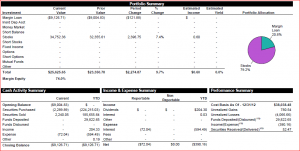

Aww Crap. I pride myself on being debt free and making my money work for me, but a little procrastination has proved very costly, and those guys at TD Ameritrade don’t go out of their way to show you how much you are paying every month as a reminder (though in fairness none of the brokerage firms will).

The debt I had was a margin trade. Margin accounts are necessary for more advanced Options Trading, they won’t open up access to these types of trades without having a Margin facility. Margin is basically an overdraft on your account and once you dip into it you start paying interest on your debt. In my case I dipped into it for about $9,000 to pick up a stock I felt was oversold and a bargain, and now I am holding it longer than I thought to make a profit. However every month I am paying out about $70 in interest which is a horrifying number for a person as nutty as myself.

Margin is certainly useful, and as mentioned necessary for certain trades, however it isn’t a long term thing, that is just dumb.. especially when we have funds sitting in checking earning 0.1% interest with the fantastic Citigold High Yield checking account (ok the rate sucks but you get a cool gold debit card instead of the regular Blue one that makes you feel very special).

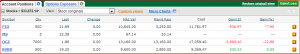

I was holding in procrastination about selling, the challenge that I have is I have to sell one of 2 stocks to clear the margin, either my FIO position or my RVBD position (I opened the RVBD with the margin play) I do hold some RVBD in my retirement account also. The problem I was wrestling with was which to sell. On the one hand I want to sell RVBD because I have a little of it sitting in my other account so if it does pop up like I expect then I still get some benefit, whereas I don’t own any FIO anywhere else so if that moves I miss out. But if I sell RVBD I will realize a short term cap gain of $530.53 versus a short term cap loss of $935.97 for FIO. As this is just a trade to shift positions and avoid fees I don’t want to release a cap gain unnecessarily.

The bigger issue is that I am further procrastinating on pushing through my Partial ACAT to OptionsHouse from TD Ameritrade because I was worried that they might reject the ACAT. The transfer would require OptionsHouse to assume not only my stock positions in FIO, OCZ and RVBD but also to assume the Margin Debt that comes with them this would leave a balance of $67 in TD Ameritrade in the form of the 3 MS stocks remaining. But if OptionsHouse didn’t like the Margin Exposure I have then they could kick it back which would mean reworking everything.

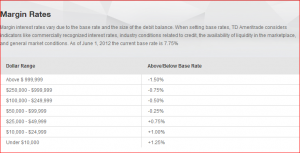

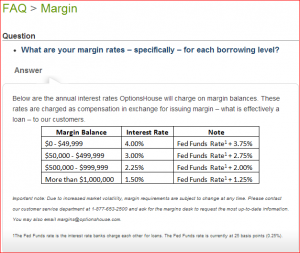

Also, looking at Margins again makes me very angry with TD Ameritrade, they don’t use clear language and can trick you into thinking it is costing less than it really is – check out the two images below, one from TD and then one from OptionsHouse:

It appears that TD is super cheap to borrow money from right? less than 10K for 1.25% above base – whereas OptionsHouse for the same less than 10K would charge you 4%! Wow, TD undercutting OptionsHouse? No, actually OptionHouse uses a real base as given by the Fed – 0.25% and adds onto that 3.75% for a total of 4% and TD Ameritrade decides to add a small 1.25% onto their base of 7.75% – where the hell does that base number come from and why now am I paying 9% for the same loan that OptionsHouse will give me for 4%? Financial intelligence is required to see through these tricks, and TD Ameritrade uses too many of these little tricks to make the fees murky and make you think you are getting a good deal.

Thankfully today I realized that carrying a Margin Debt and Procrastinating was the most stupid move of the year and I transferred $9,127 from Checking to TD Ameritrade to wipe out the Margin Debt, then mail the Partial ACAT forms to OptionsHouse so they take my stock and there is no debt for anyone to worry about. I have no idea why it took so long for this to click for me, but I think it is a problem that debt has, you kinda shy away from certain debts and bury your head in the sand, only to realize that they are ticking up every day. Clear off them damn debts ASAP!

Wohh exactly what I was searching for, regards for putting up.