Did you know that the most powerful force that can act on your wealth is the miracle of Compound Interest? Actually, based on my readers here I am certain that you did, but some of you may still be leaving something on the table when it comes to making that power of compounding really work for you, by following this simple step you can earn considerably more money from your money.

The Big Secret:

Your IRA contributions, either Traditional or Roth can be made at the beginning of the year rather than at the end of the year. The impact of making this change cannot be overstated enough. Think about it, if you go for an entire year within today’s market keeping funds within a Checking or Savings account the best you could be looking at would be under 1% APR from that money, thought the majority of you likely bank with the big banks like Citi, Chase, Bank of America etc and are actually getting more like 0.01% Interest.

If we are talking about a $5500 contribution per year, the interest earned would be 55 Cents, and before you go out and blow that, don’t forget that checking/savings account interest is taxable, so you are going to lose some of that to Uncle Sam.

On the other hand, the stock markets historic return averages out around 10% arithmetically, and you could have a year of that growth instead of 0.01%. The power of compound interest is such that the year you gain here by putting in at the start of the year has a trickle down effect on your entire investment. Of course, you could (as I frequently do) say that the stock market can crash, and your 0.01% is guaranteed rather than the wild fluctuations that average 10% but that argument is negated by the fact that you were already going to go into the stock market, you are just doing it sooner.

Equally, if stocks aren’t your thing, you could buy US Treasuries that yield around 3%, and whilst the impact of this is obviously smaller on growth, the risk profile is considerably safer, though I might wait a day or two on that til we emerge fully from this latest government silliness, as there is a good chance we will face another sovereign debt downgrade.

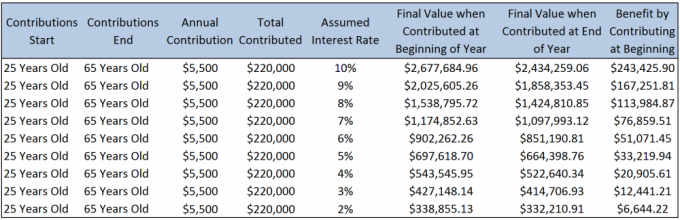

So, if you want to use the historical numbers of 10%, just by contributing $5500 per year in this manner you will net an additional $243,495.90 which is a serious chunk of change, it will help pay for several years of retirement.

Consequences

Every action has an equal but opposite reaction, there is no decision that you can take without it having an impact beyond the benefits. This is generally coined ‘opportunity cost’ when discussing investments and finances.

The opportunity cost here is that by determining to contribute to your IRA at the start of the year you have to forecast income for the to decide, not only if you can afford the $5500 at the end of the year, but also if you should be going for a Roth IRA or a Traditional IRA. If you are close to phase out limits, and a pay raise could put you over these limits you may wish to hold off on early contributions, and conversely if you predict a stable income stream that fits within the bands of the contribution limits then you could feel much more confident in this strategy.

Like this tactic.

If you already have enough saving and are sure you won’t need that $5.5K during the year then putting all of this in at the begging of the year makes perfect sense.

Good post…just to nitpick, you wouldn’t pay tax on the 55 cents. I’m pretty sure Checking/Savings accounts only get 1099’s if they receive more than $10 interest in a year. FreeLunch!

Actually it is a common misconception about 1099s you must declare ALL income however small on your taxes.