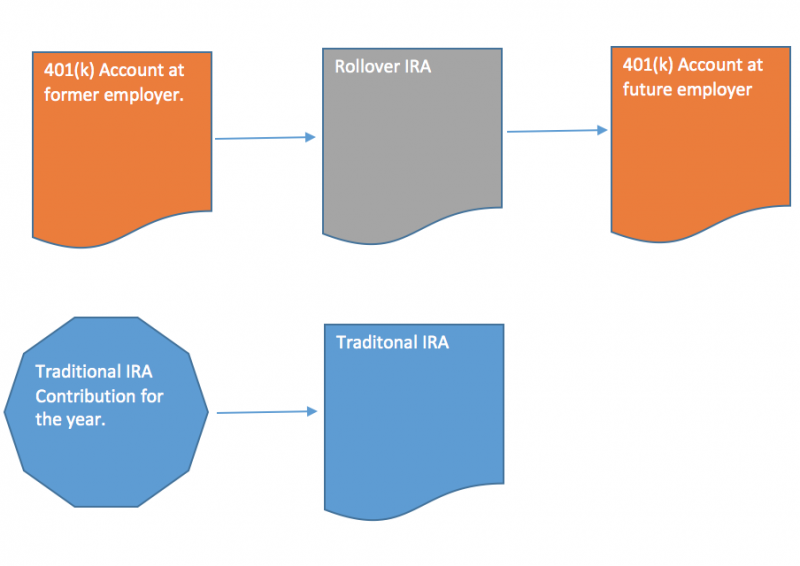

A rollover IRA is used to receive funds rolled from outside custodians. This could be other IRAs, and also employer sponsored accounts like a 401(k). The Rollover IRA is essentially the same as a Traditional IRA, but there is one important factor to consider:

If you roll in funds from employer accounts to a Rollover IRA and nothing else is contributed, you retain the ability to roll the funds back out of the Rollover IRA and into a new employer plan in the future. However, as soon as you add an annual, Traditional IRA contribution to this account it becomes ‘Co-mingled’. When this occurs you lose the ability to roll it back into a future 401(k).

If you do find yourself both wanting to rollover a 401(k) and contributing to a Traditional IRA the solution would be to open two accounts at your custodian, one that receives 401(k) and a second account to receive your regular annual Traditional IRA contribution.

Why would it matter?

If you co-mingle, you lose the option to use the rollover as a conduit between two 401(k) accounts. The importance here is the ‘option’ as it might be that your future employer has an inferior plan to what is on offer within a low cost IRA. But that said, even the worst 401(k) plans offer things that IRA’s do not. The two most important items are:

- ERISA protection. The ERISA act of 1974 puts into place safeguards for the owner of a 401(k) that the owner of an IRA does not have. Important ones pertain to creditor protection on a Federal level. ERISA makes it harder for a 401(k) to be the subject of liens and litigation, whereas an IRA is afforded protection on a State level, which varies in strength.

- 401(k) required minimum distributions (RMDs) are not required while employed, whereas the same employee with a Traditional IRA would be required to take these distributions.

These two factors alone offer upside over an IRA, however, the choice to flow Rollover money back into a new 401(k) should be viewed holistically, and investment options are a key consideration. There are some fantastic 401(k) investment options, with ultra low fees, and there are others that are utterly abysmal. Since you’ll likely not know what the next 401(k) will be until a later time, it might be a good idea to keep the option to conduit into it, rather than lose that via a commingling decision.

Such a timely article, Matt. I just changed jobs. I actually rolled over my traditional IRA into my new 401(k) contrary to what you mentioned above. I was even asked the reason I wanted to move it over to my 401(k).

Matt conduit IRAs are now pretty much useless.

IRS Pub 590 “You can use a traditional IRA as a conduit IRA. You can roll over part or all of the conduit IRA to a qualified plan, even if you make regular contributions to it or add funds from sources other than your employer’s plan. However, if you make regular contributions to the conduit IRA or add funds from other sources, the qualified plan into which you move funds will not be eligible for any optional tax treatment for which it might have otherwise qualified.”

That last sentence – those ‘optional tax treatments’ are very rarely available for any plan (that is unless you have employees who contributed a to the plan prior to 1974 and you’ve kept certain provisions in your plan document ever since).

I can’t remember the last time I saw an adoption agreement which didn’t allow such rollovers. Plus recent guidance has made it possible for the Qualified Plan to be held harmless against single employees with regards to assets they roll into the plan.

Interesting issues to discuss would be how some states may treat an IRA that holds only former qualified plan assets with certain protections in bankruptcy (a potential reason to keep the IRA assets separate). Or what happens to your non-deductible IRA contributions if you in turn roll the entire IRA into your employer’s plan. But conduit IRAs vs. contributory IRAs are nearly irrelevant in the way you discussed.

Great info Ben. The impetus for the post was being informed by Vanguard that if funds were comingled they wouldn’t allow the conduit.. That could be an uninformed rep.