As I continue to realign my portfolio, the next investment I will be focusing on is international exposure. I have decided that I want to be more focused in Europe and will do so via an ETF strategy. The overall weight of my portfolio will remain in US equities at this time, so I am just fine tuning the allocation that is assigned international equities.

As most will know, an ETF offers the opportunity to invest in a broadly diversified manner. And for this reason I favor them at this point in my own wealth generation timeline. There are two reasons that I like Europe:

A weak Euro

The Euro has dropped dramatically against the USD in the past 12 months. I see this as a buying opportunity.

An Emerging business cycle

If we compare the US business cycle since the 2008 financial crisis, the markets have been very bullish. We are already at a point in time where historically things have declined in terms of business cycle. While I do not anticipate a sharp contraction, I could see things becoming a little flat for the next 1-3 years. Europe, on the other hand, is still fighting hard to get their economy moving, with a rate of almost zero.

To hedge or not to hedge?

When you invest internationally currency risk becomes a factor. Regardless of how the underlying equities within such an investment should perform, you absolute return is pegged to the foreign exchange rates between your currency and the country involved.

A hedged ETF addresses currency risk

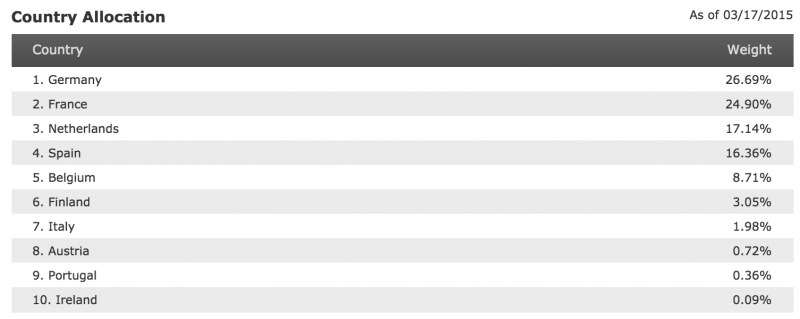

If you invest in a hedged ETF it will have currency risk strategies built into it. This means that the performance of the ETF will somewhat match the local returns, regardless of change in rates between the two countries. The downside of this is that hedging does create additional expense ratios. A good example of a hedged ETF is HEDJ, from WisdomTree, which seeks to track the WisdomTree Hedged European Index. Here’s a breakdown of the investments via country

Note, that while this does appear to reflect diversification by country, the companies within these geographies tend to be major multinationals that have global revenue streams, and this does impact correlation.

An unhedged ETF does not offer the same protection for currency

With unhedged investing you are investing in a 2 dimensional risk model. You have the potential for gains and losses on the companies within the ETF and additionally gains and losses on the currency.

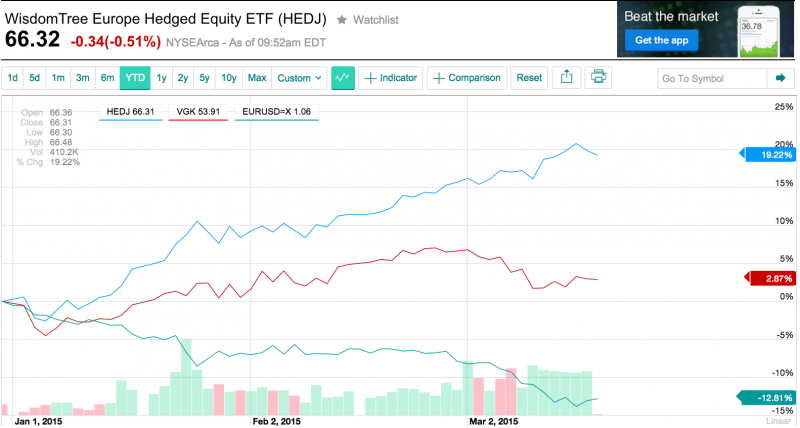

This chart is a great way to see how the impact of the declining Euro impacted the returns of an unhedged ETF, I selected Vanguards VGK for this comparison . As you can see, very similar funds performed in very different ways because one (VGK) was dragged down by the Euro whereas one (HEDJ)was hedged against that.

What do you think?

Would you invest in Europe now, or focus on the US market? If you do decide to invest overseas, would you seek to hedge that currency risk, or add it in as an additional upside potential?

I just moved some money into VGK and DFE myself under similar logic. I hadn’t been aware of the hedged funds though and it would have been interesting to look at. My question is how does the currency hedged fund operate when the Euro is instead appreciating? Would the expectation be that if the Euro appreciates the returns are similar or does the hedged ETF actually lose some returns at that point? Is it in sense shorting the Euro?

I noticed the dollar took a fair hit yesterday with the latest Fed meeting. I had been thinking we were heading towards parity and starting to look at a Europe trip to take advantage. Would have been nice not having to add a third to all the prices like I had on the last few visits.

The way I understand it a currency hedged ETF has the components of an ETF coupled with currency hedging via derivatives. The latter is what differentiates it from the underlying ETF. As such, it costs money to acquire the hedge position (premium paid) which is passed on to the consumer in the form of heightened Expense Ratio. So yes, with that in mind it could be considered a short.

However, there are two routes that it could go on the upside – one might be to leave it uncapped, or the other to sell the upside to offset the costs of buying downside protection. The latter would be a collar. Frankly I am not sure whether they collared every ETF or allowed some to flow upwards. In any case, the presence of the additional cost implies that if there was a collar it is unable to fully offset the cost of the hedge. HEDJ has an ER of 0.58% and VGK has an ER of 0.12% so you have a premium there of 0.46%. That alone will change upside if the currency remains flat or appreciates.

I moved into VGK yesterday, though I would not be surprised to see some downside movement against the dollar in the short term, I think longer term it will work out.