Getting your ducks in a row is a saying that means get organized. Getting organized is something that you have to keep on doing; revisiting and revising your plan constantly to make sure that not only do you achieve your goals, but you make sure you set the next level of them as quickly as possible without losing out on any opportunities.

I was very excited about verbalizing my Passive Income plan, creating a structure where I can allocate my assets to create the most wealth, but in doing so am I missing something? Are my other financial commitments in the proper shape in order for me to do this, or will I be filling up with a bucket full of holes.

The key in Saverocity is to lose the least, save the most, earn as much as possible, pervading this is efficiency – there is no point saving 50% of your income if you are paying the other 50% on just rent – it doesn’t work out!

So, revisiting my situation I am consider relocation of my Primary Residence, and I have a lot of options, both in where to go, and how to pay for it.

3 Years ago I moved into Brooklyn, NY as a First Time Homebuyer – we decided to buy because renting was wasteful to us, and also the Government kindly introduced a Tax Credit (if you are going to be a Saver you have to understand the value of Tax knowledge). The property we closed on was on the market for $279,000, we made an all cash offer and after some negotiation ended with the price of $200,000. With no mortgage we avoided a lot of closing costs, and ended up paying around $1500 on top of the $200,000 all together. The Government then gave us back $8000 in their Tax Credit. We renovated, spending another $20,000 on labor and materials and conservatively I would estimate the value to be $250,000 now.

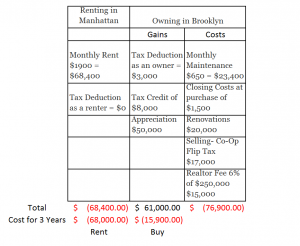

So what is the profit? Well you could say we made $36,000 if we get the price of $250,000 but it isn’t that simple in the land of Saverocity…. Actually we saved $52,100 over these 3 years (and if I had thought harder about taking a place with Flip Tax we would have lived for free!)

Other factors: Rent VS Own over 36 months

I am very happy with the savings, but before I embark on the next big step of the investment journey, I have to reassess the situation, looking at how my money is structured (is All Cash the best option?) how much I am paying just to live in Brooklyn VS somewhere else in the Region (City Tax) and several other factors…

It is time to get my Ducks in a Row!

Leave a Reply