An Emergency Fund is arguably the single most important feature of your saving and investment plan. There are all manner of articles talking about the fund, and how to be savvy with it, but if you don’t under what is an Emergency Fund you will not have the knowledge to know when a strategy is good advice, or bad advice. This post will explain the essence of an Emergency Fund, and if you can understand that, you can take that knowledge and apply it to more sophisticated fund management strategies.

An Emergency Fund is designed to protect your assets

The purpose of an Emergency Fund is that if an short term cash flow situation occurs you do not need to liquidate assets in order to manage the problem. The reason for this is that the Emergency would force you to sell at a time outside of your control, and it may be the worst time for you and your finances.

What should be inside, and what should not be inside an Emergency Fund

Fixed, necessary expenses should be inside the Emergency Fund, things like Mortgage Payment, a Basic Grocery allowance (without the frills if you are keeping costs low), any amounts that are required to be paid within any given period of the duration of the fund, such as Car Insurance if necessary for providing income. Life Insurance, and assets like Long Term Care insurance policies are also things that need to be paid monthly during such times in order to protect the value already invested. Variable expenses such as entertainment allowances, vacation funds etc should not be allowed in the fund.

The concept is not that an Emergency Fund will maintain your lifestyle as it is now, it is that it will allow you sustenance, without jeopardizing your wealth during a time of need. Once your financial situation increases, and you have a considerable amount of net worth, it is acceptable to plan a fund that incorporates variable or luxury expenses, but from the start, that is not worth the opportunity cost in terms of wealth accumulation.

The theory behind this is that if you lose your job, you will have enough money to pay the mortgage, and put a meal on the table until such time as you get it back again, it is your decision based on your own risk tolerance how long that time period should be, though it is generally accepted to be something between 3-6 months of your core, essential expenses. During this time you should tighten the spending habits, cut out out unnecessary expenses and retrench into a defensive financial position. At this time, savings plans should stop, it is not wise to keep putting money into regular savings, from emergency savings.

The Rationale

An Emergency Fund when implemented correctly it holds an opportunity cost for your money, since you cannot have it stored in the stock market. For that reason it is key that the fund be enough to cover the absolute basics, paying for your monthly costs for a period you determine, but absolutely no more, it must be lean, because each dollar inside the Emergency Fund can be earning more in less liquid assets.

Why can’t the money be stored in Stocks or Bonds?

The purpose of the fund is to have access to money irrespective of market conditions. If an emergency situation arises at the same time as a stock market crash you will be in one of two situations: either you won’t have enough money in the fund anymore to provide for your needs, or you have to sell twice as much assets to cover the needs of the fund. Furthermore, it is quite likely that emergency financial situations will have duality within Macro and Micro Economic events, by which I mean if the market is depressed perhaps due to lack of credit funding such as happened in our last Great Recession, jobs are affected, so you would be more likely to lose your job when the markets are in bad shape than in good.

Where can the money be stored?

Confusion from overly sophisticated strategies raises its ugly head here, people start spouting highly advanced Asset Location strategies and miss Asset Allocation fundamentals. You may (or may not) have heard that a ROTH IRA is a good place for an Emergency Fund, and it is in truth – that is an Asset Location decision. However, within the ROTH, should you take that approach, it is key to remember the same basic tenets of Asset Allocation for Liquidity. The money in the Emergency Fund must be accessible without relying on the market trends, it must be in Cash or Cash Like Equivalents.

So, if you decide to keep it within a ROTH or not, the money must be stored in the format of: Savings Accounts, Money Market Accounts or CDs. Most CDs can be cashed in early without loss of Principal (check terms because some bad ones actually can impact principal) whereas a Stock or Bond can be traded at below the price you paid for it. If you calculate your fund needs to be $10,000 and you put it in Bonds or Stocks the day you call upon it the value could be lower, as easily as it could be higher.

Building Wealth Protection Firewalls

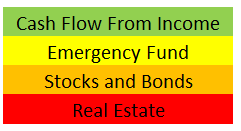

If you consider the liquidity of assets, you should think of each layer of your Asset Allocation plan to protect the next, they build firewalls. Your monthly income, from a job or from retirement income is designed to offset your monthly costs, if you needed to sell stocks every month to cover your expenses you would be in terrible financial shape, so you need to control your outflows and ensure that your inflows can cover them.

The Emergency Fund Firewall is designed to step in and buffer the need to dip into stocks or bonds (in case the market is down) and the purpose of holding an amount of money in stocks and bonds is to protect against the need to sell your primary home in order to survive. From a wealth generation perspective it could be argued that Stocks and Bonds do generate more appreciation than real estate, but from a wealth preservation perspective the last thing you want to be forced to do is sell your home and relocate your family due to an emergency.

In other words, the fund buys you the time you need to get back on track, or to start selling off less liquid assets so that you can get a better price on the dollar for them.

The Core Emergency Fund, and the Secondary Emergency Fund

The Core Fund is what we have described to date, and is necessary for anyone who has wealth or assets to protect. However, certain people would require a Secondary Emergency Fund to cover for Self Insurance decisions. This is not something that I need, because I live in an apartment building in a city, but if you were to live in a house in Long Beach, NY that you owned outright flood insurance is optional. If you decided to opt out of insurance to save the premiums you need to consider allocating ‘Self Insurance’ money to the Core Emergency fund, to the extent that you think is sufficient to assure your mind.

How much should it be?

Only you can decide the amount that you feel comfortable about storing in an Emergency Fund, remember, too much money inside it causes opportunity costs, too little makes it inadequate. Most planners will advise 6 months of core expenses, if you are self insuring you might want to double that number, if you are working in a very stable job, such as a tenured Professor you should probably elect for a smaller core fund.

Conclusion

Understand the purpose of the Emergency Fund, and resist the temptation to invest it in assets that can lose value, in doing so you are kidding yourself that you are protected and have completely missed the point of having the fund. It should be invested in the highest possible income earning assets that cannot lose Principal Value, so that in a time of need the exact amount of money you decided you needed is present in the fund. Now you understand the purpose, you can start playing with sophisticated strategies to maximize the value of the fund.

Leave a Reply