Now, I know you might think this is crazy advice coming from a Personal Finance blogger, but its not, the post explores the concept of Tax Deferral, a key tool in your tax management planning.

Tax Deferral is a concept that takes the income you earn in one year, and pushes it to a later year, when the percentage tax paid on it is lower. This only works under tax systems that are progressive, IE ones that increase in percentage required in a tiered system based on total income.

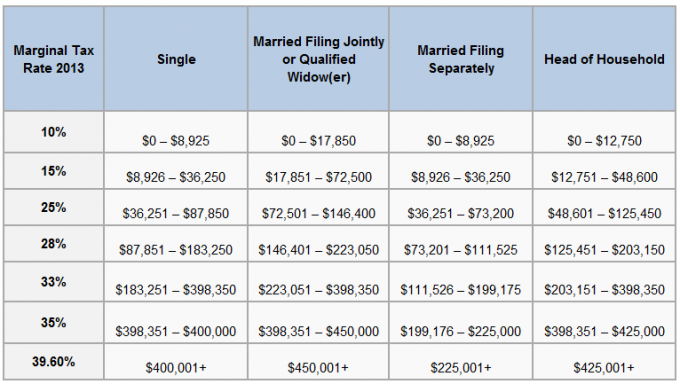

Here are the tax brackets for 2013

There are some real sweetspots for both the relatively well off, and those on a more median salary. For example, if you look at the shift between tax rate 2 and 3; when it goes from 15% to 25% for a Married Filer that key number is $72,500. The vast majority of money for this person is being taxed at 15% (the first $17,850 is at an even more attractive 10%) but once you go over that number you are suddenly losing an extra 10 cents in every dollar earned.

Another good sweetspot occurs at the 33% – 39.6% range, especially for single filers. The bracket is so tight that there is only $1,651 difference between 6.6% in extra tax, though you should be aware that there are tighter rules on deductions for what the IRS terms ‘High Income Earners’.

Common logic therefore is to push your AGI downwards by using deductions take keep not only more of each dollar in your pocket, but also keep the overall rate that you are paying tax down.

This is good logic – do it!

But the inverse is also true. Once you find your average rate of tax, either as a family or individual you should consider that a benchmark level, and if you are every in the lucky position to be under benchmark then you should use the Tax Deferral strategy to boost your income in order to wipe the taxes off at a lower marginal rate.

A time where this is going to work best is a time where you didn’t earn what you expected, or you went from a DINK (Double Income No Kids) family to having one parent leave the workforce to be a Stay at Home Dad.

In order for you to be able to navigate this you will need to have enough money saved to cover the tax bill, and must remember that you will have less income proportionally with which to do this. In someways in terms of cash flow you are going to double tax yourself, so make sure you have the reserves.

Traditional IRA Rollover to a Roth IRA

If you have paid into a Traditional IRA when your income was high, then roll it into a Roth IRA when you income is lower, you have successfully deferred taxes, here’s an example:

- Joint Salary of $80,000 Tax Burden with No IRA Contribution would be $12,066

- Joint Salary of $80,000 Tax Burden with $5,500 x 2 Contributed to IRA would be $9,484

So the IRA contribution saves this family $2,582 Great Stuff! This number was higher because they started off by wiping out any salary that was sitting in the 25% bracket (above $72,500).

But, you are only deferring the income until retirement, and it will be growing in your IRA (hopefully!) so you will have a huge balance over time that when you start making mandatory withdrawals from you have to pay taxes on. A Traditional IRA deduction is counted as income on your 1040.

However, lets say circumstances allow (loss of job but sufficient savings, one parent leaves the work force etc) and the following year the same family earns:

- Joint Salary of $50,000 Tax Burden with no IRA contribution would be $6,634

- Joint Salary of $50,000 Tax Burden with $5,500 x 2 Contributed to IRA would be $4,984

This time around the IRA Contribution saved them less, only $1,650 because they were fully within the 15% bracket. What we can see here is the logic that the more you earn (up until contribution phase out limits) the more value you garner from IRA contributions.

So this family now is living in a reality where each $11,000 contributed is worth a tax saving of $1650, but previously they were living in a land where each $11,000 was worth $2,582. And they netted that saving on their return last year.

So we now have an opportunity to pay less money in taxes. By pulling the money out of the Traditional IRA and rolling into the ROTH IRA we can add on $11,000 to our income (twice). So what that would mean is in year 2, instead of putting money into the Traditional we go straight to ROTH for 11K, and we bring over another 11K from year 1.

That would have the following impact on taxes:

- Joint Salary of $61,000 (50K plus 11K released from Traditional) Tax burden of $8,284

To summarize:

Year 1 Taxes Reduced by $2,582 Year 2 Taxes Increased by $1,650 for a net deferred tax gain of $932

Maximizing Deductions

This strategy is incredibly effective if you have an unusually low AGI this year, because you cannot claim a tax refund unless you pay a tax bill. So paying more tax can get you to the place where you can deduct everything you want, the more deductions you have, the more you want your salary to be – boost it up through a conversion, and wipe out the taxes with your deductions!

Conclusion

Deferring the taxes early ensures that they will grow Tax Free, which will reduce your overall Tax burden, additionally a Roth IRA is a better investment vehicle than a Traditional IRA in retirement as not only has the Tax been already paid, but it does not come withe same mandatory distribution rules, and as such can be a better estate planning vehicle.

Your own situation will dictate your approach to this, but I would suggest people who anticipate income in retirement, such as from Rental Property, or certain retirement plans consider tools like the ROTH in order to keep overall Tax lower.

For more on this see Partial Transfers in converting to a ROTH and my experience opening a Vanguard Roth IRA remember, when you are converting it doesn’t have to be the full amount, the most effective way is to convert so that your AGI+Conversion=Tax Bracket threshold.

Leave a Reply