Options Trading, the secret to getting rich quickly. I guess if you consider them to be a Zero Sum trade then yeah, someone just got rich off my bad decision. Though as I mentioned earlier in Options Trading 102 its all about the news, so if Citibank knocks it out of the park today then its happy days. However, I am not holding my breath on that happening!

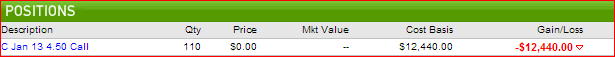

Here is the trade:

So as you can see, my basis was $12,440 and those pessimists over there in Wall St already think it is worth nothing. However the truth is that it isn’t worth absolutely nothing, there are 2 days (at the time of writing this) of Time Value remaining as it expires on Friday 18th January, and that means there is a chance of some news happening to pop the stock. Also… Citibank announces earnings on Thursday 17th January. Therefore if the stock, does pop then I could make all the money back. But for that to happen it would have to rise up above $46 a share, which is a 10% gain… so yeah, they are probably right that it is worthless, but it could still happen. update – Citibank did move on earnings, down 3%. Sayonara LEAPs.

I bought these LEAPs in 2011 full of hope that the market would turn around. Actually I do like Citibank stock and think it will go up, but I bought the LEAP when it was at $43 a share, and then it dropped way down into the $20’s before making its a little too late come back. If I had just bought the equity instead of the options I would have broken even on this trade… just a heads up, don’t get greedy and throw risk out of the window.

A big lesson I learnt from this is that buying options is a risky game, and I now speculate lower, at about $1000-$3000 per trade, and a little safer too with closer to the money plays. I still try to buy the news though, so when I see a small cap stock about to make an announcement on news like earnings I will check out the options plays. Typically small caps move more aggressively than their more larger and established brethren as Large Cap stocks have a more entrenched supply chain and diverse product line.

The good news about losing all this cash? Well, I get to carry the Capital Loss! Hey Ho!

Leave a Reply