This subject annoys the heck outta me, as I hate waste and I hate seeing ignorance past down from generation to generation. The basic idea behind a Piggy Bank is a tool to teach your child to save money – you make it a cute pig shape and clap like a demented Sea Lion when they put a quarter in the Jar, knowing that you are starting them on the road to financial freedom.

This subject annoys the heck outta me, as I hate waste and I hate seeing ignorance past down from generation to generation. The basic idea behind a Piggy Bank is a tool to teach your child to save money – you make it a cute pig shape and clap like a demented Sea Lion when they put a quarter in the Jar, knowing that you are starting them on the road to financial freedom.

I see these young families proudly taking their little cherub, and their coin jar to the local Supermarket, which has a flashy Coinstar machine that will spin up and count your hard earned savings and turn your nickles into real dollar bills – for a 10% fee. Have you really succeeded to teach your child to save money here?

In New York we have TD Ameritrade Banks located throughout the city, they are one of the friendliest banks, open some 7 days a week, and have waterbowls and dog biscuits for your pooch – they also have a wonderfully fun game called ‘The Penny Arcade’ in every store – they give a lolly pop to your child and bring out a young MBA Graduate to guide them through the “inserting your bunch of coins into the coin monster process”. At the end, you get a receipt that you can take to a friendly teller which they will cash out for you, for a 8% fee (waived for customers).

What you are doing when you encourage the child to pour the money into a machine is positively affirming that it is OK to completely lose site of the purpose behind your actions by using tools and actions that are marketed as helpful, but really are designed to thwart your goal,to teach your child to save money .

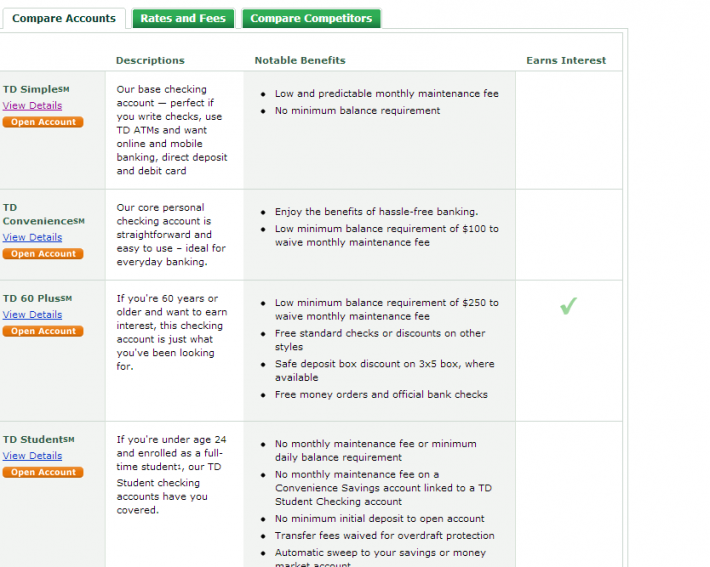

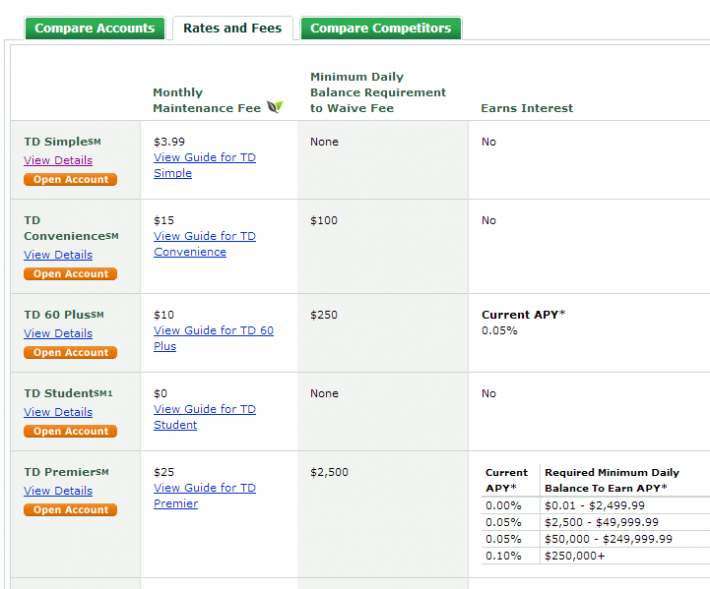

Remember, you save money by not wasting it- if you spend a year saving up $100 in coins, then give away 8% to someone for counting it for you how are you ever going to get rich? The way around this with TD is to open an account with them, and this probably isn’t a bad idea, watch out for account maintenance fees – if you take the nice and easy TD Ameritrade Personal Checking Simple, with no account minimums required (perfect for your little one!) they will stiff you with a $3.99 per month fee.

Nice of them not to make it too obvious either, apparently its too hard to fit in a column for fees next to a column that says ‘its simple, no account minimums’ or maybe they get a lot of people suckered in by this, and, just to make it a little harder, its not just a tab to see the fee, you have to tab and select two unsorted drop down boxes in order to get the information, make a note of it and cross reference the original page.

Anyways, if you can navigate this nonsense then setting up an account (TD Convenience – not TD Simple) for your little one and keeping the balance above $100 you can take your coins down, keep a MBA Grad in work, and get a lolly pop for your trouble.

Wrap the coins at home, together and talk about why

Coin Wrappers are available from your local bank, and every bank I know of will accept wrapped coins for deposit, or cash – they won’t accept them loose, but will be happy to give you the tools to do it yourself. Whilst you could see coin wrapping as a menial task, think about how you can spend the time with your child, and explain the machine option VS the self wrap option – you have the chance to talk about Fees, percentages, profit, savings – its all very easy when you have the money in front of you- you wrap up 10 rolls of coins and can use that to explain the difference the 10% fee makes – ask them if they want 9 rolls or 10 to take to the bank.

Also, it really isn’t that mundane, when you work through it with you kid you are spending good time with them, and forging good habits for the future. My advice – get an old jar not a fancy pig (paying for the pig kinda defeats the purpose eh) and make it into a piggy bank by having an arts and crafts afternoon, talk about what it is for and why you are doing it – get them saving, smart, from the start. Take the extra step, and teach your child to save money properly, not just easily.

Leave a Reply