I was reading an article this morning by Kitces on Tax Loss Deferral (something I do currently with partial Roth Rollovers) which had a line in it that really caught my eye:

Broadly speaking, this means that the more diversified a portfolio is, and the more granular the positions are (in the extreme, holding each of the 500 stocks in the S&P 500, rather than an S&P 500 ETF), the more opportunities there will be to do at least some tax loss harvesting

He links that out to a post on Robo advisors, and the current buzz around automated Tax Loss Harvesting (TLH)… which got me to thinking, are they doing it all wrong?

Your typical ‘Automated TLH’ is built around a mirrored set of Indexed ETFs, the concept is simple: Hold a basket of say 8 different ETFs covering markets like Bonds, US Stocks, International Stocks etc – and then mimick each holding with a mirrored pair, this allows you to sell losing ETF 1 and swap it for ETF 2. The reason for the mirroring is to work around IRS wash sale rules without throwing your portfolio out of whack. If you didn’t have this mirror in place then you’d have to sit for 31 days out of a large segment, such as the US Stock Market in order to capture the TLH, which isn’t desirable.

Why Granular positions matter

As Kitces mentions in his quote, it is a combination of both diversification AND granualization that allows for best TLH opportunities. To simplify this notion, imagine an ETF that holds 500 stocks, 250 of them decline by $100 and 250 of them gain by $100 in a given year. The net result is the ETF would be at par (simplfying here for the example). From a TLH perspective this is very interesting, because the ETF as a whole would be considered 1 taxable item, and the net result of all the winners and losers would be combined. You’d have 250 losers, but no TLH.

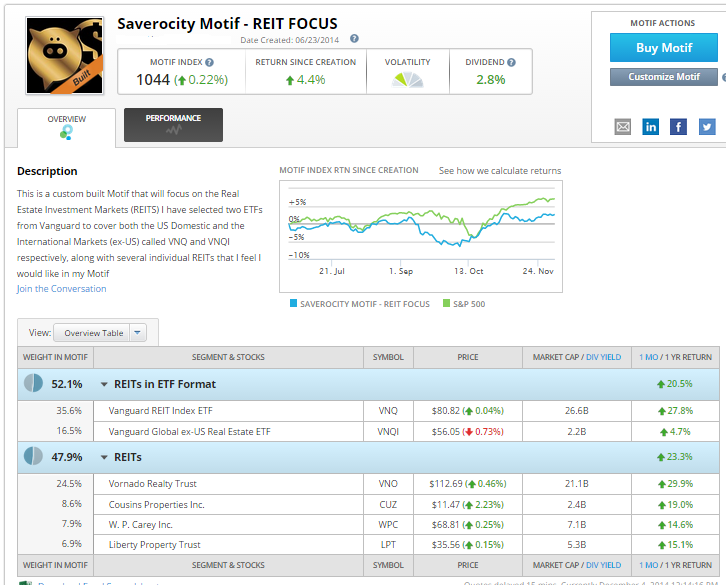

If you were to contrast a person holding an S&P 500 ETF and someone holding each stock in the S&P 500, the TLH opportunities would therefore differ. To see this in action, take a look at a Motif I built earlier this year:

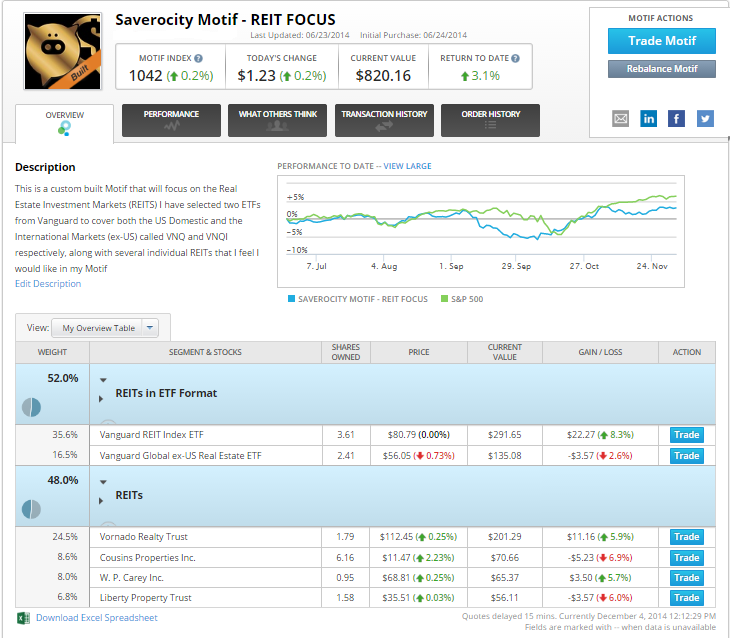

As you can see, it has great overall performance, though unfortunately for me, the timing of my acquisition was off a bit, so I actually only have the following return from it:

The second image (my actual YTD return) highlights how timing of a entry to a position can impact the returns. But lets focus on the big picture for a moment – my YTD Return is 3.1% gain – you might say that there is no TLH opportunity here, indeed, if this wasn’t a Motif, but was a regular ETF that would be the case, but because it is a Motif it possesses granular characteristics. If I wanted to TLH all the losing positions, all I would need to do is slide the holding percentage in my losers down to zero.

The confusing thing is that I would have to sell Vanguard Ex-US, Cousins, and Liberty to capture losses, though it doesn’t appear that would happen from this page alone. Note that although the other Vanguard fund (REIT Index ETF) is in the red, it isn’t one to harvest, as my own position in it is a gain.

What’s the point of Motif here?

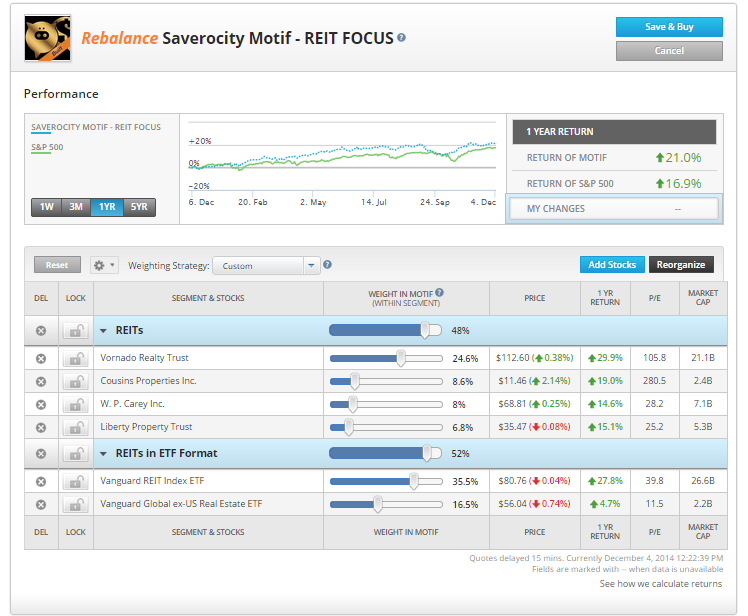

Motif is being used as a tool to sell whole and partial stocks at low cost – they charge $9.95 per ‘rebalance’ so if you used this rebalance to TLH you could sell a bunch of losers for a low price. Each Motif holds 30 stocks, we are using the product and pricing to batch sell on demand. Alternatively, if you have access to free or low cost trades you can just use your brokerage account for this. If you want to play around with Motif, this link will give us $100 each to get started if you fund with $1,000 and make a purchase.

Granular Levels 2.0

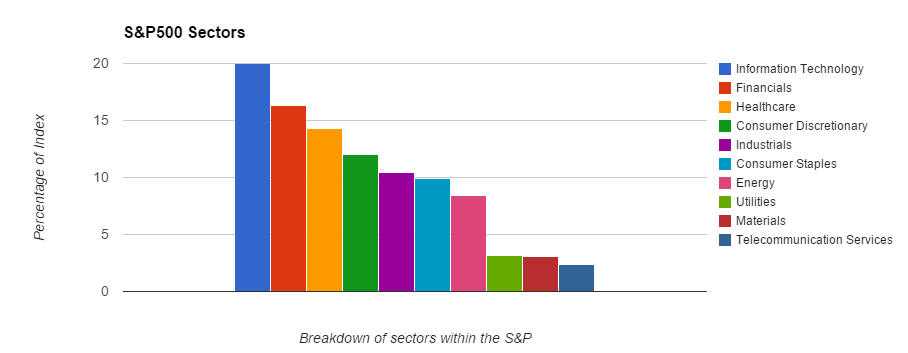

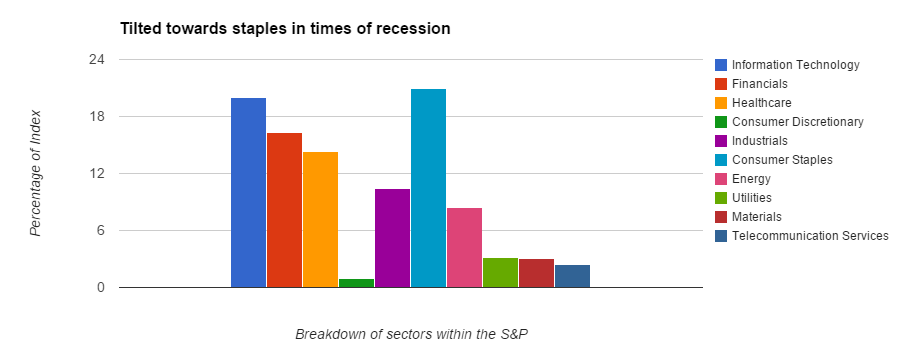

Consider a S&P50o ETF to be well diversified, yet not granular, and an individual stock within it to be not diversified, yet highly granular. A middle ground might be considered at the Sector level. The stocks that make up the S&P500 are sub categorized into Sectors, and have the following weighting:

As such, you could consider 3 different people all being able to hold the same investments by either:

- Holding individual Stocks

- Holding Sectors of Stocks

- Holding an Index of Sectors

Sector level investing in an interesting approach here, typically it has been approached with a tilt approach as tactical indexing. This is where weighting may be assigned with an active management approach, factoring in micro and macro economic indicators. However, another approach might be to let the stocks tell you what to do, rather than you tell the stocks. Let’s look at three different models, a Passive Index, Tilted Tactical and TLH Tactical:

The passive model would seek to rebalance to the sectors shown above.

A Tilted Tactical might also rebalance, but would embark with different rules, for example, at tilted tactical within a recession cycle might want to be more heavily into Consumer Staples than Consumer Discretionary. Such as the below:

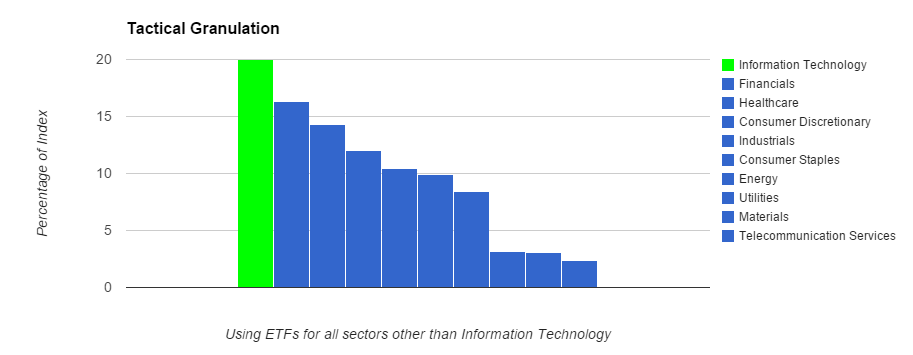

A TLH Tactical might look like this:

Here we elect to lock in the sectors via ETFs for all categories other than Information Technology, in this sector, we instead hold single stock positions. Note, this is not stock picking as we are still ‘buying the farm’ so we don’t increase risk at this point, what we increase is the opportunity to tactically TLH from this segment. The thinking behind that is perhaps you feel that Tech stocks have more of a mix of hits and misses than other stocks, so being able to cherry pick your losers has more value here. Note, we could marry this concept with the Tactical Tilts.

Motif 2.0

Circling back to Motif as a tool for a moment. You might implement the the Information Technology Sector granulation by:

- Motif #1 (The Backbone) ETF Basket, holds an ETF for each sector, mirroring the S&P500 sector allocations, with the exception of Information Technology Sector.

- Motif #2 29 of the tech companies that make up the S&P 500, and 1 Information Technology Sector ETF (Ticker: XLK)

- Motif #3 29 of the tech companies that make up the S&P 500, and 1 Information Technology Sector ETF (Ticker: XLK)

(simplified to 58 tech companies for example, in reality the balance of companies can be stored in Motif #1)

One day 1 you would have a total allocation inline with the S&P, however as the markets moved, you could start cherry picking your losers by using the rebalancing tool – simply shift the Motif slider to zero for the losing stock, and increasing the Information Technology Sector ETF accordingly for the 31 day wash period. This would be a bit clumsy in that it would shift your weightings more heavily into stocks that were winning, but this would be offset by the TLH opportunity.

Example: Nvidia corporation merger/acquisition falls through, impacting that stock by -8%. You sell the stake in Nvidia, and buy XLK, by it’s nature you’d buy back a small amount of Nvidia in this transaction (0.28%) but it wouldn’t be a wash because XLK is substantially different. Indeed it is that substantial difference that would skew your other holdings during the wash period.

Conclusion

Using Motif for this is a clunky solution, but it goes to show what Robo Advisors could really do if they started going beyond ETFs, the challenge would be on managing risk when tilts occur, because by being able to cherry pick stocks within an Index, you forgo the opportunity to replace them with ‘substantially different -but the essentially the same‘ that Automated TLH strives towards. As a concept, Granulation is the inverse logic of a mutual fund and ETF – these were created to allow an investor who couldn’t afford to invest singly in every company to diversify. However, with new opportunities emerging in low cost trading, such as Motif, the game might be changing again.

Leave a Reply