The US Tax Code is a hot mess, there, I said it. Reading it takes a large degree of skill, and any conclusions that you draw from it are often vague at best. However, all we can do is seek to find the best route through this quagmire, and wherever possible confirm everything with a qualified Tax professional before making any final decisions. I’m not a qualified Tax Pro – so take whatever I say with a pinch of salt.

The Saverocity Household is going back to college this week. Leading the pack is my wife Allison who decided it was high time to obtain her Masters in Education. I too have been thinking hard about taking on further education for some time, and just made up my mind to study for the Certified Financial Planner exam. Unfortunately for me I have to attend a 14 month course to sit that exam, but I got over the grumbling and decided it was worth the time and money investment.

They say that College isn’t cheap, and certainly many schools can come in at astronomical figures. I have spoken in the past about reducing costs by creating a 529 plan, and within that there is a tax rule where I could actually create one for myself, and claim a deduction.. lets look at that, and the other options for reducing costs spent on Education expenses.

Employer Education Expense Reimbursement Programs

One of the most highly under utilized benefits that people have, Allison works for a company that will reimburse upto $3,200 per calendar year for education. This is not uncommon, and you should certainly check in with your HR department to see if they also offer such a plan. If you are reimbursed for your expenses by your employer you cannot double dip – IE you cannot claim the other deductions, such as paying through a 529 plan or claiming the Lifetime Learning Credit, or American Opportunity Credit. For many part time Masters programs (barring the most prestigious schools) an allowance of $3,200 more than covers the course costs, including fees and textbooks.

I am self employed and have been for years, as such I have two decisions, I can set up my own Employer based Education Expense Reimbursement Program, and only reimburse people called Matt, or I could use one of the 4 other key areas for reducing costs through tax planning.

The College 529 Plan

Whilst many people think of these plans as something to save for their kids and grandchildren, as I outlined in this post, it is possible to create a plan where you are both the owner and the beneficiary. The only rules are that the money must be in the plan for 7 business days prior to distribution. Since the college wants payment by next week, and we have Labor Day Weekend (a non business day on Monday) I wouldn’t be able to fund the 529 and have them cut a check to the college. However, I can fund the 529, pay the college in cash and then have the 529 plan reimburse that payment. So I would need to float double tuition for about two weeks, then could claim a tax break.

The tax break for 529 Plans differs by state, in NY State it would be a $5,000 (for single, $10,000 for joint filers) deduction that would reduce my State Income Tax payments for this year. The catch – I can only claim for what I do this year, so if a course asks for prepayment in full for 2014 subjects, I cannot pay them and claim them this year. For more on 529 Plans check out this primer: College 529 Plans Explained

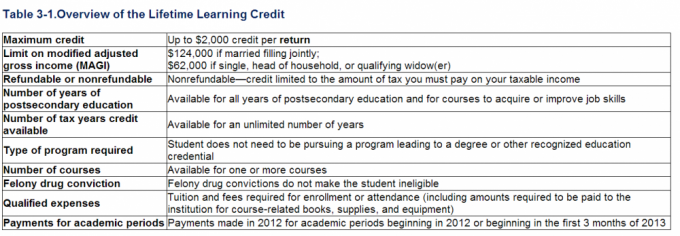

The Lifetime Learning Credit

- Limit per year is 20% of expenses, up to $2,000; there is no limit to the number of years that you could claim this credit.

- Non Credit Courses do not qualify, unless they are for career enhancement in which case they may qualify (don’t you just love the ambiguous rules?)

- As per all the options shown in this post, you cannot double dip, in that you cannot claim both the learning credit and the Employer Reimbursement, or the American Opportunity Credit. However you can still be eligible if you receive grants, scholarships or pay with a 529 plan for the balance of payments.

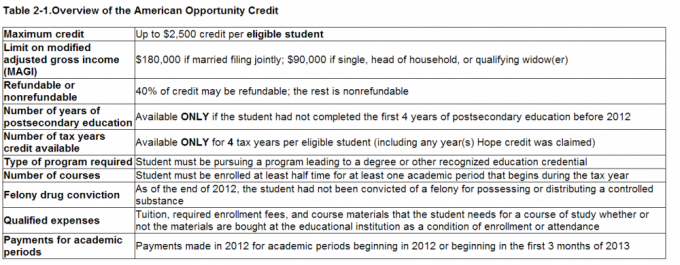

The American Opportunity Credit

- Limit per year is 100% of first $2,000, then 25% of second $2,000 up to a max of $2,500. You can claim this for 4 years, but it is only available to people who have not already undertaken a 4 undergraduate course.

- You need to be enrolled at least ‘half-time’ in the course (this differs by school and reflects number of credits studied) and be free of certain drug related convictions.

- Double Dipping is not allowed between the various programs (such as the Lifetime Learning Credit) but you can still be eligible if you receive grants, scholarships or pay with a 529 plan for the balance of payments.

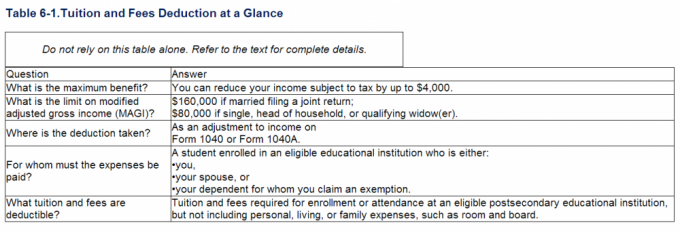

General Tuition and Fees Deduction

- Limit is $4,000 Deduction, not Credit. A deduction reduces your overall taxable income by (in this case) up to $4,000. This will in turn reduce your Federal, State and City Tax bill.

- Double Dipping is not allowed between the various programs (such as the Lifetime Learning Credit or the American Opportunity Credit) but you can still be eligible if you receive grants, scholarships or pay with a 529 plan for the balance of payments.

Summary

College 529 Plans are great, but these deductions and credits cannot be ignored, you need to find a way to claim the maximum on one of the three options: The Lifetime Learning Credit, The American Opportunity Credit or the General Deduction. Typically, the American Opportunity Credit is best for people going into an Under Grad program, because $2500 per year Credit is better than $4000 per year deduction (a deduction just reduces your total tax liability, so it puts about 1/3 of that number back in your pocket, think of the full claim as being worth about $1,300 – or less if you aren’t earning a lot).

Best of all, get some free education from your employer, make sure you that you check with HR before you sign up for the course to ensure eligibility, and then you can leverage this great benefit. A perk of this is your employer will know you are bettering yourself, which should put you on the radar for promotion.

When paying for education, think of using the 529 Plan Distributions separately from the tax credits – EG if you have a $10,000 tuition bill, pay for the first $4,000 with non 529 money, giving you the full $2.500 credit, and the balance of $6,000 from 529 money.

I spoke to many people about these plans, and nobody is really confident enough to give proper answers (including the IRS representatives) but hopefully if you can discuss your options with a tax professional you will get some clarity. If you like any of the plan ideas above check out the links to the IRS Publications as they offer more insight and further details on inclusions and exclusions from each plan.

Lastly. a murky area indeed – but the general rule of thumb I learned is that it is not so much the course itself that is eligible for some of these deductions (such as the 529 expenses) but rather the institution where you study. If you take a course from an accredited University, the course itself doesn’t always need to be accredited, such as for the CFP I am studying.

Interestingly, in researching this I have decided that due to the price point of my course, and our current salary I will probably opt for not using the 529 Plan for this, and instead select the General Deduction. You need to look at both cost of course, and income phase out levels when selecting the best one for you.

Leave a Reply