The single most important thing you need to do in order to gain the ability to change gears in your financial world is Education. That doesn’t necessarily mean a formal University degree (in fact most of what is taught in College is not relevant to this task). Education is free and knowledge is everywhere, providing you are able to source the good stuff.

The single most important thing you need to do in order to gain the ability to change gears in your financial world is Education. That doesn’t necessarily mean a formal University degree (in fact most of what is taught in College is not relevant to this task). Education is free and knowledge is everywhere, providing you are able to source the good stuff.

You should always consider that information is being presented for a purpose other than to educate you – but to skew you into a school of thought and then slip in little extra’s that are not in your best interest. I call this steamrolling, and it happens everywhere, from the highest office downwards. The best way to avoid being steamrollered is to make sure you look at both sides of an argument dispassionately and try to discern where the truth lies…

When it comes to financial information you will need some tools, in addition to verbal reasoning you will need Mathematical skills, and an appreciation of the Tax Code. These basics will get you very far. Also, knowing what people are referring to and understanding the concepts is very important to stop folk bamboozling you.

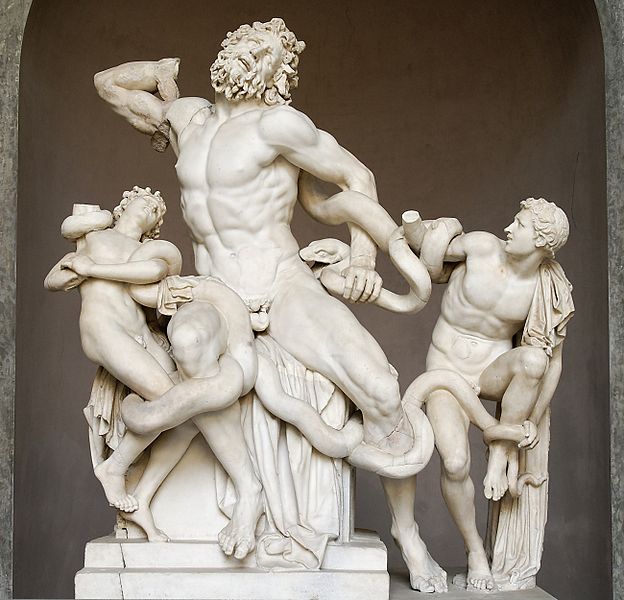

Let’s start with the Greeks, these are a classic that you will come across constantly in your investment goals.

A is for Alpha – everybody is seeking Alpha (indeed that is the name of a great website that I would recommend perusing) Alpha is profit, what you can gain above expectation of the market. If your Savings account can pay you 1% per year then Alpha is anything above that, people get caught up seeking Alpha and can take risks that are not worth the rewards, I’ve done a grand job over the years chasing Alpha and losing a ton of money- don’t do that! The best way to not repeat my mistakes is to understand Beta.

B is for Beta – Everybody is avoiding Beta, Beta is Risk, it is how volatile your investment is in relation to both the market and also the Return on Investment (ROI). You want an investment product with the highest possible Alpha and the lowest possible Beta in order to ‘beat the system’, but believe me beating the system is not an easy thing to do at all. Beta is typically displayed as a number where 1 is equal to market, less than 1 means it is less volatile than the market (which is great!) and more than 1 more volatile (not so good at all) EG a Beta of 2 means your investment is going to react double what the market does, so if it tanks, you go down twice as fast.

When chasing Alpha you need possible upside to be bigger than possible downside. For example a simple coin toss where if you win the toss you win $1.50 but when you lose you lose $1, sounds like a great bet and it is, but you never seem to get offered those odds. However the vast majority of investment products offer the exact reverse of that and people hand over their hard earned money willingly.

There are several other Greeks, regarding Options Trading there are Delta, Theta, Gama, Vega – i’ll get back to those later when I discuss Option Trading in more detail. The ones that really matter are Alpha and Beta, the rest are just tools to look into that relationship a little more closely.

Leave a Reply