Health Savings Accounts, or HSA’s are a very important part of your financial planning process. They are particularly good for people with high incomes that are seeking to reduce taxation, and work towards that in several ways. Before we go on, we need to quickly differentiate a HSA from a FSA, as the two are often confused:

- FSA -Short Term

Use it or lose it– new FSA rules allow a $500 carryover of money, providing that your employer opts in. This is an account designed for smaller health related purchases, such as medical co-pays, contact lenses, eye exams, etc. Funds are not invested, they remain in a checking type environment, with an attached debit card. You fund a FSA annually and you must spend the account in full each year or lose the money inside it. $2,500 annual maximum contribution (2014), deducted from taxes. - HSA- Long term – this account is designed for long term health needs, frequently invested in the market, it is similar to an IRA for your healthcare. You do not have to spend down this account. You can use the HSA for similar medical expenses as the FSA, however you cannot use it for non-prescription drugs (other than Insulin) and check first! $3,300 Single, $6,550 family annual maximum contribution (2014) with a $1,000 catch-up allowance for those over 55. Contributions deduct from your taxes, above the line. HSA’s require pairing with a HDHP.

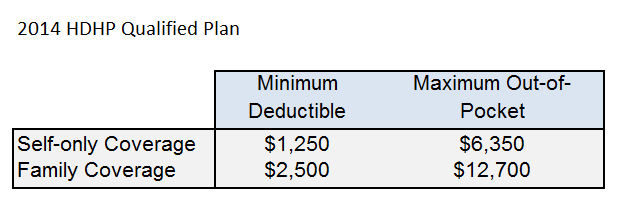

You must be enrolled in a qualified High Deductible Health Plan (HDHP) to participate in a HSA. The limits that qualify these plans for 2014 are:

Other rules of ownership

- You must have no other health coverage.

- You must not be enrolled in Medicare.

- You cannot be claimed as a dependent of someone else.

Why you might need, or want a HSA

It’s all about taxes.

Contributions are deductible – regardless of income

HSA contributions deduct above the line, and do not suffer from the salary caps and phaseouts of IRAs. That means even a person in the highest tax bracket (39.6%) could contribute and take the deduction, which is incredibly valuable. Certain states will also allow deductions for the HSA, though it seems California, New Jersey and Alabama do not (check with your local state to be certain of the current rules).

HSA withdrawal rules

A qualified withdrawal at any age is tax free. There is a partial list of what qualifies here in IRS Publication 502 and another broken down in a little easier to read format here.

If you make a non qualified withdrawal from the HSA it is subject to:

- Under 65 years old, taxes on gain, plus 20% penalty

- Over 65 years old, taxes on gain, no penalty

65 is the magic number

- At 65 you are eligible for Medicare, if you elect to do so you can no longer contribute to the HSA – so if you are approaching that age and want the tax advantages you would be wise to load it up (and use the $1,000 catch up). It is possible to defer the Medicare election, but that has a lot of considerations to factor in, and while it would allow you to contribute to the HSA it may not be the best idea, you would have to run the numbers. Lastly, you should consider the impact of the HDHP in this choice – if you are in poor health approaching 65 then it might be wiser to have a regular health insurance policy in place.

- At 65 you don’t have to withdraw from your HSA, but if you are electing Medicare then you can use the HSA to pay the premiums, so it is a logical thing to use it for.

- At 65… a HSA basically becomes a Traditional IRA. Because you are no longer subject to the penalty you have deferred taxes from when in higher brackets, and can withdraw from the account in retirement. Just like a Traditional IRA, you would pay income taxes on these unqualified distributions. Note, you cannot roll a HSA into a IRA.

A note on Estate Planning

HSA’s can be passed to the surviving spouse without a taxable event occurring, however, if the beneficiary is anyone other than spouse then tax considerations will apply. A non spousal beneficiary will cause the HSA to change status at time of death, there is an interesting article on this from the American Bar Association. For estate planning, and all HSA considerations you should certainly consult with a professional to discuss your specific situation and decide whether it is right for you.

Final thoughts

HSA plans are often recommended for people who cannot access IRAs due to salary phaseouts, or for those who have already filed IRA and other savings plans. They can be offered by most employers, and can be easily established by the self employed. I would recommend not only looking at the math behind the tax savings, but also the short term insurance cost risks associated with the HDHP. I personally declined creating a HSA account based upon my hobbies having high risk of injury, where a regular health insurance policy made more sense, even at the loss of tax deduction.

However, I do expect that if my lifestyle should change, I would create such a plan as long term care and other health costs in retirement are going to be a very large drain on family resources.

HSA’s are one of the best things since sliced bread IMHO. Unfortunately my current employer doesn’t offer one but does provide a “comprehensive” health insurance policy at no “cost” to us. However at my prior employer you could choose between paying like $6k for a similar policy, or more like about $1k for a high deductible plan and then saving the additional $5k in a HSA. The HDP typically has the same coverage once you get over the deductible so really there was no reason NOT to use this. If you got sick you’d wipe out your HSA and then use the insurance. If you don’t, you keep the money in the HSA. If you stay healthy until retirement you’d have a huge pot. In a traditional insurance plan that huge pot would belong to the insurer to cover losses on people who had not been so fortunate.

Yeah, they are great- I opted not to simply because I think the chances of me visiting ER on any given day are above the curve 🙂

Maybe you could set one up through the blog, and divert your revenue into funding it?

Make sure to check out all the fees before signing up. HSAs often have monthly fees on to of regular investment fees that can negate much of the tax benefit unless you’re socking away close to the maximum. Some also have severely limited investment options. Shop carefully.

Good advice for any investment! And thank you for pointing it out, fees and taxes are the two worst things for our savings. The fees I see most frequently are fairly de minimis for those maxing out the family level, but if people are putting small amounts in then they obviously become more of a proportional drag.

In case of Wells Fargo, which I opened last year, there is a $4.5 monthly fee that can be waived as long as there is at least $5K in the account. So preferably we do not get sick or have a lot of medical expenses in the first year so that the balance does not get changed. The following year however, should let us start spending some funds which allowed us to decrease taxes amount anyway as the balance should grow to some $10K after another contributions 🙂

“….hobbies having high risk of injury”

Care to elaborate? 🙂

Martial arts training. I typically train 10-15hrs per week. Has a high injury rate (currently am injured!)

HSAs are indeed the best thing since sliced bread! Some notable points:

1) If you fund it through your employer, tax savings are huge: Federal income tax, social security/medicare tax at 7.65%, even state income tax in most cases.

2) Employer usually throws in some money into your account for FREE! Wife’s previous employer was throwing in $1.5k in the first paycheck of January! New employer throws in $750 per year. Free money is the best!

3) We use it as an IRA type account for health expenses in retirement. So, we fund it to the maximum allowed and pay non covered health expenses out of pocket and allowing it to grow tax deferred and in retirement we will pay our health expenses…tax free!

4) They are portable if you change employers.

4) Most HSAs allow a window for you to invest your funds in the financial markets. Check the fees.

5) Most HSAs money market accounts do pay substantially more interest than you get at bank savings accounts. Yeah, it is still pathetically low comparatively speaking. But that’s a different story all together.

Awesome – thanks for the additional info George!

You’re mixing up prescription drugs with non-prescription drugs for HSA restrictions. You used to be able to use it for either, but since 2011, you can’t use it for non-prescription (over the counter) drugs without a doctor’s prescription, with diabetic supplies specifically excepted I believe. You can and could always use it for prescription drugs unless they were for cosmetic reasons.

https://www.hsaresources.com/faq/

Yep – you are correct – thanks. I’ve updated that.

Thanks Tim I was starting to worry as I had used an HSA for prescriptions. Thanks Matt for teaching us about the HSA. My mom was cool enough to set up an HSA account for me in college while working for their company and she just said only use for docs and scripts. I just rolled with it. Still have the card and it still has money on it. So even though I moved on it’s still paying off for copays and scripts.

Also, good to use as an emergency fund! See article from DQYDJ:

http://dqydj.net/how-to-make-an-emergency-fund-with-your-health-savings-account/

No No No No No.

Well, yes.. it can, but it is far more complicated than that… there is too much leaning on a nuance of the ruleset and not enough understanding of the events that would be required to build that strategy. I like DQYDJ a lot, and his point is interesting, but it doesn’t work as EF for most people at all.

1. EF must not be invested in the market.

2. This strategy would require sufficient medical expenses to be collected to build a free pass into the HSA, which would take years, until which time you need to have a real EF in tandem and double up. If you can do this, then it can happen, but it isn’t a way to store emergency funds for today.