I’m a little disappointed with myself. We have a 401(k) and a 403(b) retirement plan through the employer of Mrs Saverocity, and they are kinda screwing us over for fees. When we set up the accounts we knew that the fees weren’t optimal, but we also decided that with the employer matching they offered, plus the opportunity to move $17,500 out of our taxable income, that it was a smart move. However, it looks like I may have made an error in judgement when I discussed these accounts with my wife back in 2011, I may have missed a fee that was buried in the plan we selected. It isn’t earth shattering, but it is worth noting.

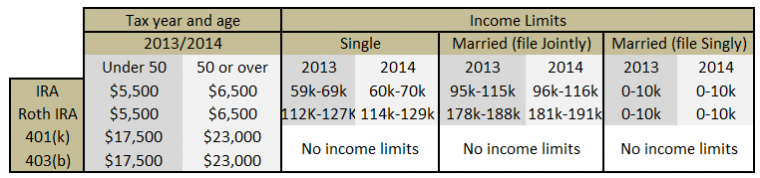

If you are offered an employer sponsored retirement plan that has poor fund selection options and high fees, opting out of your employer plan altogether is possible. The problem with that route is it automatically caps the amount you can contribute to retirement to the amount of the much lower IRA, and frequently salary levels mean that access to IRAs are not available to everyone.

I understand that not everyone will be able to contribute the full $23,000, however if your debt is under control then loading up 401(k) and IRAs with such hefty annual amounts puts you far ahead of the pack when it comes to retirement savings, and for me personally is a goal because it means I dramatically reduce our tax bill each year – by a five figure sum.

The real difference (other than the contribution amounts and salary limitations) between a 401(k) or 403(b) and IRA programs is that the former plans are Employer driven, they are a perk of the job. Many employers have arranged a relationship with a plan hosting provider, such as Metlife to execute on the plan, and these provide the infrastructure support to deliver. ERISA is a set of legislation that applies to employer provided plans, and is in place to protect the holders of the plan, it doesn’t cover IRAs. I believe ERISA is too limited in scope, and simply having these rules in place does not stop you from having a really bad plan in place.

The plan that Mrs Saverocity has been offered from Metlife is really bad, the fees are high, the penalties are high, and their reports are sketchy. I’ve thought myself to be fairly savvy financially for some time, but back in 2011 some products were new to me in the US, and I suggested we split our money between their 401(k) offered by CIRS and a 403(b) variable annuity offered by Metlife.

In fairness to me, both were pretty crap options, and the data wasn’t presented well at all, one could think that they actually deliberately obfuscate the data provided to make you think there are no fees at all… I did a fair job of searching through for data on these plans to find the fees, not an easy task in and of itself. Ultimately we were able to make a calculation based upon deducting the spread in fees between a crappy Mutual Fund from the Employer Matching bonus that comes with our 403(b) and find out that we still came out ahead. However if I had opted for the 401(k) rather than the 403(b) we would have been better off. I was forced to pick between the frying pan and the fire, and I picked the fire.

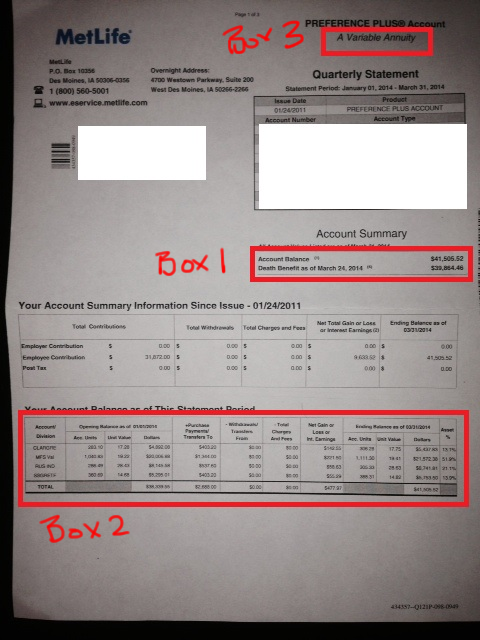

Reviewing the Variable Annuity Statement

Here is our latest statement. You may have something similar, and if you do, perhaps these observations can be of help to you too:

If you have a regular 401(k) your review process will be the same, as indeed it will be for a brokerage account, however the Annuity has a couple of extra ‘Bonus Features’ that will be worth exploring to see what you get for your money.

The first thing you should notice from this statement is that it looks pretty damn good right? $31.8K contributed, plus gains of $9.6K, I have to say overall I am happy. There is a lot to be said about getting things ‘good enough’ for now, and then revisiting to refine them, I discussed the Japanese notion of Shu Ha Ri recently to explain this perpetual cycle of refinement. Our tax rate has always been quite well optimized, but even so we have probably saved about $10K in taxes through this annuity, and gained another 10K in appreciation, so we are looking at a $20K gain in 3 years on a $30K drip fed investment.

The goal now is to refine further by stripping out excess waste from the solution we have in place.

It’s not what is there, it is what is missing that matters

This is the part that I think is really bad about this statement, it disgusts me actually. There is no talk of fees anywhere, but the plan is in fact riddled with fees. They even go so far as to have a column for Charges and Fees but leave it as zero. It’s simply false advertising, and it catches people out.

There are three fees that are affecting the policy, two are presently draining money out of our pockets annually, and the third, the ‘Surrender’ fee kicks in if you try to exit the program too early (by too early I mean before their other two fees haven’t bled you dry enough). Other policies have additional fees, such as Rider charges.

Our Missing Fees, and how to find them

Box 1 Death Benefit – Insurance Charges

Some people think of death benefit as what you would receive if you were to pass away in terms of your own money coming back to you, however Annuities actually have a life insurance portion. This policy has $41,505.52 in present cash value and $39,864.46 in death benefit. Of course, what isn’t shown is the fee for the death benefit, typically called the “insurance charges”. I don’t know the exact amount of our insurance charge (I have sent off for the data for review), it is typically a percentage of the value of the account, and could range from 1-2% (or more) of assets.

In other words, we could be paying between $400 and $800 per year for $40,000 of life insurance. If we were in a 401(k) we wouldn’t have that fee, and with the savings, if we were to buy a term life policy we could cover $1M for about $230 as per a recent quote.

Box 2 Mutual Fund Charges

All the funds have an annual management charge, some funds also have upfront load fees. The data on this statement is insufficient to determine the amount of fees being charged, but we should assume it is at least 1% of assets, if not more. The reason why there is insufficient data is that mutual funds are sold in different ‘classes’ and while the underlying holdings of the funds are consistent, the type of class will impact how and where you are paying fees – classes include:

- Class A – Heavy Front Loaded Fee, resulting in lowered annual management fees and no back end fee

- Class B – No Front End Fee, but higher management fees and can convert into Class A after they have earned enough annual fees

- Class C No front End Fee – medium annual management fees, some back end fees which drop off in time.

- (there are many more classes with a variety of nuance)

Knowing what the Class of Fund you own is critical in knowing when to optimally sell the fund. If you are holding a Class B fund that will penalize you for early sale, you might be better off holding it for a little while longer to allow that fee to drop off, then once it has converted to Class A get the whole thing out and rolled over into an IRA.

Front End Fee Example – a front end fee of 5% on a 10,000 investment buys you a 0.5% Annual fee: Your $10,000 would start out as $9,500, then 0.5% would be charged over the year ($47.5 if there was no appreciation of the fund) your total fees would be $547.50

Back End Fee example – no fee to start, so your investment starts out at $10,000 and you pay 1% annual management or $100 over the year, however if you sell before they fund has garnered enough of your money in fees a back end ‘exit’ fee will be charged, for the sake of clarity it could be 4.5% Your total fees after a year should you exit would be $550.

So with either model, you pay your dues, picking front end or back end makes sense in relation to the time horizon of your investment.

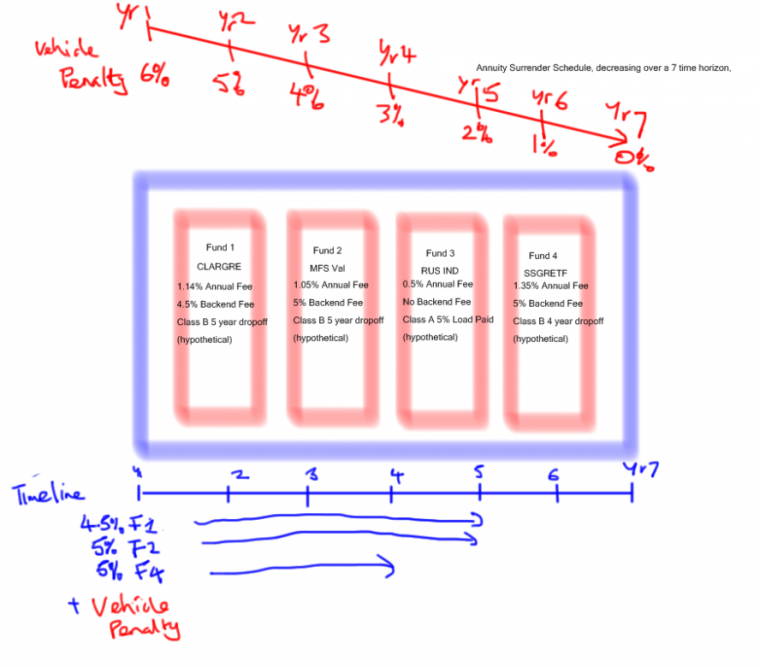

Box 3 The Account Surrender Fee

Simply by nature, these Variable Annuities often come with a surrender fee, or another ‘back end fee’ so even if your Funds are all held in Front End Fee funds, you still get bitten on the way out. This tends to be a downward sliding scale, starting at perhaps 7% in Year 1 and dropping 1% per year. If we look at a hypothetical chart below, you can see that the vehicle itself has the sliding scale, and independently of this the mutual funds may also have surrender values. This can only be confirmed when you explore the prospectus.

Impact – if we used the model above and surrendered after year 3 we would trigger penalties of:

- 4.5% for Fund 1

- 5% for Fund 2

- 0% for Fund 3 (front loaded fund)

- 5% for Fund 4

- 4% for the Variable Annuity vehicle itself.

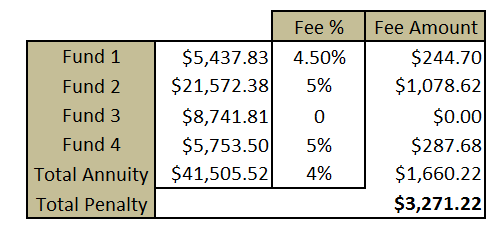

Assuming our current value of $41,505 the surrender penalty in total could amount to $3271.22!

Know when surrender penalties drop off

It requires another calculation now to figure out whether it is best to keep your money in the Variable Annuity or not, if you surrender the policy will that penalty wipe out any savings you might have made by rolling it into a low cost fund? It’s likely that in these early days, if you are being hit by something that large, it is best to suck it up and wait for the penalty period to end, or at least to reduce somewhat.

In our example, the funds start changing from Class B to Class A (and as such lose the back end penalty) after 4 years for F4 and 5 years for F1 andF2. So, after a 5 year wait, all these funds would be free of penalty, and the overall Variable Annuity Penalty would have reduced to 2%, as such, the total 5 year penalty would be $830 at the current valuation, which may, or may not be worth swapping out for.

Understand Cliff Vesting and Graduated Vesting

A cliff vesting schedule means nothing happens until the target date has been reached. In this example the Funds are Cliff Vesting, after 4 years for Fund 4 and 5 years for fund 1,2 the penalty drops to zero – but even one day before that period the penalty is 100% enforced. The Graduated Vesting method occurs with the variable annuity, so you slowly get to zero, and each year helps shave down the penalty.

When faced with a cliff vested scenario, the closer you are to the target date, the more powerful waiting will be, as the value is accruing without you being able to access it.

How to fix the problem

Ask the provider (Metlife in our example) for a copy of the annual fees and the class of funds you are invested in, demand to know what the total management fees are for the Annuity and for the funds within it.

Confirm the origination date of the plan and the surrender time horizon, if you are free and clear then rollover the plan to an IRA. If there are penalties find out about them now – ask ‘if I was to surrender this plan and roll it into an IRA today what would I pay in penalties’ while you shouldn’t trust them explicitly, they might throw a few charges in there that you missed and you can then challenge their validity.

If you are still with the employer

If you find you have something like this in place and like us have access to both a 401(k) and a 403(b) Variable Annuity, your first decision can be to funnel money away from the annuity and into the 401(k), doing so will remove the insurance/ death benefit fee. Cut that out and replace it with regular term life if you think you need coverage. Before you change your mind and fund the 401(k) instead, make sure that you aren’t taking on an even worse plan, with higher expense ratios, it is possible that after you have paid into a Variable Annuity for a long time, and the funds are all Class A, that they will be cheaper than what is on offer in the 401(k), it is likely the 401(k) is best, but check before you go ‘all in’.

If you are no longer with the employer

You no longer need to worry about redirecting contributions, but you still need to be mindful of both cliff and graduating fee schedules – it might be worth waiting to roll over. I will follow up this post with some calculations to help you understand that better.

WARNING- use extreme caution when surrendering a plan

If you withdraw your funds thinking that you can then put them into an IRA you just triggered a penalty! You have to perform a ‘rollover’ both 403(b) and 401(k) accounts can be rolled over into IRAs, and you should have someone help guide you with this if you have even the slightest doubt on how to do it right. It isn’t hard to do, but it is easy to do wrong, and not worth the risk.

It is quite likely that any plan you have from previous employers, be them 401(k) or 403(b) will have some funds in there that aren’t optimal, it is a good idea to review them periodically and consider rolling them over into a lower cost plan. Not all mutual funds are bad, so if you have access to some that have acceptable fee structures then they can have a place in your asset allocation, but if you are over paying for poor performers it might be time to make the switch.

Remember… there are two types of Financial Advisor out there. One will cost you nothing, and encourage you to get into a variable annuity, because they are paid to sell them, the other you have to pay, but they get you out of mistakes like this, and ensure you don’t make any more. Think carefully about which one you want to work with.

I think I’ll just stay broke, it’s a lot simpler 😉

Broke can be fun… I had some great times, and may again!

Didn’t know one could put in $17.5K in 401(k). Every kid right out of the school getting a $60K+ job should be doing that at least for first couple of years.

We put in 17.5K plus another 5.5K for the IRA – you can put in 23K.. drops your tax bill considerably, apply that to student loans and you are looking good.

I didn’t follow the student loan part. How do you apply the 401(k) contribution to student loans.

The is no direct application, it is just that by keeping more dollars in your pocket you have more spending power.

If you earned 65K as a hot shot grad, assuming you were single.. you would be well in the 25% tax bracket. That means if you put in 23K you would get back 1/4 in taxes or $5,750 in extra money, which you could spend on a trip to Vegas, or you could use to pay down debt.

That’s great. The only thing I am afraid of is what if the income tax rate goes up drastically 20 years from now. Then you will end up in a higher tax bracket when you withdraw the funds.

And that’s a great topic for my next post!

nice.

“If” the income tax rate goes up dramatically? You’re joking right? Seriously though of course it’s going to go up and I would bet on more rather than less. You also need to consider what tax bracket you will be in at retirement – which I’m sure Matt will touch on in his next post 😉

Ahhah but there is direct application! If your loans are consolidated with D Ed and you are paying under income based repayment plan (“IBR”), which is calculated based on your AGI, which of course comes after your 401k contributions!

Interesting angle 🙂

Unfortunately, nearly all 403bs are outside the scope of ERISA. And if a 403b plan is ran through an insurance company, there’s a good chance the fees are disgusting. Although ERISA legislation is not perfect, it has forced many 401k plans into changes for the better or at least require better disclosure of sucky plans. If you have a 401k, you can ask for the latest 408(b)2 fee notice which reflects the fees your account may be subject to – it’s a great notice that only recently became a requirement.

Matt – I REALLY do like the good mix of points/miles with other personal finance issues on your site. But when you tackle a number of large, diverse planning issues (share classes, retirement plan fees, ERISA, retirement plan distribution options, etc), I think a few links guiding your readers to additional information would be a good idea.

Great points, I’ll look into increasing those links too.

You’re missing details of the life insurance piece. What if your account has a net loss. Pretty sure your death benefit will match contributions.

Also mutual funds aren’t charging you up front fees. You are buying at bet asset value (NAV).

Hey there, thanks for commenting. I have to say I haven’t hear of death benefit matching contributions – do you mean that the death benefit steps up to peak level? If you have anything that explains that better I would be happy to read it.

Regarding mutual funds, if you read the part about the 3 classes of mutual fund shares, you will indeed see that they some will indeed charge you. Not all have front and back end loads, but many do, and if they are of the classes mentioned you will have to be mindful of that.

My employer has a stable value fund, target date fund, an ESOP, plus active and passive indexed large cap and mid/small cap domestic equity funds, active and passive developed market equity funds, and active and passive bond funds. The active bond fund is PTTRX, which hasn’t been doing so well, but might get their act together again. The target date and index funds are all Vanguard institutional shares, so costs are as low as they get.

I could wish for other asset classes like emerging and frontier equities, commodities index funds and other cool stuff, but I understand why they can’t let just anyone play with that stuff.

What sucks is the absolute lack of transparency around the active equity funds. I think but I am not certain that I’m looking at a funds of funds managed in house, but a detailed list of holdings, daily return data and other essentials are being withheld from the employees.

So I’ve done the only sane thing, and kept my money 30% in the large cap indexed fund, 30% in the small cap indexed fund and 40% in the passive bond fund. I track the 50 day and 200 day SMA of each fund, and if share prices go below the 200 day SMA and the 50 day SMA is less than the 200 day SMA, I will switch the holding to the stable value fund until the shares are above the 200 day SMA and the 50 day SMA > the 200 day SMA. I could get whipsawed, but with 0 transaction costs that’s not so bad.

I have a 403b with Security Benefits.

and there fees are 5.5 percent on every deposit, that seems high to me.

I am 59 and I just started to put money into a 403b, I am putting 24,000 a year into it.

what do you think?

Thanks.

It sounds awful. If you email my professional account I’ll look at it for you for no charge and see if we can find a better investment option: matt@guidewealthmanagement.com