I wrote about Motif some time ago, and am enjoying their product, Motif Investing An Introduction and Review explores my experience opening up the product. Motif is currently offering two new account bonuses:

$100 for each of us if you open an account using my link, fund with $1,000 and make 1 trade for $9.95

$150 for you for opening a IRA Account and funding with at least $5,000 (note that Rollovers do not qualify for the bonus) Motif is SIPC insured.

Terms

The credit applies to Motif Investing IRA accounts funded with a transfer of at least $5,000. A transfer is defined as an IRA to IRA transfer (rollover does not qualify). Funds must be transferred between February 1, 2014 and May 31, 2014 , and remain in your account for a minimum of 30 days to qualify for the offer. The amount will be credited to the account within 30 days of funds being received. Motif may modify or terminate this offer without prior notice. This offer cannot be combined with any other. One retirement account promotion per individual customer.

Deadline for 2013 IRA contributions is April 15, 2014. Maximum contribution limit for tax years 2013 and 2014 is $5,500 ($6,500 if you are 50 or older), or 100% of employment compensation, whichever is less.A distribution from a Roth IRA is federally tax-free and penalty-free provided that the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, qualified first time home purchase, or death. For Traditional IRAs, penalty-free withdrawals include but are not limited to: qualified higher education expenses; qualified first home purchase; certain medical expenses; disability, and other conditions. See your tax advisor or refer to IRS Publication 590 for further information and to find whether a Traditional IRA or Roth may be the right choice for you. Motif does not provide any investment, tax, or legal advice and suggest you contact your own investment, tax, or legal advisor for further information your investment strategy.

Standard pricing: $9.95 total commission per motif transaction, or pay $4.95 per stock for individual transactions within a motif. Other fees may apply. For details on fees and commissions, please click here.

Investing in securities involves risk, including the possible loss of principal. Individual investments or a collection of individual stocks such as motifs which are concentrated in an idea or theme may face increased risk of price fluctuation over more diversified holdings due to adverse developments within a particular industry or sector.

You’ve received this message because you’ve registered for Motif Investing. If you no longer wish to receive Tips and Offers, please update your email preferences.

P.O. Box 3548, Rancho Cordova, CA 95741

© 2014 Motif Investing, Inc. All rights reserved. Member: FINRA / SIPC

(Bolding Mine)

How Motif Works

Motif is pretty cool in my opinion. It allows you to build a basket of publicly traded stocks and ETFs which they call a ‘Motif’ so you could pick a bunch of individual stocks, or you could use it to build a classic passive investment portfolio.

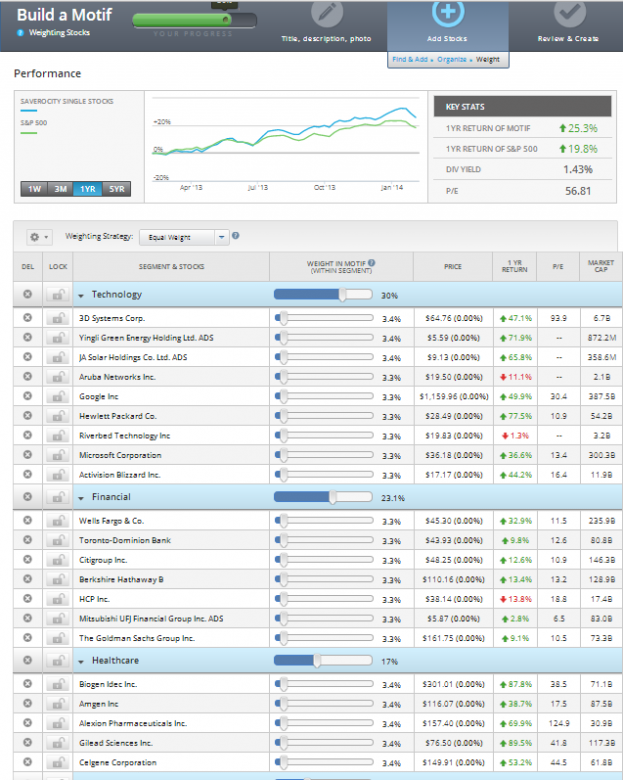

Here’s an example of a Motif I just built with 30 stocks picked, first you choose the stocks, then Motif orders then by Sector and allows you to allocate a weighting within the Motif.

The Motif Allows fractional shares, so I could own all 30 companies for a predefined amount, such as $900, pay a single $9.95 trade fee to buy them all, and then in the future, if I wanted to re-allocate or re-balance these 30 I would pay that trade fee again. It’s interesting to see the 1yr return of the stocks I picked so I can factor that into my decision making.

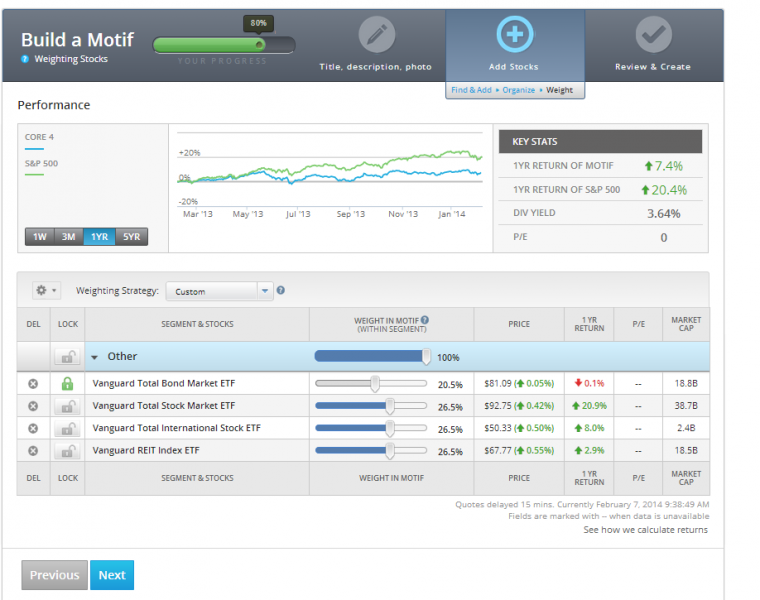

Building a lazy 4 fund portfolio

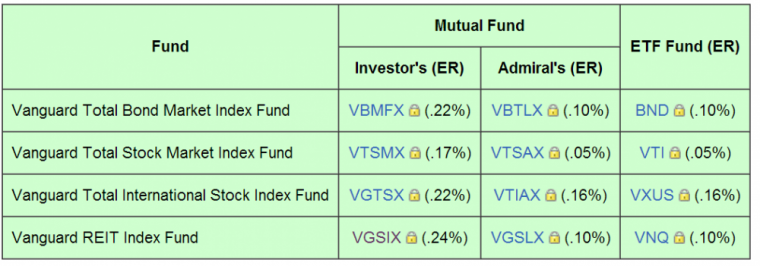

The Motif doesn’t mean you have to trade stocks or hold individual positions, you can also build a solid, stable ‘lazy portfolio’, the Core 4 Portfolio is described by Rick Ferri as the cornerstone of any portfolio and can be built in Funds or ETFs for a similar cost, it looks like this:

Within the Motif you could build this in seconds:

Some might argue (myself included that BND has no place in a portfolio right now, as it contains too many long term bonds within the fund which are simply asking for a haircut when interest rates inevitably rise, but from an asset diversification perspective some sort of bond allocation is a good idea (I’d be looking at short term 1-2 years to maturity options).

Worth the hassle?

The $100 bonus for $1000 is a slam dunk for me, it requires you make a single trade and for which you net an immediate profit of $90.05 on your $1000, or a 9% gain. Because it allows you to move into something stable like a Core 4 allocation it is as risk managed as any investment and a good place to put some play money – don’t get involved in the stock market with money you might actually need anytime soon.

The $150 bonus for $5,000 (I don’t have a link, so I would get in touch to confirm your account bonus prior to opening) offers a 3% immediate gain, they want you to keep the account for at least 30 days to qualify for the bonus, and the $150 should be considered a credit towards building a position, for $9.95 and then a boost to the account of $140.05

You can, if you dislike Motif, roll out your IRA into any other provider, and these companies will help you with that, but since you can also buy ETFs within your account you could also simply just by $5,000 of VTI and let it sit. Frankly, there isn’t a lot not to like about Motif, but I have built many alternative investment accounts this year and there is something to be said for having your accounts all at one place for simplicity, but at the same time, there is something to be said for chasing these free bonus to boost your savings, especially if you are at the start of your saving lifecycle where every $100 counts.

Matt,

I’m also a big fan of motif. If you rebalance once a year it will cost you only 10 bucks a year (plus etf expense ratios.) Pretty great.

If you are uncomfortable with BND, why not structure your lazy portfolio with SHY or SHY/VCSH? short term treasuries and investment grade corporate bonds have exceedingly low credit risk and minimal if any interest rate risk.

Alexi

Skeptical about this, as I was when you first mentioned Motif.

Is there an existing Motif that replicates/is the core 4? Are there fees for automatically re-investing dividends? Are there additional management fees that would not be incurred by holding the core 4 in a Vanguard acct.

It looks like $9.95 to trade, then $9.95 again to trade the $100 bonus, then $9.95 to close out?

Not eager to jump in on this one, sorry.

Harveson,

You can make any motif you like using any etfs or stocks ( up to 30 total)

I believe dividends are held in cash which you can then invest when you rebalance.

AZ

Hey Harvson,

Let’s see:

Skeptical about this, as I was when you first mentioned Motif. –Good skepticism is key

Is there an existing Motif that replicates/is the core 4? –Don’t know, and it isn’t relevant because if there isn’t build one in 20 seconds.

Are there fees for automatically re-investing dividends? –I guess so, as MD mentioned I think they go to cash. But at 1.79% annual dividend from VTI it is negligible in the $1000 account.

Are there additional management fees that would not be incurred by holding the core 4 in a Vanguard acct. –Only the transaction fees of $9.95.

It looks like $9.95 to trade, then $9.95 again to trade the $100 bonus, then $9.95 to close out? –If you wanted in and out it would be $9.95 to trade, $9.95 to close out. You wouldn’t need to trade the bonus, it would be in cash.

Not eager to jump in on this one, sorry. –No worries.

You were correct to bring up the roundtrip cost of the transaction, I had overlooked that. But even so, your profit roundtrip is still $80 on a $1K investment, which is very good.