Target Date Retirement funds are ‘set it and forget it’ funds available from all of the top Investment Management Companies. If you want a primer on them I suggest checking out this post first: Target Date Retirement Funds -An Introduction – in a nutshell they are a single fund you purchase, from someone like Vanguard that is a basket of 2-5 other funds – made up of Stocks, Bonds, and Cash.

The idea is that you should always have some sort of diversification between Stocks and Bonds in your portfolio, and should one do well whilst the other does poorly in the market the Target Date Fund will rebalance things based upon your age til retirement.

Saverocity Reader Marcus recently asked me my opinion of the Target Date Fund, and my answer was:

“I would consider them better ideas if you go for one and push the retirement date on the fund back a ways….”

I can see that isn’t the clearest answer, and as such I wanted to write this follow up post to explain further.

I am 36 Years Old, if I retire at the regular age of 65 that would be 29 years from now, and the year would be 2042. Target Date Retirement Funds are issued in 5 year increments, therefore if I was to purchase one for my 2042 retirement I would have to pick between the 2040 Fund and the 2045 Fund if I follow common reasoning.

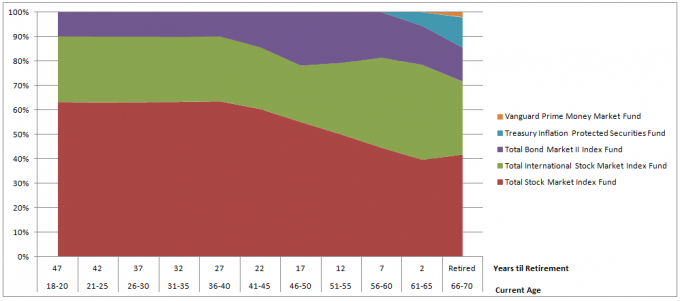

However, a Target Date Retirement Fund is NOT an annuity, it isn’t like Social Security that only starts paying out once you trigger the date. It is just a basket of funds you are holding. What happens instead with a Target Date Retirement Fund is that each 5 year increment that it steps towards its ‘Target Date’ the asset mix is softened, it moves from weighted heavily in stocks into more Bonds, and eventually also into a Cash Position too.

What that means:

- You can have and hold a Target Date Retirement fund like any other investment, its name ‘Target Date 2045’ only refers to how the fund mixes up its asset allocations between Stocks, Bonds and Cash – it would be perfectly fine to hold a Target Date Fund between the ages of 20-30 years old instead of picking your own stocks, and then you can cash it out just like selling any other stock or fund.

- You can pick a different date from the ‘proper’ Target Date, making it shorter or longer based upon your risk and reward goals.

- You need to consider if you have enough money to achieve your financial goals in retirement from your current nest-egg or if you need asset appreciation to occur in order to meet them.

Again, the question of how you should do things comes down to whether you are at Wealth Protection stage or Wealth Accumulation Stage in life, personally I have been guilty in the past of expecting too much upside from the market and not focused enough on earning a sufficient ‘nut’ of money that I would use investment vehicles to protect from inflation and grow a small amount. I think that this is a mistake that I can survive as I have many years to retirement and I am still on track for it, but if I was near retirement age I would have to think hard about if I could actually retire without the need for the market to boost my income.

Having said that, the tipping point just before retirement is also the most powerful time for a person in terms of Investment Earning Potential. At the age of 60, you have built up as much as you are going to build up – the mortgage should be paid off, college bills cleared and you are empty nesters. The amount saved over your career into 401(k) and IRA Retirement Accounts and Taxable brokerage accounts is at its peak.

The wisdom (and perhaps fault) behind the Target Date Fund approach is that it mitigates risk as you reach the Target Date, as time goes on the fund moves you from an almost exclusive Stock position into a heavy bond position and a percentage of your assets actually become stored in Cash in a Money Market fund. In doing this you are losing upside from the market (note this could also be viewed as protecting from downside, depending where you are with your money). The closer you are to the date, the lower your gains will be from a positive Stock Market return, as shown here:

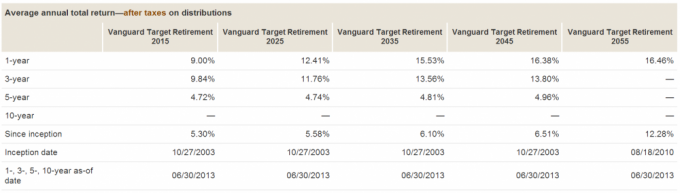

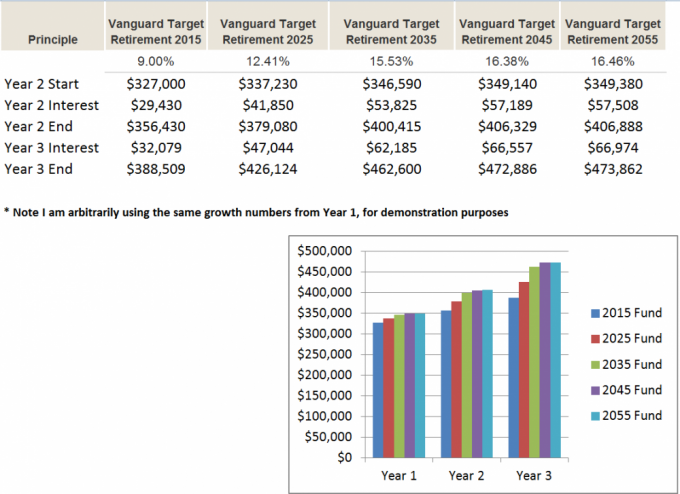

Lets look at this in a Scenario based upon what you have earned by age 62, assuming retirement in 2015 and where you allocate it between Target Date Fund:

Scenario: IRA Value $300,000 – Impact of picking a later date ‘Target’ for your fund, the chart below shows 1 year gains for 2013:

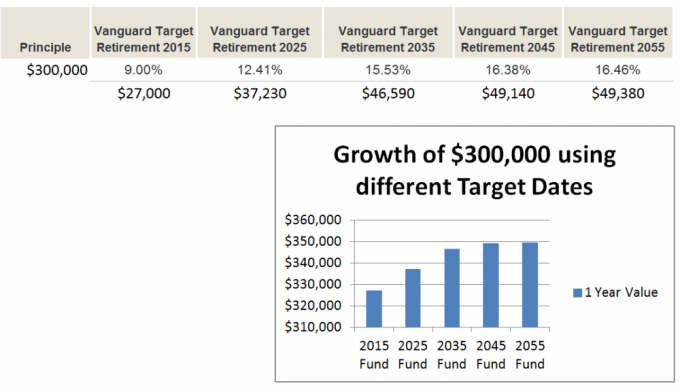

Now, it is also important to remember the power of compound interest. At this point, you have 2 more years to go until retirement, and if you start off year 2 with that much more principle, you will see the impact much more on your overall investment. For the purposes of this demonstration I simply kept the annual performance the same, which is not necessarily accurate, but a good way to see how picking a different mix of stocks and bonds can impact you during those final years.

Also, I am not recommending that your entire retirement savings are $300,000, it is only for illustrative purposes.

Of course, I am using numbers here from a positive stock market period, and by the same token if you had been exposed to the market during the recent recessions, your accounts would have dropped that much more. And here is where the subject of debate comes into play; should you gamble with your retirement account?

The answer is unique to everybody, but the core question will always be, what happens in a worst case scenario? This is setting your risk tolerance. In retirement if you have to live on the Target Date Retirement fund and absolutely need to take distributions from it every year you will be hurting if the market drops.

Think of it like a Scuba Diver – you have a limited tank of air, and in a recession, when the Dow Jones is crushed you are taking big gulps of air to survive, and in an growth period you only need little sips of air. The tank is finite. If you really need to take out 30K a year every year and a recession reduces the value of your $300,000 to $150,000 every year you are reducing your investment by 20% and in 5 years at that rate you will be out of air, in a year when the growth has pushed the account value to $473,000 as shown above you are taking out only 6% for every 30K and your money will last 16 years.

Therefore, if you want to start increasing risk with your account and pushing that Target Date further away to capture gains it would be best if you were able to get through a year or two without touching the funds in the Target Date. If you have a separate fund source that you could tap into that is not tied to the market, so you don’t pull anything out when the value is poor. If you don’t and you really do need to use your Target Date Fund as your only source of income in retirement then you should be thinking carefully about the impact of losing up to 40-50% of value in one year, and asking if you can take the risk (the answer I would suggest is that you shouldn’t do it in this case).

When I recently set up a Roth IRA with Vanguard I picked a Target Date Retirement Fund of 2060, just so that I would be exposed to a riskier mix of Stocks that would offer greater upside, way beyond my expected retirement date of 2042, and my hoped for retirement date of 2020. Don’t get attached to the date, think of it as a name for the fund and the risk that is attached to it.

Before embarking in any new position or fund I recommend screening your current portfolio for efficiency, here is a review of how I used the free tool from Personal Capital to do this, and saved over $1,000 on just one small fund position:

Review: Personal Capital Powerful Free Tool To Examine Your Investment Accounts

Leave a Reply