Entitlement has been on my mind for some time now, I found myself falling into the common trap of blaming others for their grandeous expectations and gearing up to berate them and their ignorant ways. However, yet again I find myself targeting not the common man when I write this, but the system, and its abuse of power, and exploitative marketing that is pervasive in our society.

The original post idea (which I may well dig into again soon) was that people are ‘buying too much house’ I was watching some Television over the weekend and watching a young couple complain that 2000 sqft of house would be a bit tight for them, and how they needed ‘at least 4 bedrooms’ – I sat watching them thinking, in NYC you simply couldn’t have that option unless you were willing to pay millions for the property. New Yorker’s have to make sacrifices on size for the more important factor – Location.

But again, Location is just another form of Entitlement – you work in the big city, have a good job, and deserve to be able to live in Manhattan. The media bombards us with positivity about such a lifestyle, and if you can buy a place in Manhattan you have it made. In fairness, I think that most people who do buy in the City will profit from their investment since New York Real Estate is constantly on the rise, and much more robust than other markets due to the limited building space creating massive demand.

The cheapest property for sale at time of writing this post in Midtown Manhattan was a one bedroom on 205 WEST 54TH STREET, the building is an old highrise and the floor plan is under 600 sqft. Asking Price: $525,000 furthermore there was a monthly maintenance charge of about $1,000. As this is a Co-Op building some of that would include mortgage interest payments and therefore a portion of that $1,000 is tax deductible.

With the New York market being what it is, they might well get asking price, so the mortgage costs would be as follows:

- 25% Deposit $131K

- Closing Costs $10K

- Monthly Payment (30yr at 5%) $2.5K

- Monthly Maintenance $1K

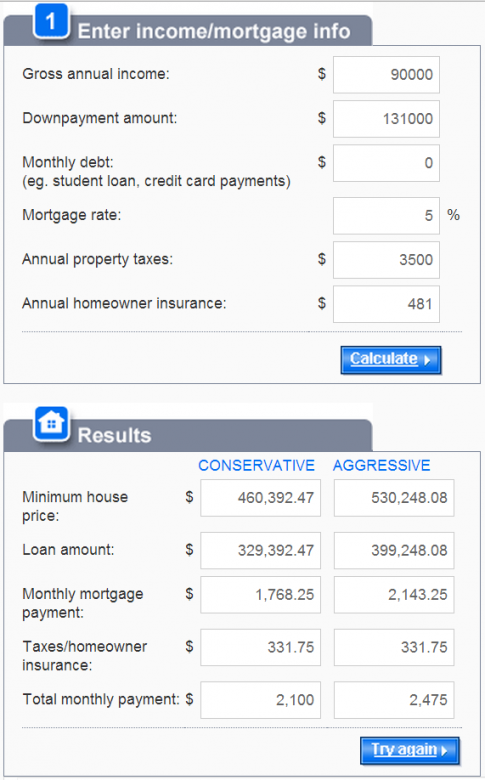

According to MSN Money, if you are earning $90K per year, and have managed to hold zero other debt and accrue $131K in savings for the downpayment you are ready to buy the property at $525K, ready to live the dream.

How is that dream looking?

With $90,000 annual salary – Monthly Gross Pay $7,500

Federal Withholding $1,341

Social Security $315

Medicare $108.75

New York Withholding $410

SDI $2.60

— Net Pay $5,322

Deduct $2.5K mortgage and 1K Maintenance:

Monthly Net $1.8K

Groceries ($500), MetroCard ($113), Internet (without Cable $60) Health Insurance Contribution ($127) = $800

Net = $1K

If you make your own lunch every day (which would bump up the price of groceries) and never went out after work for drinks then maybe you would be able to also contribute to a retirement plan or savings, but its not likely. Take a cab in the city and you have spent your daily allowance of money, buy someone a pint and its gone too.

Living like this would be so challenging, yet you are still bombarded with positivity about how to live in the City, and how you are entitled to this lifestyle that you would start to splurge and spend, binge spending and it wouldn’t be long before you started wracking up debt.

Oh, and you are supposed to have an ‘Emergency Fund’ of 6 months expenses, which at this rate is about $24K, which would take you 5 years to build up if you saved half of that $1K per month. Forget going out for dinner, and you cannot afford to shop at Wholefoods like the adverts say. Oh and don’t lose your job for at least 5 years since that Emergency Fund won’t last and you might lose everything…

Of course, after a few years you might realize that life is pretty miserable, and you might try to sell. But when you do remember broker fees are 5% and you probably are looking at another 5% in Co-op Flip tax. So if you earned less than 10% profit on the price of the property then you aren’t going to make a lot of money in the deal (though you did save on paying rent).

Buying a home is the Best Investment you can make

I do generally agree with this sentiment, and here are some pro’s and con’s of home ownership as to why this is the case:

Pro’s:

- Tax Benefits from home ownership include deductions on mortgage interest, and more importantly the Capital Gains ‘allowance’ on sale, currently $250K for single filers and $500K for joint filers of your profit on the sale is excluded from Capital Gains – this is the single most attractive ‘tax break’ that the average Joe can hope for.

- You need a place to sleep – home ownership is an asset you can actually use, and in doing so save money on rent that pays other people’s mortgages for them.

- Home Prices trend upwards over time.

Con’s:

- Maintenance costs can be high, the home can be subjected to damage that requires considerable expense to repair – in the wrong location they can be a liability, such as when they can be affected by the elements (homes near the coast in NY and NJ were recently ravaged by Hurricane Sandy).

- Banks can foreclose, if you invest $131K as a down payment, but cannot keep up the carrying costs of the mortgage you lose everything, the bank doesn’t give back your money.

- Whilst home prices do go up over time, in shorter periods they cycle up and down. If you are buying with anything less than 7-10 years in mind then you could easily buy into a bubble that bursts, leaving you with a home that is worth less than you paid for it. Some people actually have homes that are worth less than the mortgage on it due to this.

Overall, I think home ownership is a great idea, but I think that society is pushing us into purchasing above our means, and this is backed up by encouragement from Financial Advice television and websites. What that creates, instead of the life we dream of is a life of misery – by listening to the opinions of these people you are agreeing to embark upon the Rat Race, and will spend every day afterwards hoping for way out.

Another Way Out

The best way to get out of the Rat Race is never to get in, but if you are stuck you can also follow this idea and get out before it is too late, this strategy has been deployed successfully by a good friend of mine, and absolutely changes the rules of the game. The key – don’t believe the hype when it comes to what you are ‘entitled’ to.

Using the same numbers:

- 25% Deposit $131K

- Closing Costs $10K

- Monthly Payment (30yr at 5%) $2.5K

Using the same buying power of $525K

A house in Long Beach NY with over 2500 SQFT that comes with an ‘in-law’ apartment built in. Rent for the apartment within the house is generating $2500 per month, fully covering the mortgage. In terms of actual living space he has double what would be available in Manhattan, even when renting out half his home.

Now, there are a few more complex tax issues to deal with at time of sale here, but what is important is that monthly cashflow is subsidized sufficiently to grow the emergency fund, and even build enough of a nest egg to buy a second property in the future. If the home value hasn’t appreciated significantly, he could move out of the home and make it a full rental (you lose the 250K.500K cap gains allowance if it isn’t Primary residence, but you also gain other deductions, such as depreciation) and gain a further $2000 per month from the property.

In effect, that would mean he has a property that is earning $1500 per month in profit, and meanwhile he could go and buy home number two with the same idea in mind.

The entitlement issue is what prevents people from doing this. We are told to think that with 90K a year salary we deserve ‘better’ but what people really should be doing is living lean during these early years of home ownership. By living in a home smaller than you are told you need you can save more, and become free of the rat race. By being willing to share your property by subletting an apartment within it you can now actually afford to own a $525K home with a salary of $90K since your renter is covering the most expensive cost, the mortgage.

So, if you have $131K for your downpayment and are making 90K per year, should you buy a luxury Condo in your town, or should you buy a multifamily, or even two cheaper houses, a little further afield? Something to think about. Because if you are over indulgent in your primary residence, you might well find that living the dream isn’t as much fun as you are were led to believe. Remember, you are ‘Entitled’ to your own opinion, please make sure that you take full advantage of that and consider all of the facts before you decide to lead your life like an episode of Sex in the City.

We are being constantly sold ‘the dream’ but really it is the nightmare, don’t buy it anymore! Instead, think about building up that Nut, having passive income sources that mean you can walk away from that stinky job, and actually live a great life.

Leave a Reply