An Accountable Plan is something that a company adopts in order to manage employee reimbursable items. In general, such a plan means that the employee’s expenses are not considered income, whereas in a non accountable plan system, they would be.

If we consider the deduction of mileage as a business expense, some people might use Schedule C Misc to deduct. However, this forces two decisions: to itemize taxes (which may not be desireable) and to subject the deduction to the 2% floor. If we took a Sole Prop business with a $50K in income, and $5000 in mileage expenses that would mean that the first $1,000 of mileage expense could not be taken.

Contrast that with a S- Corp with an Accountable Plan. Each month the Employee (perhaps the owner) submits an expense report to the company with mileage costs, and the Company reimburses the Employee. If the amount of the reimbursement falls within the federal guidelines for accepted mileage ($0.54 per mile for 2016) then the employee need not declare this as income (as an accountable plan) and the company may deduct the amount without being subject to any 2% hurdle, it is a regular business expense.

The Three Buckets of an S-Corp

When people run a business as an S-Corp there are three main buckets (in order):

- Expenses

- Salary

- Distribution

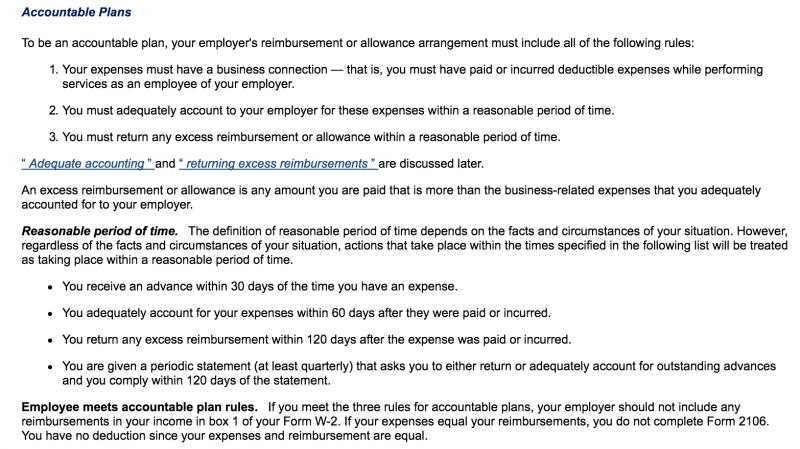

Expenses, especially with an Accountable Plan, must have a business connection, good recordkeeping, and follow certain rules if errors occur.

Expenses (valid and legitimate ones) such as the deduction for mileage reduce business income off the top. This leaves a smaller bucket from which to consider Salary and Distribution, thus reducing City, State, Federal Taxes, FICA, and FUTA.

Salary within an S Corp must be considered ‘adequate or reasonable’, which is quite nebulous. There is no real safe harbor defined, though many people aim for around a 50/50 split between Salary and Distribution (after expenses). Distribution trumps Salary as a way to take money from the S Corp as it is subject only to Tax rather than Tax and FICA (social security and medicare, thus reducing the cost by 15.3%).

So.. we have Expenses, which for Accountable plan items pass through money at zero tax/zero FICA. Then we have Salary, which must be paid out, but can be reduced with retirement accounts, and finally we have distributions. The three buckets make a powerful combination.

What counts as Accountable Plan Deductions?

We’ve talked about mileage thus far, I like mileage because it has a natural arb element. If your car gets 30 to the gallon, and the gallon is $2 your cost is $0.067 per mile, while you are receiving $0.54 per mile. The balance being to cover depreciation and maintenance. It’s a lot of spread. This fixed concept comes up in several places within an Accountable Plan, and offers tremendous opportunities. Other qualifying expenses include:

- Home Office

- Cell Phone

- Internet

- Travel, Meals

- Per Diem

- Others

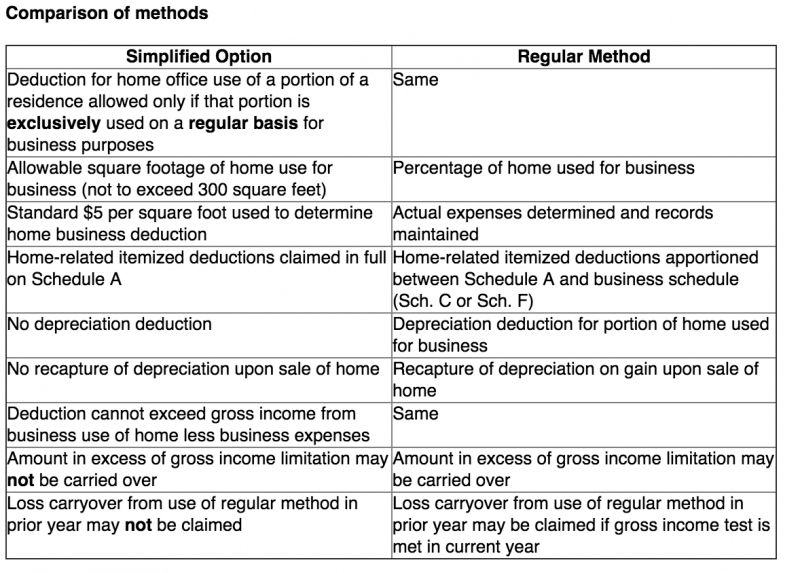

The home office is a great one. There’s a simplified formula akin to the mileage here, with a $5 per square foot allowance up to 300 sqft. The important difference between this and ‘itemizing’ the home office is that when you sell your home using the simple method there is no depreciation recapture.

Per Diems also come into effect for Travel away from home for business. As owners, you can’t use the lodging Per Diem rate, but you can use the Meals and Incidentals rate… this is an interesting thing for expenses. Per diem lookups are found here, they apply for both Domestic and International destinations.

Example:

Bob flies to Vegas for Business on Jan 14th. He stays 4 nights. As an owner he could not pick the $108 reimbursement rate for the hotel, so would have to use the actual rate. Let’s say that it is $100. He can however, claim the $64 per diem Meals and Incidentals expense (note there are special rules for first and last day).

The advantage of the per diem for Meals and Incidentals here is that there could be times where you aren’t sure exactly what you spent (receipts are required) so you just claim the per diem amount regardless. Records of the trip are required, such as the duration and purpose, but not the receipts.

Using the above concepts, it is not unreasonable for a thriving ‘gig economy‘ company to reimburse around $1,000 per month, free of tax. Add on the perks of a self employed retirement plan, and favorable S Corp election taxes, and the savings really add up.

If you have elected an S Corp (or are thinking of it) and wish to create an accountable plan it is a pretty simple one pager that you should implement, and then make sure you keep proper records, and report them to ‘the boss’ on a monthly basis, per the rules outlined above.

Very enlightening. Not sure how much impact such a strategy would have for a consultant who earns under $10K a year but it is worth exploring esp. if that income grows. Thanks!

Well.. it’s probably really good for such a person… easy to reduce $10K (tax free…) quickly if the business expenses are there…

Good to know!!

Wow, the mileage deduction is up to $.54? I may have to start driving just to create deductions. Better than that , I could just get a mechanic to roll the odometer forward.

I bet that’s something they’ve never been asked to do.

Because of the unique tax treatment of traders in securities, they do not pay SE tax despite operating as a business and getting to deduct expenses and losses.

The downside is I’ll only get $693/ mo in social security. I am, however, really going to make bank on Medicare.

This of course, assumes I make retirement age.

Matt, so many of the retirement savings approaches I have seen fail to account for long-term disability or home health care. I’m not sure if you have opined on that before, but isn’t it virtually impossible to buy home health care insurance now? My sister-in-law’s father requires 24 hour care and it’s $250k per year for in-home assistance.

Id have to do some research on the health care side, I believe it’s doable, but it will certainly depend on personal circumstances and may differ state to state.

Can a C Corp have an Accountable Plan.

The accountable plan is one where the company reimburses its employees it would work with an S or C Corp.