That’s fine though, failure is needed on the path to success. If you feel strongly about this I advise you to:

- Argue.

- Listen.

- Change.

I promise to do the same.

You should not accept anything that is written as the truth, you should seek to challenge it. In the end you will either confirm your hypothesis or refine it. Either way is a win.

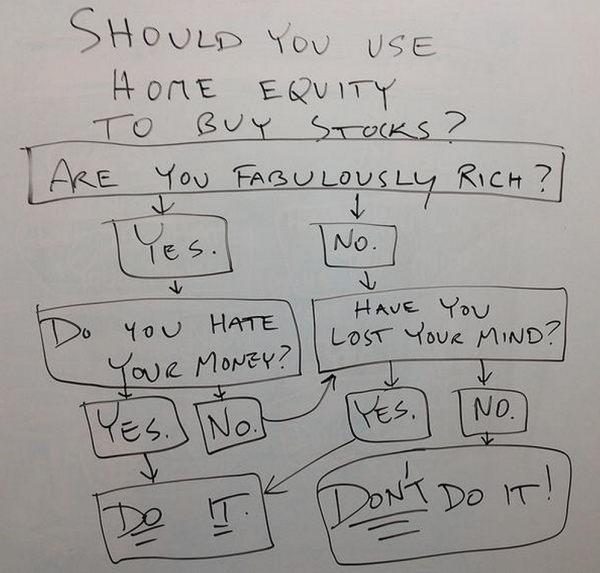

Here goes…. do you agree with this flowchart?

This flowchart is something everyone seems to agree with. But it shows a massive disconnect of financial intelligence. The problem: Most people who are invested in stocks have debt. It might be in the form of overt debt, such as a loan (Mortgage, Student Loan etc) or covert, such as an obligation to assist a child through college or a parent through retirement.

The chart here says it is clearly ‘silly’ to take out home equity to invest in stocks. But that is really saying you should not invest in stocks while you have debt. Too tantric for you? Let’s look at home equity as a concept first.

- A home is not an investment. It is a vehicle for storing equity and debt. Fringe benefits of ownership is shelter need. Frequently, home owners in start out with an equity:debt ratio of around 25:75. That means on a $400,000 home you put $100,000 down and borrow the remainder as mortgage.

- If the home appreciates in value by $100,000 the equity is now $200,000, the loan remains $300,000 and the equity:debt ratio has become 40:60.

- If the home depreciates in value by $100,000 the equity is now zero and the loan remains $300,000. The equity:debt ratio is 0:100. Should the price depreciate any further the loan is considered ‘under water’ because the loan is more than the resale value of the property.

Example 1 (the person the chart is aimed at)

The home appreciates to $600,000. Equity is now $300,000, loan is $300,000. 50:50 ratio. Advice is ‘don’t take out equity to buy stocks’. Everyone agrees.

Example 2 (why this chart is illogical)

A person who cannot afford a home purchase has no home equity, therefore can invest in stocks.

Example 3 (another example – using me)

My equity ratio is 100:0. If I pull out a a chunk of money, my home equity ratio will still be better than a person starting out. I’ll have a mortgage, and a let’s say $200K in cash.

What advice would you give?

If you saw a person with a reasonable equity:debt ratio, and say $200K in cash, would your advice be ‘you should NOT invest in stocks, you MUST pay down your mortgage!’ or would you instead compare opportunities for the money?

Let’s take this further… lets compare two hypothetical people:

- Person A buys a house with 33% downpayment ($100K) and has $200K in stocks

- Person B buys a house with 100% cash ($300K) and has no stocks.

Which person is smarter?

This flowchart states that if Person B was to become Person A he would be an idiot… in that case, we can surmise that according to this chart you should not be invested in stocks until your mortgage is paid off in full.

Now, I’m not saying whether I agree with that or not, but you should ask yourself, if you think that flowchart is so awesome, what are you really saying…

Conclusion

This is a massive financial concept. It ties into my talk at TravelCon about being able to view financial decisions holistically, and not in isolation. If you look holistically at Person A and B in the final example their net worth is identical. As such, if one cashed out equity from their home they would still appear to be in a strong financial position.

The holistic view in this example should compare opportunity cost between low cost borrowing and high risk investing. The correct path will be subjective, but not as silly as that flowchart makes it appear. For that reason, this flowchart is silly. It looks only at your home as an investment vehicle and doesn’t consider overall wealth. Once we understand these concepts we can decide when investing in stocks is a good idea.

I personally have leveraged my home’s equity to finance different investments (real estate and business ownership related to my career, not stocks readily available to the public). I am not sure if it was a good idea but time will tell. There is definitely a risk investing using equity of your home. However I realized that there is also a risk of failing to meet future financial goals by doing nothing. It would have taken me at least 2-3 years to save up the cash to do these investments without borrowing. They may not be available then, the price may have changed, and I would miss out on any returns. Also you can deduct the interest on these loans.

The point is that it’s only money…. There’s some additional risk due to the lien of course, but whether it comes from your home equity or other places it’s still equity.

I agree. The chart is not correct. Rules of thumb are rarely a sophisticated analysis, and just a shortcut for lazy thinking. Then again no one has the time to rigorously analyze everything, so such shortcuts are necessary.

I agree with you, Matt. The path is subjective and a holistic approach should be considered. In my opinion, if the person has a mortgage high then it is best to pay down the off the mortgage or refinanced before considering investments. If the mortgage rate is low then the person should compare the opportunity cost of paying off the mortgage or to invest. I think that the same analysis applies when deciding the opportunity cost between low cost borrowing and high risk investing.

Interesting piece. The chart sure makes sense when you first read it, but once you start analyzing it, you realize that there is no perfect advice.

No perfect ‘generic’ advice I believe. There are some people to which this chart would make sense, but putting it out blindly to anyone is silly.

Not a finance expert here… but the chart made sense to me at first, then when you think about it a little more… it’s not great to have all of your money in any one investment, even one that’s “safe as houses”. Having a house that’s completely paid off, but having no other investments makes you vulnerable to that one investment ending up much less valuable than you expected.

its also important to consider that people have cash that they cant use to pay down their mortgage but can use to buy stocks and bonds Ex IRAs