I was speaking recently with someone who was seeking to leverage credit card arbitrage to reduce monthly HELOC balances. He was wondering if his plan to leverage the monthly interest free cycle of a credit card and use those funds to offset his HELOC balance was sound. In essence it was, but I suggested that rather than use a solution from Amex, he might instead consider an offering from new kid on the block Evolve money.

I was interested by his reaction to this, he was very much against using Evolve Money because he thought their website was clunky, and their name was less well known. Getting his wife onboard with such a financial play was key for him, as it should be in any marriage, and he felt her level of risk aversion would preclude working with such a strange new company – but she would probably be OK with Amex because, well it is Amex. And as we know, Amex is too big to fail.

My initial reaction was that he was being silly, because the look and feel of a website shouldn’t matter, nor should the longevity of the company in question. Indeed, within the electronic finance frontier it is frequently the goal of ‘power’ users or customers to get as much money pushed through their system as possible. It is a win/win scenario for these new players, like Evolve, Incomm, Bluebird from Amex, Square Cash, Amazon Payments and a plethora of others. These firms are battling it out for dominance within the field, and the more user data they can present to corporate clients the more value they generate. It is the like the Wild West on the Electronic Finance Frontier.

The relationship works like this: the new electronic payment solution allows users to send money via Credit Card and earn reward points in the process. Once they have ‘Beta Tested’ their solution sufficiently, and can present a detailed set of data, they can then cut off the ability for these loss leading customers to generate free points, they go back to hunt for ‘the next thing’ having captured their profits in the process. However, with all of these new players fighting for dominance, what happens if poor management or planning results in a company that cannot meet their obligations?

Understanding Risk and Insurance attached to your money

There is a risk that your bank or broker can go bankrupt, when this fear escalates something called a ‘run on the bank’ occurs, when people come in and demand all of their money from deposit, fearing its loss. During the the Great Depression a major run occurred during their stock market crash, and as a result of this FDR signed the FDIC regulation into effect. Since then the amount required for deposit into this insurance fund has increased over the years in reaction to the changes in wealth, and the shape of the Macro-Economic climate. The purpose of this was to create an insurance fund that all banks could opt into, voluntarily assigning funds to deposit to create a slush fund to protect the family of banks within the program.

FDIC Insured is not a mandatory status for Banks, if you are not banking with a big main street institution you should confirm if they are part of this program. Those banks that do participate cover the accounts up to $250,000 against insolvency, this is designed to create faith and trust and avoid subsequent ‘runs on the bank’. The theory is that banks who do not ‘opt in’ cannot compete on a national level, but they do not want to make entry mandatory in order to allow smaller banks, who could not afford the insurance premiums, to thrive.

SIPC Insured is not a mandatory status. It is a similar program that was signed into effect in 1970 by Nixon, and focuses on the assets and investments that FDIC does not cover, such as investments in Broker/Dealers. The coverage here is typically $500,000 (of which $250,000 covers cash positions and $250,000 for investments) the primary difference is that the investments covered by SIPC are of the nature that they can lower in value, whereas the FDIC (Checking/Savings accounts by design cannot) therefore, the FDIC protects against downside of your account, whereas the SIPC protects only if your broker/dealer faces insolvency.

In other words – you can’t go buying Twitter stock, watch it tank and then ask for your ‘insurance’ money – but if you buy that Twitter stock in Fidelity, and Fidelity turns out to be a ponzi scheme, it will cover you up to $250,000 of Twitter and other stock, and $250,000 of cash. It is worth noting that in the most recent Ponzi scheme to hit the news, the Bernie Madoff case the SIPC denied coverage to 50% of the people who were affected, stating that despite their funds being ‘insured’ they had made enough of a profit during the scheme to be ok by being screwed over at the end of it.

How do Giftcards and Reload Cards fit into FDIC Insurance

When you load money onto a giftcard the card itself acts in a similar manner to a promissory note, the funds are funneled into deposit accounts on the back end, and the giftcards PIN/Code are a tool that can access that money. If that account happens to be FDIC insured then your funds are, if that account is not then your funds are not.

I called up the FDIC and they have no idea what card is covered by what, reassuring eh? However, the concept is that your purchase of a gift card equates to a bank deposit on the back end, and indeed it is worth being mindful of the fact that you are giving these companies your money to invest. My agent at the FDIC assured me that if the issuing bank of the card held deposit accounts that were FDIC insured, then by default, such giftcards would be covered. However, when I asked if the issuing bank held segregated accounts where some were FDIC insured, and some were not, could there be potential for no coverage, he mumbled agreement.

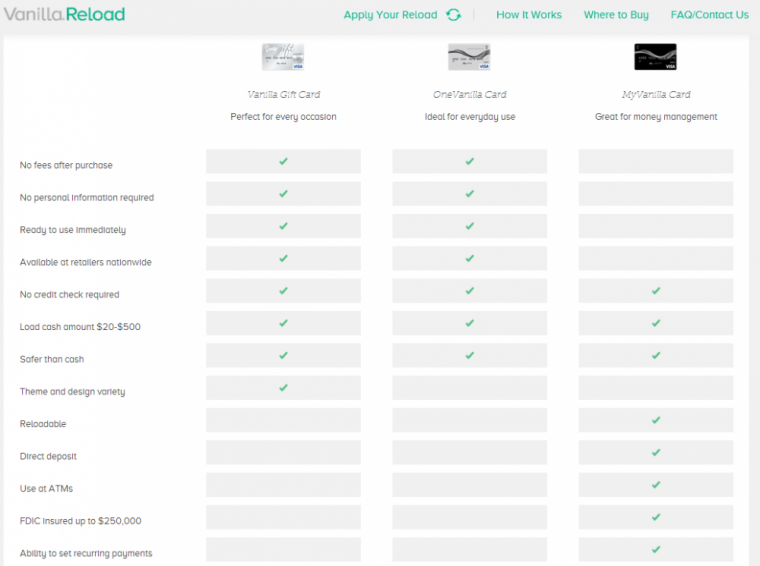

Taking a look at one of the big players, you can see exactly this happening:

So despite this one ‘brand’ issuing a variety of options in order to cater for this growing market, they are only depositing to FDIC insured accounts for certain products. This choice is one that saves them money on the products they don’t care to cover, as FDIC insurance eats profit, but for the MyVanilla Debit card it is offered, because they see it as an investment to win the trust of the market and garner share.

The FDIC and SIPC are marketing tools

These things are designed to assure the customer that the firm is legitimate when it doesn’t have a history, you buy legitimacy in the form of insurance. It costs money, and you make sure your customer knows about that expense, in the form of advertising your compliance with the program. Another big player, possibly the biggest is the Vanilla Reload card. That site does not mention the FDIC at all, the FDIC doesn’t know if it is insured or not, it may or may not be. I am going to make an assumption here and say – if FDIC insurance is a marketing tool, and they didn’t put the logo or disclaimer on the Reload site, they either have really crap marketing, or they aren’t insured…. Sure enough, I called up and the Vanilla Reload cards are NOT FDIC insured.

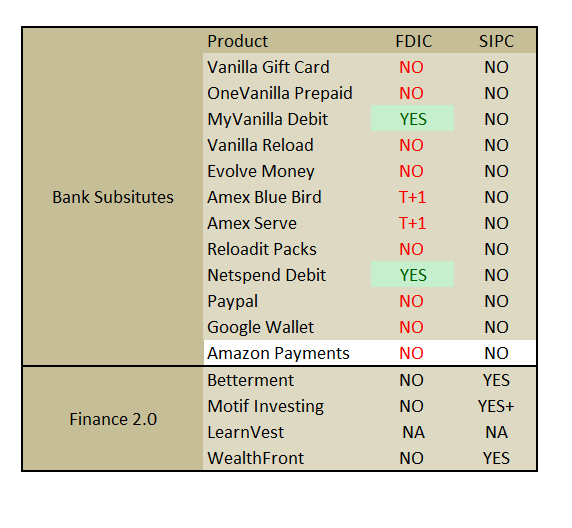

Which vehicles are protected and which are not?

One surprise may be from American Express. This is a product that is targeting the unbanked, and while the name Amex inspires confidence and trust regarding money, it may surprise you to know that the two banking alternatives that this company offers, the Bluebird and Serve product are actually owned by a subsidiary of American Express, and is actually part of its ‘Travel’ arm rather than its financial services. The travel arm does not have FDIC insurance, but the funds are swept into insured accounts after a day.

Of course, the common reaction will be to say “well it is Amex, they won’t go bankrupt” my uncommon reaction is “if they won’t go bankrupt why is the Amex Travel company a separate financial and legal entity without the protection and liability of the American Express Financial Services?” sure, they probably won’t go bankrupt, but the reason that a subsidiary was created was for exactly the reason of reducing company exposure should they decide to default. If you consider people that are loading the Bluebird and Serve with Vanilla Reload cards, you have an extended period of time where there is no default protection against loss.

How about PayPal? A firm with a 74BUSD Market Cap, how could that possibly go bust? Well, let me remind you Enron had a $60BUSD Market cap when that turned out to be a house of cards, and that was in 2001 prices, making it worth $79BUSD in today’s dollars! Ironically, most of the regulation and protection that was created in the wake of that disaster can be skirted around by the newest players – Sarbanes Oxley was the financial reporting regulations created, and whilst Paypal does have to comply with it, many firms do not – in fact it is only required for listed companies or those seeking listing on the market.

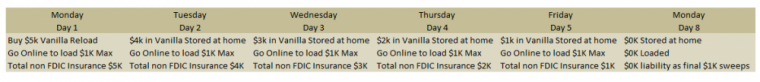

Understanding Risk in the lifecycle, Vanilla Reloads to Amex Bluebird

So as you can see, there is considerable risk attached to the people who rely upon these vehicles for their banking solutions. Some people may decide to purchase several Reloadable cards from a store, and due to daily load limitations by the receiving Debit card actually be holding onto a default risk, along with the risk of loss or theft from these products.

Conclusion

It seems clear that firms that are leveraging technology to offer innovation in Finance from a Broker/Dealer side are fully aware of the trust that the SIPC insurance conveys to a cautious, and more experienced investor marketplace, however, with an increasing number of products that are targeting the unbanked, who often have a lesser comprehension of regulation, risks and threats to their money it seems that most companies in this space are not being as thorough in their offering, and it could well be the case that there feels to be no need for such protections because they are really marketing tools, and if the audience is too dumb to know why these things matter, why bother actually protecting them at the expense of the profit line?

Of course, out will come the argument that these firms are ‘too big to fail’ and that they don’t require Sarbanes Oxley or Dodd Frank regulations, or that FDIC insurance isn’t important when you have a lot of money… but really, if that is the case why do all the big banks have to comply, and have to pay for this? Make no mistake, the small firms in this space, like Evolve Money and REloadit are very much small enough to fail, and the big firms like Amex and Google have built entities that separate liability from the parent companies so as to protect them in the event that they decide to default.

Very good analysis. Not something I think about too often, but probable should with $20K sitting on debit cards or reload cards at any one time.

Yep, I think this is something to bake into risk management decisions, it shouldn’t stop everyone, but should be factored in.

Great article as usual Matt. This should be required reading for anyone new to MS. I’ve always wondered about the spenders that buy $5K at a time. Do they load 2 a day over 5 days as in your example or do they load multiple cards over multiple days? Personally I only buy in one day as many as I can load to my wife’s and my card – so 4 per day max. I’m lucky in that there are 3 CVS stores within 5 minutes of home/work so multiple trips during the month are routine for me.

Thanks Mark! I used myself as an example, in NYC Vanilla is hard to find, so if you see $5K of it on the shelf you better get it fast! Then I need to unload via 2 cards (wife and I) so I have several days of exposure from this. At first I thought of it just as a free loan to Mr Vanilla, but really, it is a free Unsecured loan to him…

It really makes you wonder what the smart play really is. To take maximum advantage of MS while you can, to nickel and dime at 2-3K/month to reap benefit but limit exposure, or watch it all from the sidelines. Of course there’s no single satisfactory answer for that…

Well, one of the concepts that could be drawn from #milemadness is that you can ‘churn’ a lot of money with a low daily cap. If you expose yourself to no more than $1K liability per day you can still generate a goodly amount of revenue…

Just want to say this is a great post with original content! I hadn’t ever thought about these issues. The risks associated with holding a few extra VRs or GCs seems acceptable most times but definitely not in times of great market stress (think Sept 2007 where everyone is panicing and looking for safe harbors).

Thanks Neil!

Very thought provoking original content – I’ve never considered the question for any of the products – and honestly am pleasantly surprised that ANY of them are actually covered by FDIC.

As you mention, it is a marketing tool – and I’m a little surprised that AMEX isn’t pushing a little harder on this aspect with the pseudo-bank account that is Bluebird… making it truly FDIC insured and marketing it as such would surely be a huge differentiator in a crowded market of sketchy products.

I’m guessing they’re trading on the trust of the AMEX brand so far.