An Annuity is an agreement between you, the Annuitant an Insurance company. It will pay you money in retirement (or early retirement) and is guaranteed to be there for the terms of the agreement. You will receive payments from the Insurance company in the form of income on a monthly basis.

The good thing about an Annuity is that since the amount you receive is fixed, you will have a steady income flow to replace your salary and it will weather the storms of stock market fluctuations and short term cash lockups. Certainly a nice thing to have. I’ll get to the bad later, since that changes based upon the type of Annuity you have. In this post I’ll start with exploring the Fixed Rate Immediate Annuity, and examining what it actually means to your overall income and long term wealth should you decide to purchase one.

Immediate Annuity

An Immediate Annuity is something that you acquire for a lump sum payment and it automatically starts kicking you a monthly payment, typically with two deadlines the first could be a fixed period of time, such as 20 years, the latter would be until you die. The good thing with the former of the two is that you can easily calculate how much ROI you receive from the investment by multiplying the monthly payment by 240 and reverse calculating the compound interest. Wow, that sounds incredibly difficult I hear you cry! Well, for starters do a quick rough calculation as follows:

(Monthly Payment Offered x Months Offered) minus Lump Sum Amount Paid.

Using the AARP for this, as they do offer a competitive rate (for the Annuity market) on a $100,000 Annuity

Lets dig into those numbers for the 20 year:

- Lump Sum of $50K ($1,91 x 240) $45,840 minus $50,000 = ($4,160)

- Lump Sum of $100K ($397 x 240) $95,280 minus $100,000 = ($4,720)

- Lump Sum of $250K ($1,001 x 240) $240,240 minus $250,000 = ($9,760)

Now, the payments keep going for life – so really the Insurance company is betting that you will die sooner than you think, which is a lovely concept. What they do with Plan A is promise to pay your family the balance between payments received and total cost of your Lump Payment pretty awesome huh?

This is because people became wise to the concept that handing your entire life savings (or a very decent lump sum payment) to the company, then dying one week later wasn’t the best way to pass along your wealth in the family. However… something to consider here is the company is paying your money back Interest Free. So you are losing any growth on the money that you would have had otherwise.

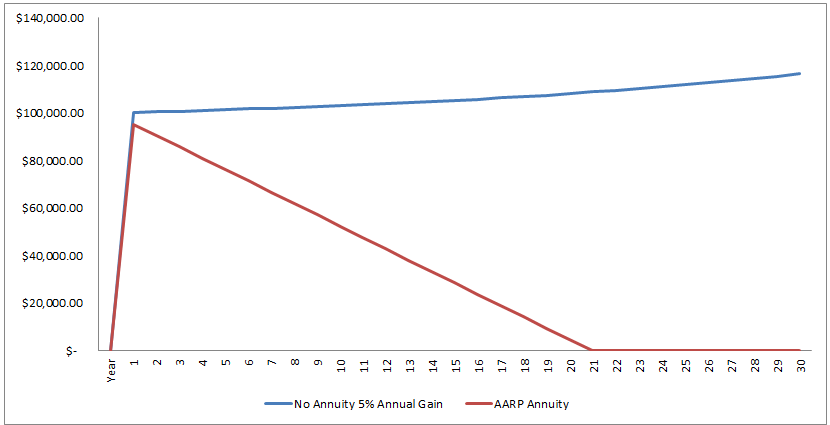

Growth of $100k with an Annual Deduction of $397 x 12. Assuming a 5% annual gain from the market.

Principal Remaining

So with the Annuity, you are tapping into the money immediately, and when you look at their guarantee program (should you not make it the 20 years) then you are only getting back what you put in, without interest. This interest makes such a massive difference. If you assume a 5% rate of growth, which is not very difficult to achieve, you are earning more in interest each month than you are being distributed. The $100,000 investment earns $416 in month 1, and when you distribute the $397 payment to yourself, as if you had an annuity, the balance compounds.

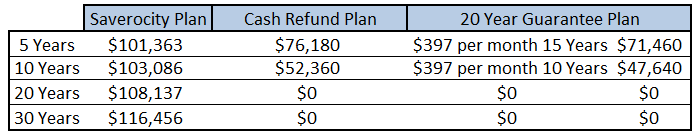

Remember the Guarantees from AARP

- Lifetime Income Plan is “Cash Refund” feature: if you die before your total payments equal your annuity purchase price, your beneficiary will be paid the difference

- Life Income plan with 20 Year Guarantee: “20 Year Guarantee” feature: if you die before 20 years has passed, your beneficiary will receive the remaining monthly payments during the 20-year guarantee period

This is going to be a little grim, but lets look at what happens if you don’t make it to 130 and pass away, the amount shown is how much your family would get ( if you hate your family give it to charity, please, anyone other than these Insurance firms!)

So, if you hand over your Principal in exchange for a safe monthly payment you are handing over a chunk of wealth that could be put to much better use. The main defense that Annuity providers will have to this is that the annuity is guaranteed for life, where as your investments may fluctuate due to the market.

Well… Annuities are NOT FDIC Insured, so if the company goes bankrupt then you lose your money – many States have implemented law that will protect up to $100,000 in an Annuity, but not more than that. Also, it is worth noting that due to the Dodd-Frank legislation (too big to fail) then a bailout may not be an option next time around, so if the insurance company gets hit then you could lose the lot, or at least anything above $100,000.

Along with that, the S&P has returned well over 5% per annum when averaged out over its lifetime, so I think it is quite likely to continue to do so. However even if you are the most risk averse person, taking on the safest possible investment in Treasury Bonds and TIPS you will still pull in enough money to keep you going well into your old age.

Sorry Mr Insurance person, it seems that you are trying to sell me smoke and mirrors again.

Leave a Reply