Today, I would like to explore my own set of Principles as it comes to saving and investing, to look for incongruous actions or habits, and attempt to align them, by adjusting my principles to incorporate them, or discard those that are not efficient. The reason for this is a feeling of dichotomy between my accumulation, saving and investment principles for monetary, and for reward programs. Can two opposing strategies co-exist, or is the presence and attraction of one a direct contradiction of the other?

On Money

I have been convinced to believe that a Passive Investing approach is the best one for my money, that active investing and picking stocks individually will fail to perform as well as Passive Investing, and that I should, in the words of Vanguard’s founder John Bogle ‘forget the needle and buy the haystack’.

This approach would have me buy every stock I can, in the form of low cost Index funds, along with every bond I can, in the form of a low cost bond fund, and then just keep buying more and more and more of these two funds. More elaborate strategies have the two funds further subdivided into perhaps 4 funds.

The concept here is to have a massive degree of diversification, so that I am protected from individual swings in value. Of course, the principle here is to be protected from a downward swing, though the cost of that is that you are also protected from an upward swing in price of any one stock.

On Points and Miles

I have been convinced to believe that I should have minimum diversity; there should be enough of a balance in 2 or 3 programs that are attached to different alliances, so that I can book flights either within those programs or by leveraging the relationships with partner airlines. Similarly I should also have 2-3 hotel programs available so that I can ideally have more than one option in each city I plan to visit. A more robust strategy would also include having a cash back card tied to travel such as the Barclaycard Arrival which offers 2% Cash back and 10% rebates when you use that cash back on Travel.

It is accepted that having a small number of points spread across a large number of programs, or mass diversity, is not a good strategy because a person would be in a situation where they didn’t quite have enough points to make an award trip happen. It is also accepted that unlike monetary assets, such as Stocks and Bonds, the value of miles will very rarely go up (on occasion, when a program offers a reduced price award such as the IHG points break hotel award; or SPG promotions for 50% of reward stays the points do temporarily increase in value).

Does the above strategy sound familiar to you? For me it sounds like a strategy that a savvy points’ traveler and a financial investor would follow, it is what I presently follow, to some extent. But the gnawing feeling that the principles are misaligned prevails.

To Summarize:

On Money, I should diversify to protect from both upwards and downwards movements of the market. On Points/Miles I should not diversify, and these can pretty much only move downwards (devaluation of points is a ticking bomb, and sure to occur).

From those two facts alone, one could therefore infer that diversification is only to protect against profit, which is complete madness… if loss is sure to happen one should not diversify. The gnawing feeling intensifies…

So, whilst I feel that I have been misled into diversification, there is something that is categorically different regarding the points based saving/storing model. It is a race to reach the next milestone (award redemption price) and lock it in prior to the goalposts being moved by the loyalty program, as such the diversification strategy works against us, as it takes too long for the average person to accumulate miles using a dozen different cards for spend.

Phew! But wait…. Are there financial assets that also require milestones?

If you were to invest anything, even $100 into stocks or bonds you would immediately be earning (or perhaps losing) at the same rate as if you invested $1000 into the same asset classes, very different from the points game, compare that with say, 3000 Hyatt Gold Passport points, which would mean nothing alone, but if you were to have 30,000 you could start booking nights in their nicest hotels. This is serves as an example of how Stocks and Bonds are not milestone investments.

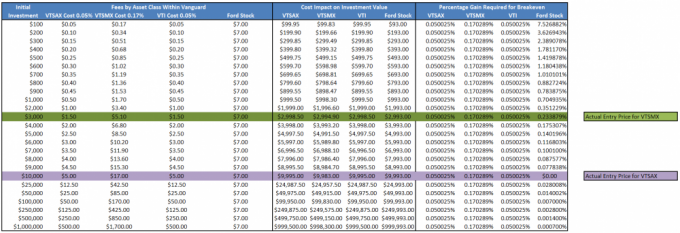

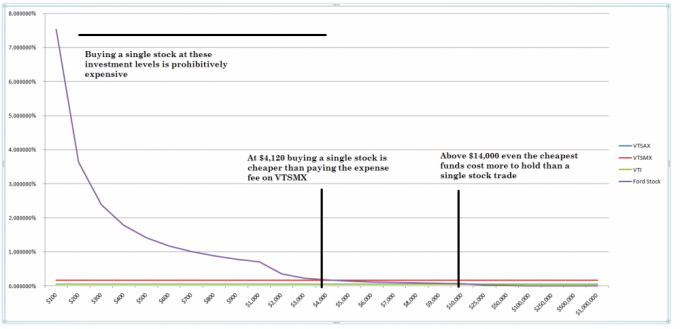

However, due to trade fees that are associated with the transaction, the acquisition of stocks and bonds too soon can be prohibitive. For example, if you were to have a brokerage account with Vanguard and sought to acquire $100 of Ford Stock the trade fee would reduce your investment dramatically, and you would require a 7.5% gain from the stock in order to just break even. Not withstanding that if you ever wanted to sell that stock the fee would be duplicated. From this we can deduce that buying a single stock too early will be the wrong move for an investor.

However, if you were to consider funds, you will actually see a way around this problem. For example, our friend John Bogle decided that if you wanted an index fund from his firm Vanguard you could enter it at different levels, if we look at the opportunity to invest in the “Total Stock Market” here are 3 different approaches:

Vanguard Total Stock Market Fund Options:

- VTSAX is perfect If you want a piece of the entire market, it requires a $10,000 minimum investment and has a 0.05% Expense Ratio with no trade fee.

- VTSMX offers the same exposure, but has a lower entry price of $3,000 minimum investment, and a higher 0.17% Expense Ratio with no trade fee.

- VTI is an ETF version of these funds from Vanguard that allows an entry price of 1 Share, which is currently $86.48 and has a 0.05% Expense Ratio – this will require a trade fee of $7 to purchase, but this is waived if you are trading within the Vanguard Platform.

These all offer the same funds, but charge you differently for the honor. If we were to transliterate those fund costs into each category, what we see is whilst there isn’t a need for milestones in theory (as Vanguard allows you to get in the game and earn from $86.48, their product diversification creates synthetic milestones.

The entry point to receive gratification has been lowered, making a stock market acquisition viable, but due to fee structuring, whilst you can get in, if you do so at the wrong level you will be penalized.

Despite waiving the brokerage transaction fee for its own ETFs like VTI, Vanguard will charge a small management expense fee, and what we can see is that after a certain price point occurring, that the flat $7 fee is much more desirable than paying even industry leading low fees as percentages. This is the tipping point where we should look at purchasing individual stocks as a viable option.

So from a savings perspective, we can see the milestone concept in action, however the differences here are not game changing, I think the concepts might well be. It has long been a goal for me to map out the best route to financial freedom. Ultimately financial freedom is a number, which is directly correlated to consumption.

What we can see from the data from Vanguard is picking the wrong price point to engage in an asset acquisition can cause serious impact to wealth generation. If a person was to opt to wait to forgo single stock purchases until they had sufficient capital to buy at $4,120, where it becomes cheaper to buy a single stock for $7 than own VTSMX at 0.017$%, or even more so at above $14,00 where it is cheaper to buy a single stock than either VTSAX or VTI, and would require much less growth from the market in order to reach break-even point. This is a prime example of selecting the correct order of asset acquisition.

In other words, we have learnt that by following a milestone approach properly, we could take two people, with the same financial situation, and by refining the order in which assets are acquired perhaps can influence the time it takes to achieve different phases of affluence. We can see that it is not wise to hold individual stocks until you reach a certain level of wealth – and as such they are a milestone asset that should come further down the path than other assets.

Now, of course the value in Funds vs a single stock is Diversification…. to protect us from large increases and decreases in portfolio value. However, I would suggest that this is a good defensive strategy, but it might be that we become more defensive later in life once a certain series of milestones have occurred, rather than at the beginning.

Questions that we need to address to find the path include: should we pay off our student loans, or put a down payment on an investment property? Should we pay down our mortgage or over-fund our IRA? Ultimately we may find ourselves in a place where we have complete financial independence and a healthy and diversified asset allocation but is it best to spread out from the first $100? In the case above you could recommend stuffing your first $100 under the bed for 6 months, until you have saved $200 and then invest it in the same asset, the Ford Stock in your Vanguard account, and be ahead of the game.

The rules of the paradigm for the milestone saving methodology must incorporate tax planning, it must also must be flexible enough to adjust and align with external socio-economic drivers. It must also work for everyone, from negative net worth through to full financial independence. Age will have to play a very large part, because number of years remaining for our working life is a critical factor.

What do you think, should we look at Financial Investments as we look at points and mile acquisition, or should they remain distinct, and have opposing strategies?

Leave a Reply