Installing strong financial habits to your routine is key to being master of your money. However, there are times when rigidity in your planning will cause more harm than good, this post will explore the concept of breaking good habits and throwing your risk profile completely off kilter for the betterment of your wealth. Before I go on, this is a dangerous post, because of two key factors: firstly in order to break a disciplined financial plan you must already have one in place, you must go through the Kihon, learning the basics, vanilla way to manage your money before casting it away and going back to what might seem to be a less refined version. And secondly, breaking a plan can devalue it from a behavioral finance perspective

This concept is akin to the Japanese learning experience of Shu, Ha, Ri which can be roughly translated as ‘learn’, ‘absorb’, ‘forget’, though you aren’t ever actually forgetting anything, you are simply casting away attachment to the concept in a perpetual cycle of refinement. The problem with Shu Ha Ri is that people do not spend enough time at the lower levels, those which are to learn and internalize a concept, they often race through and try to refine before truly knowing the subject at this level of inspection.

The real danger of Shu, Ha, Ri though, is that at the end people can use the Ha level as an excuse to cast away the concept too soon. For the examples we discuss today it would be very dangerous for a person to attempt what I outline here without first having a disciplined approach to their budget. In other words, what this can mean is that if you are willing to break a promise or a rule once, for a specific reason, your brain may decide to have devalued that promise across the board.

In the example we explore today that will mean that if you are encouraged to go against all good advice, run down your Emergency Fund to zero, or sell your stocks for a specific event that makes sense now, you may from now on trick yourself that it is OK to spend your emergency fund on something wasteful, since you have damaged the integrity of the fund – that is a very real behavioral issue you need to be mindful of, as such you should not attempt what I suggest unless you think you are capable of doing this.

When to break the rules

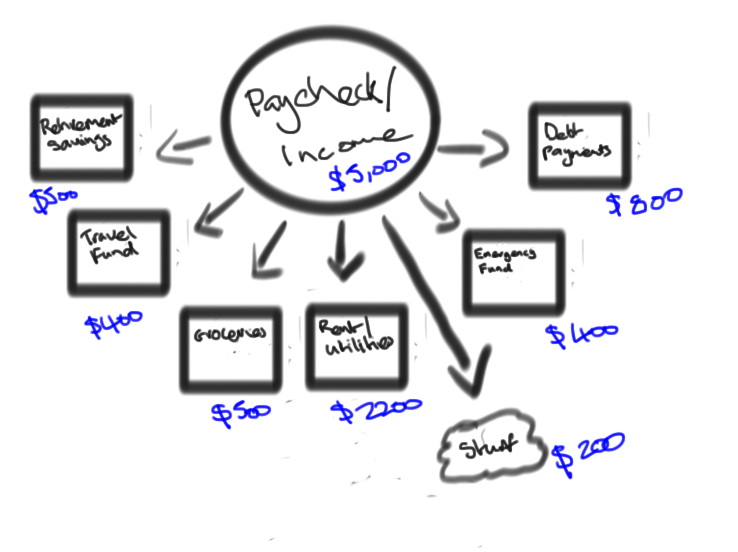

I outlined one of the most powerful rules to controlling your finances in the post The Magic of a Name where I explain how if you allocate your paycheck/income to specific monthly goals you suddenly have less ‘free money’ that floats around, and you not only work towards financial goals, but by its nature you also aren’t in the same position to waste your money as it is allocated – it uses a ‘bucket concept’ as outlined below.

In the first example, with no allocation of income you have a nebulous monthly outflow called ‘stuff’ with an abundance of income you will be more likely to think of everything as ‘stuff’ and be happy to spend more on luxuries than might be wise, leaving no money to pay down debt or save for retirement.

In the second example we take the same income, but allocate the paycheck into differently named accounts, this results in only $200 of ‘stuff money’ each month, meaning that goals are met. You can name the buckets what you like, and allocate as much or as little as you want, but by doing so you gain mastery of your money. The way that you allocate your buckets is determined by a combination of your own personal risk tolerance and also your financial goals. The Naming of Your Money is the Shu (First) level of learning, once you have done this and really understand how it works for some time you can say to have progressed to the Ha (second) level of learning. The Ri level, which is the most dangerous, but also most rewarding, comes next.

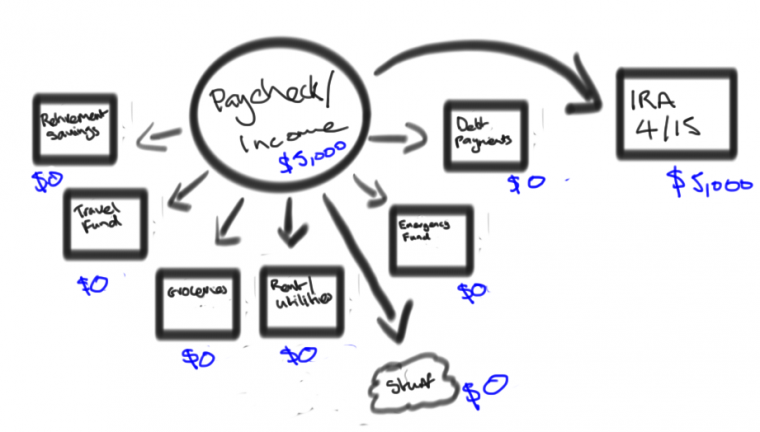

The third example asks you to break your pattern. In the (timely) example given here I suggest that you cancel all buckets and throw the entire amount into an IRA in April, you have under one week from today to do this as the deadline (for last year’s funding) is April 15th. Now, of course if you were to just stop paying rent then you would be facing eviction, so in practice there are some payments you always have to make, however oversimplifying this model highlights the pressure you should face in order to become wealthy. If you instead took the approach of saying, well I must pay $2200 in Rent/Utilities is more likely that you would also ‘settle’ for just putting $2800 into the IRA yep, that’s great, way better than many of your peers are doing, but it could be better.

Changing your Risk Profile in Relation to Changes in Reward

If, and only if, you have established a bucket system based on your risk profile, you should consider that your risk profile is variable in relation to the potential rewards. All investments come with risk, and all should come with suitable rewards for such risk. For example, owning a Bond has some short term risks such as inflation rate changes, for which you get a reward in the form of yield. Owning startup stock has higher risks from a large cap stock, so it should pay you more when the news is good.

Breaking into your emergency fund savings

The size of your emergency fund should be correlated to your decision on what the impact of an emergency would have on your wealth. If you decide that you want 6 months of income in there ($30,000) for the example in the diagrams, that is because you think any less would be detrimental to your wealth. However, if you were suddenly told that there was a no risk opportunity that lasted for 1 day only and could return an immediate 20% ROI to your Net Worth, you might well be inclined to risk some of that fund, because the guaranteed increase in upside outweighs the potential downside loss should a real ‘emergency’ occur and you need that cash.

If someone (other than me) calls you up to say they have a limited time deal that will guarantee a 20% ROI you would be smart to run for the hills. As Benjamin Franklin wrote, there are only two certainties in life, Death and Taxes. Luckily for you, this concept deals with Taxes, so it is a safer bet.

If you can find a way to contribute (up to $5500 per person, plus another $1,000 if 50 and older) into a Traditional IRA you will get to deduct that amount from your income for last year, you will pay taxes on the withdrawal in retirement, but hopefully at a lower rate. Alternatively you can fund a Roth IRA and the money will grow Tax free, but you cannot deduct the contributions.

The importance of these contributions is that they annual amounts that expire on 4/15 of this year, for last year’s contribution; if you miss the deadline the opportunity is gone. That this occurs as fixed date in time means that if you have a rigid savings plan that sets you towards a long term goal is that you can miss out on opportunities like this, by sweeping up all of your buckets and targeting everything at the time dated event you will increase your wealth significantly.

Putting yourself into debt to meet an obligation

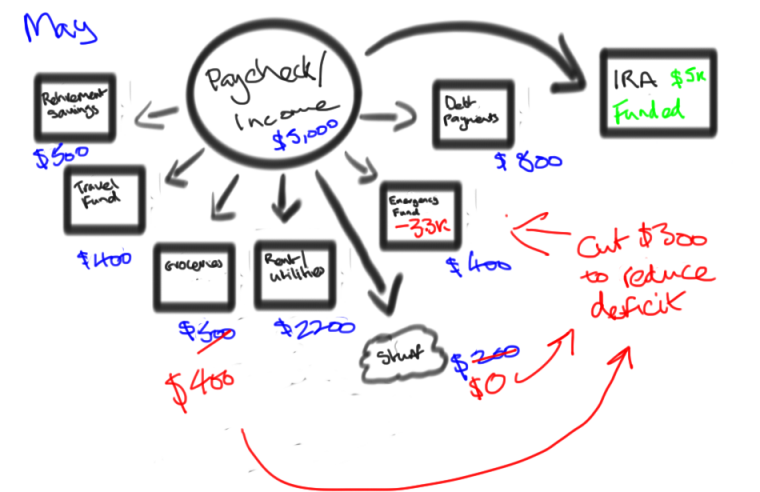

In the month of April in the diagrams I used you are actually running at a deficit on your other payments in order to meet the IRA contribution, so in March you need to restock. If you had decided to raid your Emergency Fund to make this happen then you need to cut back on other spending to get it back up to par, while you aren’t technically indebted to someone else, you are to your own plan and must make adjustments.

By shaving off $100 from Groceries, and allocating the $200 that was just ‘stuff’ you can restock your Emergency Fund.This is the danger zone – if you are willing to ‘borrow’ for a non emergency, do you have the discipline to restock the fund and not dip into it for a non-emergency? It isn’t easy to have the discipline necessary to break habits in reaction to timed events. At an extreme, there are actually times when borrowing money with interest is worth doing to fund opportunities like this, however the risk profile of such an approach is very high indeed.

Another example of a timed taxable event would be selling losers in December

You can capture capital losses at any time, but once the date ticks past December 31st for the trade to be completed (I would advise trading by Dec 24th for plenty of wiggle room) you cannot capture for that year. Remember that Cap losses can be used to offset gains and also carried over for $3000 against your income – capture more than $3000 and it will rollover to future years.

This might be another time to break habits – you may have disciplined yourself to be holding 60/30/10 (Equities, Bonds, Cash) as you don’t want too much cash sitting around, but selling 100% of your stock position, should it be losing would make you 30/70 (Bonds/Cash) and completely off your risk profile, however the reward for breaking the profile would be guaranteed tax benefits. When doing this watch out for re-entering the same positions too soon for danger of triggering a ‘wash sale’ judgment from the IRS that kills your cap loss harvest.

Other events can happen that are less guaranteed, as nothing is as good as taxes, but you may wish to be able to break from a regimented pattern, only if you can first prove to yourself that you can stick to one, and evolve through Shu,Ha,Ri.

Its a shame that your best post garners no comments when in fact an article like this is priceless. Such good stuff for someone that hasnt thought this way before. Pretty concise not sure if I could have explained it this compact. Nice one.

Thanks for the kind words, nice to see someone likes it! A very powerful concept here if people can control it properly.

Great post Matt.

Thank you!

Great stuff. These posts are evergreen.

Thanks Asar, glad you liked it.