Insurance is one of those necessary evils once you start accumulating wealth. In our case, we are actually forced into having homeowners insurance, since our co-op board demands it from all residents. I use Travelers for my co-op insurance and wanted to discuss some decisions, old and new based upon my current coverage, you can see the old policy here, and let me know how it ties into your understanding of what is correct, and if my decisions make sense or not.

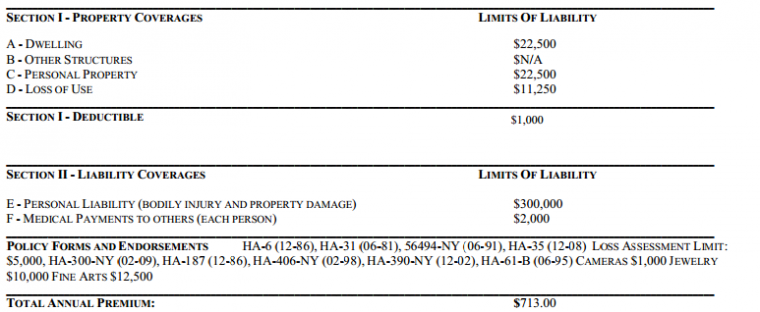

Living in a co-op, is very common in NYC, less so in other parts of the US. But as such, the building itself carries insurance for loss, so if there is a fire the external is covered, and the coverage that I need regarding the ‘bones’ of the place is what you see in column A. I picked a rather lean 22.5K for Dwelling.

What that means, is if we took the place down to the studs, and had to build a kitchen, bathroom, flooring etc I would have $22.5K of coverage to do so. That may seem like little for a 750 sqft apartment, but I know from experience that most of the cost of such work is labor, and for parts I can build a great looking place for that, I’ve done it before.

Column B is N/A because I live in a co-op, I don’t have any responsibility for other structures.

Column C covers my personal stuff, such as clothes, computers, etc. I think that is enough, possibly even too much when you consider buying things in a savvy way that I advise here on Saverocity.

Column D is supposed to cover my expenses if I cannot live in the home, again I can offset these by using travel related trickery, such as staying in cheap hotels for even cheaper costs.

I didn’t adjust column C or D today, I think I had in the past and these were basically the lowest I could ask for, the other notes on $300K and $2K for liability insurance were the limits that my Co-op building told me I must have as a minimum.

Riders

Riders are things that you add onto your policy for specific named coverage, we have riders for the following:

Jewelry – $10,000 to cover my watch and our engagement ring. This amount doesn’t actually cover the combined cost of both, but covers each separately. I reduced the coverage to the minimum that would cover either of us independantly, but if we happen to be robbed together we would not be fully covered. I think that is OK since I don’t always wear my fancy watch, and right now Mrs Saverocity is not wearing her ring (I think so she can pick up a lover, but she tells me it is because she is rather pregnant right now, and worried it may get stuck on her hand).

Art – $12,500 yes, as weird as it sounds I can rebuild our apartment for $22,500 but we have expensive art. By putting that on a rider it doesn’t eat into our personal property cap (also $22,500). Care must be taken with coverage, as some will only cover replacement cost, and some will cover only amount spent. My coverage will replace up to $12,500 but our actual replacement cost of two paintings is about $15,000. Again I am taking the chance that one may fall/rip but both won’t. This may sound like poor planning, but our cost basis for the art was around $12,500 so I cover our expense, but don’t look at insurance as covering any (potential) appreciation.

Camera – $1,000 we decided on this when we bought our first ‘nicer’ camera, a Nikon D90 with a couple of Lenses, additionally, as Scuba divers we carry dive camera/equipment so this is covered too.

Deductible

Our policy shown above has a deductible of $1,000. The items on the rider are not subject to the deductible, so if I was to drop the camera (as I did in the Maldives) I could call upon insurance for the $70 repair. Items not on the rider are subject to the deductible, where I must forgo the first $1,000 of claim before they start kicking in the money.

Changes I Made Today and Why

I raised my deductible from $1,000 to $2,500. My premium dropped from $713 to $678. A $35 annual savings. Now, I know it doesn’t sound like a lot, but every aspect of our financial lives can be optimized with more informed decision making, and for me this is a no brainer:

The reason why this is so obvious a saving is because I would never claim for $1,000 or less, heck I probably wouldn’t claim for $2,500 either. What could happen to my home that would result in a claim $1500 of damage? A fire perhaps, but if that was all that was damaged it would be a surprise, and the only difference between the old policy and the new is that I would be on the hook for $500 more. That spread between $1,000 and $2,500 involves such rare claims that they make little sense to be covered for. If the whole place needs replacement then as a percentage my coverage is marginally affected, but overall I have enough.

Dropping the camera Rider. I know, I really should use the word ‘dropping’ and Camera when talking about how it is no longer insured. However, it actually still is insured, it is that now it is subject to the $2500 deductible, again in the event of fire or theft it would be covered as it would be counted within personal property.

What wouldn’t be covered would be those claims up to $1,000. However, since owning that camera I have dropped it, requiring a $70 fixing fee, and when I called the insurance company they told me not to claim because if I did for such a ‘trivial’ amount it would be likely that the increase to my annual premium for being a ‘claimer’ would negate any value. So if I am paying for repairs out of my own pocket why bother insure the damn thing? Oh, and yes, we actually lost it too, we left it on a bus in Vancouver, but someone handed it in and therefore we still have it. So loss also doesn’t mean that you actually lose it, since you may be lucky like us and have someone be honest. Lastly, technology depreciates. If we self insure and repurchase these cameras they will cost less now than what we first paid for them.

Camera Rider savings $17.

New Policy price $661

Conclusion

Make sure you have enough insurance, but realize that it is an expense, and it does harm asset accumulation to be ‘over insured’ also realize that when you take a proper look at your coverage, things that seem ok at the time might actually be ill thought out, since things like your deductible amount and riders are frequent areas where you can optimize and find value. Why not ask for your policy, they can mail it to you, Travelers sends me mine via email, and check out your deductible – is it really what you need?

I am going to start counting the savings from the insurance, and when things do go wrong, which they always will, we can see how much savings will offset the damage. In an ideal world I will be self insured for as much as possible, as it keeps more money in the family eco-system.

A slight correction to your first paragraph, Travelers is an independent insurance company (one of the largest) that typically sells through a broker network (rather than direct). Geico is a broker for Travelers.

Keep in mind that in NYC it is very common for property damage in the $1,000 to $2,500 range, typically caused by water damage from apartments above you. I agree it pays to keep your deductible high, but I think $1,000 is a better target. With a $35/year savings, you’ll have to go 42 years without a large claim to be worthwhile (ignoring time value of money).

By the way, coincidentally my wife is an insurance adjuster for Travelers and her area of coverage is NYC. Feel free to email me with any questions.

Thanks for the Correction Tom! I am not totally, sure, but I think that if there was water damage from above the warranty of habitability might provide coverage. Insurance is all about personal choice, and I agree in my example the savings aren’t huge, but they will add up. For me, I probably wouldn’t claim at $1500 with a $1K deductible, so I see my liability there being only an additional $500 which I would reclaim in 14 years, plus I would benefit on premium costs by not claiming, which would likely make a difference was I to claim at the sub $2.5K level.