I remember reading Robert Kiyosaki’s Rich Dad, Poor Dad back in the day and it having a massive impact on me. I think people like Kiyosaki and Dave Ramsey offer amazing value to the financial intelligence of our community, and do great work, but there are times when their views are perhaps overly simplified, or perhaps, like all of us, sometimes they create something that is inaccurate. One view that Kiyosaki held that caused uproar was that your house was not an asset, it was in fact a liability, because it created negative cash flow.

I do feel that there is a certain element of pedantry when it comes to taking a theory like this and dissecting it, because some things can be true on one level and false on another, and depending on the sophistication of the reader, should, or should not be extrapolated further for the sake of losing the message. In fact, it is likely that I tackle this post in such a way that another person can in the future challenge it, because the reasons behind my analysis will perhaps a little more esoteric at times in order to share my thoughts on this matter.

Pedantry aside, the reason for wanting to explore this post is that home buying is high on our minds again, and the process involves all manner of interesting questions, such as Rent VS Buy, and the pros and cons of home ownership.

Your House is a Vehicle

Gypsies will appreciate this one more than most, but I would like to propose that your house is neither an asset nor a liability, it is a vehicle which can store equity and debt, not unlike a bank account. Within the legalities of a home ownership there are liabilities and assets, and these are the areas that we should focus on, starting out with looking at them as benefits and disadvantages of ownership.

Benefits

Appreciation of Value in a Tax Advantaged Manner – typically, like the stock market, the value of a home will increase in value over time. Certainly, there is potential for bubble markets where the value decreases, but in general, prices trend upwards. This is due to supply and demand, and the ever growing population acts in many ways like inflation does on cash in circulation to increase available demand. However, the advantage that a house can offer you, providing it meets residency requirements is that the first $250,000/$500,000 (Single/Married filer) is a tax free capital gain. That is incredible value.

Disadvantages

Home ownership lacks liquidity as an investment. If the market is down then you can possibly still sell, but will have to reduce your prices accordingly.

When considering liabilities regarding home ownership, I don’t consider the home to be a liability, I consider the following to be liabilities:

- An individuals need for shelter. This is the real cash flow drain, it is not the ownership of a home that is the liability is that you need shelter, you will either spend on a rental, or purchasing a home. Shelter is the problem, entitlement regarding what you feel you deserve to live in can exacerbate that, or it could actually be a good thing, depending on how the market performs.

- Possibly the greatest liability of home ownership is again, not the home itself, but the Lien. The mortgage agreement you sign puts all the power to the lender, if you put $250,000 down on a $500,000 home and default, there is nothing to stop them selling the property for $250,000, breaking even on their loan and you losing the full deposit. In my opinion the threat of that happening is often the difference between a person making a payment and missing one, so is a good thing too, but sadly, in too many cases people have lost life savings through home ownership and repossession.

- Another liability of owning a home can be that your value can be lost through certain acts that are outside of your ability to control, flooding wiped out many homes recently in the New York and New Jersey area, and whilst those properties that had mortgages required flood insurance, those that did not and were sitting there as ‘assets’ we’re severely impacted in value when the storms came through. Insurance can protect against that, but that then is something that does impact cashflow and should be factored into profit.

Offloading Inflow Generation to Assets

By locking up both Equity, in the form of the down-payment, and Cashflow in monthly mortgage payments it is agreeable to accept that we are harming a pure cashflow generating plan, however, the Home is a Personal Use Asset which means that we actually get value from it beyond its marketable price.

The idea behind a cashflow generating asset is that it is something that we can acquire, and then through varying degrees of convolution receive income from that asset, it works for us. These income producing assets offset our consumption. There is lots of talk about the 4% rule, where people claim if you can save enough money (25x your annual expenses) you can stop earning money, because you get a perpetual passive income that covers your consumption, this is based upon The Trinity Study. So whilst there is some truth that opting to purchase a home impacts cashflow, in no way can you say a House itself consumes cashflow, it is in fact the “shelter consumption need” in relation to total outflows that is in question.

Shelter Consumption Need as a Percentage

We need shelter, it is essential to our survival. With the weather in New York currently, without shelter many people would die (and unfortunately I think many people are in this position) therefore the need for shelter is an elemental liability of being Human, not of being a home owner. This becomes interesting when we look at the difference between ownership and rental.

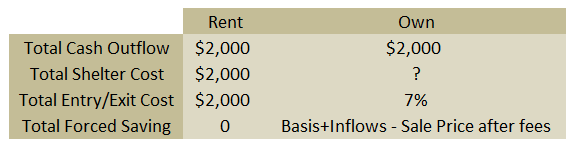

The difference between the cash flow impact of home ownership and rental is that whilst an outflow of cash of the same value, say $2000 per month is a cash flow ‘liability’ according to Kiyosaki in actuality both payments are not equal, the rental is a 100% payment to Shelter Consumption whereas the home owners expense (mortgage/taxes/insurance etc) are partially a payment towards Shelter Consumption costs, but also partially a forced savings plan.

When thought of as a percentage, the more expensive the acquisition, the lower the percentage that your consumption demands, and the greater the savings plan:

Without factoring sales price, which I will shortly, the data we receive is difficult to map, but the concept will hold true as we start modeling shortly.

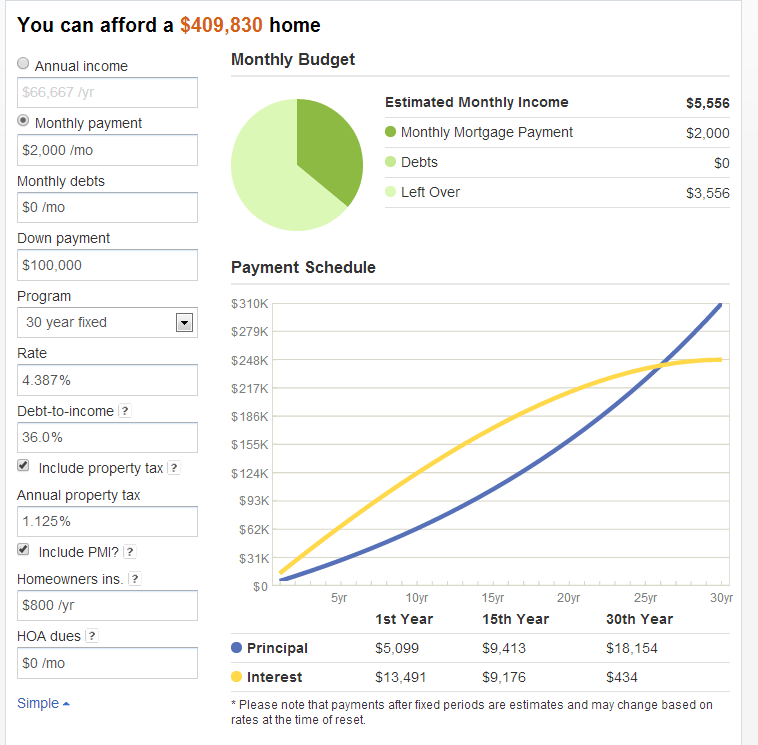

I ran a scenario through Zillow that suggested if I was to make a $2,000 PITI payment (Principle, Interest. Tax and Insurance) I could afford to buy a home valued at $409,830 with $100,000 down-payment – I didn’t cross check these numbers, but that amount seems reasonably within budget so lets run with it.

How to calculate the Shelter Cost of the purchased home

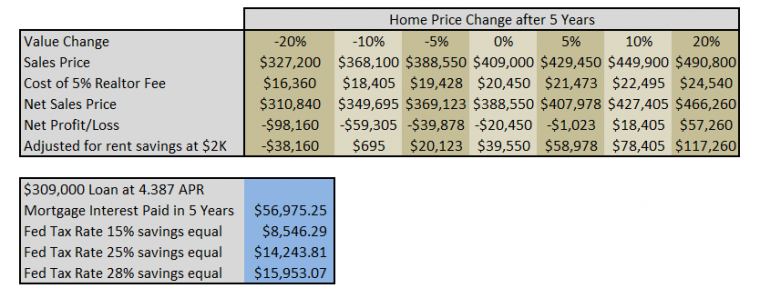

There is no way to know how much the Shelter Cost of your purchased home is in advance, as it is a variable number. The more the property appreciates in value, the lower the Shelter Cost becomes. If we take that Zillow example and consider the appreciation of a $409,000 home over 5 years, we can calculate the costs as follows:

As you can see, even when the property depreciated in value by 10%, due to the savings of $60,000 in rent payments over those 5 years the home buyer still made a profit from buying, since their shelter cost at $2,000 per month offset any decline in resale value. Furthermore, not only are the gains tax free, but for many people home mortgage interest is also deductible (it phases out from $166,800 in 2014), which is included for reference.

Opportunity Costs and Other Factors

Let’s acknowledge that the $100,000 down-payment could be earning money elsewhere, in a 5 year transaction we could hope for perhaps 3% fixed income from that, if the transaction period was indefinite then stocks could be used as a vehicle, which have historically earned around 10% interest (though they obviously fluctuate quite wildly within that). Additionally, there would be a cash-flow discrepancy because the the mortgage $309,000 loan after the $100,000 down-payment would run at $1451 per month, rather than the $2,000 that the rental would cost, so there is something to factor in there.

Now, it is certainly worth noting at this point that home ownership is nowhere near as secure an investment as a fixed income product, but I would posit that it could be more stable an investment than the stock market, so from a risk perspective it falls somewhere between the two when you consider the average property purchase, though some purchases are likely to be more, or less risky than others.

I am currently going through the sale of my first home, we are taking last and final offers tomorrow at noon, and we have done very well out of it. I would argue that if you select the correct price point, and control the leverage you put on that property your chances are that you will benefit from the investment of the ownership as the personal use asset value of shelter cost, plus the tax benefits of both owning, and selling an appreciated home are so favorable that they skew the odds firmly in your favor.

You’ve left the best option out. My friend became semi-wealthy and now I am retracing his path. Renting, I paid 860/mo for a quality tiny 1 bedroom with garage. Money gone. Now with the mortgage I pay 860/mo for a 3 bedroom 2 story house with a 2 car garage including utilities/maint. The reason I can say I pay the same now is because I let a roommate move in to pay half the house and utilities. Also have an extra room that could be rented for people or storage but have no need to. Really buying a house and renting the extra rooms out is a much better choice then renting. Its like a passive side business if you know the roommates very well as you gain equity and property value. Then if you have to move its ok because you have renters in the home and can get a real-estate rental service to take care of it in the future. The best part of buying a home with little down is getting a loan that is so cheap that investing your own money elsewhere pays higher rates of return and with inflation the principal is at a discount down the road. Your locking in at todays value something you pay off after decades of inflation.

Nate, that is an excellent point. Again, it ties into that your house is a vehicle, and can be used to hold equity or generate income in this case. I think more people should consider renting out parts of their home like this in order to offset costs. I am looking now at buying a place with sufficient land to build a subdivide and create a second house on it for similar purposes.

So less than 2 years later here’s an update: I did end up getting another room mate that pays another 400 of the bills. My house has gone up in value 40 percent since I bought it 3 years ago! Jackpot! Best investment I will likely ever make. I learned buying in a down market makes great opportunity. I would think buying in a balloon market is not a good choice (2008). So the moral of the story is timing. Sorry if I sound showy just want to spread the good word of what works. Timing the market is the best determiner of if someone should move from apartment to house.

Happy to hear of your success! Timing is easier said than done but glad it’s working for you.