Estate Planning concepts into a post talking about Frequent Flyer miles in order to help people re-frame their risk models. One of the matters that was discussed was Estate Taxes for amounts that are above the 5.34M basic exclusion amount. I only wrote about it as an aside, yet some of my readers picked […]

How to properly locate speculative stocks

Let’s kick things off with a value judgement. You need about 20 single stocks to be diversified, and you need to be able to explore correlations within them to ensure that you didn’t just acquire a slim sector that is highly at risk. As an arbitrary number, I would suggest you don’t need single speculative […]

How to win at Blackjack, and at Annuities

I’ve been known to have a punt on occasion, and when playing in casinos my favorite game was Blackjack for quite some time. Blackjack, for those of you unfamiliar with it is, is often considered to be a game of ’21’ in that the goal is to get as close to 21 without going over […]

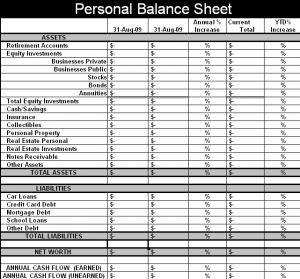

Creating a Tax Aware Personal Balance Sheet

I recently talked about some basic concepts that will help you on the path to wealth, in it I stated the two most important documents you need are the Personal Balance Sheet (listing assets and liabilities) and the Cash Flow Statement (what you spend your money on each month). This post will tackle the Personal […]