To be honest with you, most of my real investing has only occurred since 2007, prior to which I was traveling the world and investing money in ice cold beers and sand dollars in exotic destinations. As such, I am always surprised when I see an investment leap up in value, and when I checked my Motif account yesterday, when I saw the balance was up 50% I actually thought I must have put in more (another large single deposit or been auto-depositing funds) it really is a shock to me to see investments ‘up’ in my portfolio.

A Motif is an investment vehicle similar to a self made ETF, you can pack in up to 30 different ticker symbols (including Vanguard ETFs to build a basic 4 portfolio) and you can create a diversified investment in one shot. For me, I picked a ‘template’ Motif from their list, and then customized it with tweaks that I felt were important (honestly, the level of analysis I did on those decisions could have been trumped by a dancing monkey) and let it go to work.

Exploring Jensen’s Measure, AKA Alpha

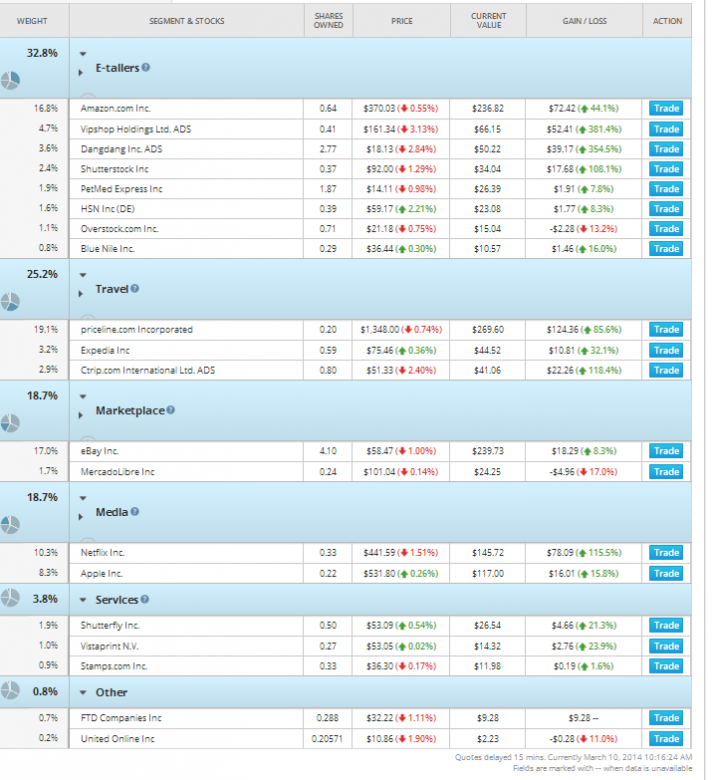

Alpha is a measure of portfolio managers ability to over or under perform the benchmark index. If you look at my Motif, I took the Template called ‘Couch Commerce’ and optimized it by shifting weightings and allocations around. In doing so my performance for a 4 month period was a gain of about 50%. If you let me charge you a fee, I will look after your money too, though past performance cannot guarantee future returns. Just take a look at the Alpha I offer:

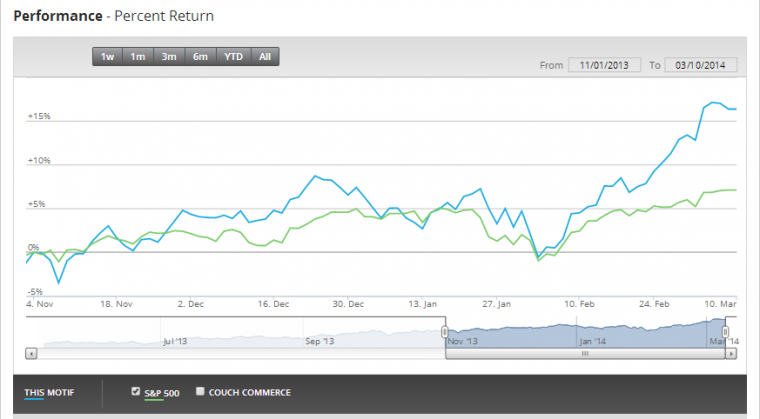

As you can see, my performance of 50% profit in 4 months is amazing, but at the same time the benchmark index did also perform fairly well, so the Alpha I offer is not actually a 50% gain, but the ratio between the gain of the S&P 500 and what I created in my ‘Motif’ using my savvy financial knowledge, my peak performance in March was a gain of 17.1% against the S&P gain of 6.8%. Pretty amazing right? The actual equation for Alpha requires a Beta (risk) calculation, so lets just gloss over all that for a moment and focus on my 10.3% (in a month) Alpha performance over the benchmark!

This is how Investment Advisors will bullshit you and take your money

Of course, they will smile, and (may) make sure you are comfortable knowing that your investment could go down as well as up, and they will encourage you to read around, but they won’t tell you one important critical factor; how accurate the benchmark is. In this case, the Motif still hasn’t gain credibility as an investment vehicle in the way a large mutual fund has, but for all intents and purposes it is exactly as important. So what you see here in this post is exactly the same for funds with Billions of Assets under Management.

Whenever a product is sold you will hear these claims of Alpha, and how it beats the market, backed up with ‘proof’. Certainly, they will ask for a fee for the sale of the fund (front loading) and the nice ones will explain that properly, you have to pay a price to buy into the the knowledge and wisdom that creates this alpha, but you will quickly recoup your ‘investment’ once you are in.

Not all Investment Advisors are bad, many are actually just stupid

In fairness, the trickery often comes not from the guy selling you the product, they frequently don’t know any better. The tricks are built in by the people creating the funds for sale, they deliberately (or again accidentally) use incorrect measures in order to show performance which the Investment Advisor just rattles off as gospel. Many of them aren’t aware for example, that r (correlation of assets) must be squared, and the resulting number being under 0.7 means that Beta cannot be used as a risk measure, meaning that Alpha itself cannot be trusted.

Of course, they don’t understand that, and will instead point at ‘the facts’ on the sales sheet and give you a lot of nudges and winks about how to become rich…

Not all Investment Advisors are bad, or stupid

Selling an investment for a commission is not a bad thing inherently, there are many good, smart people who will look at the ‘data’ rather than then conclusions and determine the truth and validity of the investment. They can operate in a fiduciary manner when it comes to your money even if they are not required to. Some will argue this is impossible because of the conflict of interests that commission creates, but that is not true, people can use their own underlying ethics along with savvy to give you the best investment advice, even if someone else (the Mutual Fund) is paying them for a sale.

Furthermore, sometimes even the most savvy financial individuals simply cannot find an accurate benchmark to compare against, so they put in a ‘best fit’ which can be quite dangerous if its lack of correlation is not properly evaluated.

Lifting the veil on my Alpha

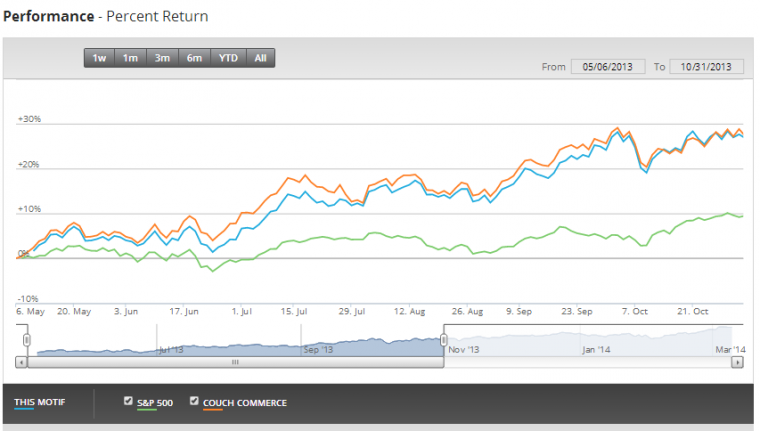

One thing that I find interesting about the Motif interface is that it will show me Alpha on my ‘adjustments’ from the template, lets see how I did:

As you can see, I took a template allocation, tweaked things up and down based upon my own set of financially superior skills (I may have rolled a set of dice at one point) and if we compare that to a proper benchmark -the performance of that same template, you can see that both did well, and in fact, I underperformed the benchmark, if I had just taken their recommendations I would have more money, and as such my actions created a Negative Alpha.

I cannot promise you a return like mine, of 50% in 4 months, but if you do want to get a Motif, read more about how they work here in my review, it includes a link to $100 of free money to start up your account (I get $100 too, and you do need to fund with $1000, trade once to get in, and once to get out, so your net profit from that $100 is more like $80) I think that is a much better offer than me trying to bullshit my way into a trade commission from you, that will cost you money and not guarantee you a return.

Two words: tech bubble. 😉

Yep. There’s a lot of bubbly stuff out there…

With returns like these, you should start your own hedge fund! 🙂

I loved the photo of the wizard.

I have a lot to say but must finish blog post and that other blog just sent me over material and want responses by Friday, i hate it when they give such short notice!

Funnily enough I was chatting with a guy today who did just that. Locker room conversations are a weird thing!