I’m not trying to Roboadvisor bash here… there’s enough of that going on. This is a sincere question. Do you know the answer? I don’t, and it would be great to find out.

Roboadvisors like Wealthfront and Betterment “sell as a virtue” the idea of automated, algorithm derived tax loss harvesting. This sounds amazing, but what if it means they were programmed to sell, when their master was saying they should hold?

Some points to ponder:

- Algorithms respond to movements in price to capture loss. They sell Investment A and buy Investment B.

- The investments in question dropped more than 5% today, did this trigger a sale?

- It takes T+3 days to settle a trade. This means that they cannot buy Investment B again until the funds are back in the main account, unless the account has margin status (an overdraft facility).

So when Wealthfront sent out the message to ‘do nothing’ are they actually saying don’t sell the losing stocks, or are they saying, don’t leave Wealthfront? Did they automatically sell the losing stock, and therefore did they miss out on the bounce back because funds weren’t available for trade?

It seems that Wealthfront accounts are cash based, Betterment have margin.

@Saverocity @johnndege Good question. All @Wealthfront accounts at Apex are cash accounts. No margin: https://t.co/Rzz4LeFnbZ

— Bill Winterberg, CFP®️ (@BillWinterberg) August 24, 2015

@Saverocity @johnndege It appears @Betterment accounts at Apex are margin accounts: See #11: https://t.co/A884OouRzo

— Bill Winterberg, CFP®️ (@BillWinterberg) August 24, 2015

So my question is:

Did your robo sell when the advice from the human masters was to hold? If they didn’t, was that just through chance (EG they have a batch trade at close of business) or was it by design?

And my follow up question: if you invest with a Roboadvisor, do you know what actually happened to your account today during the flash?

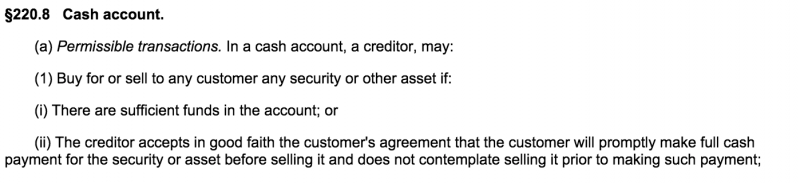

Update 8/25 – I reached out to Adam Nash, Wealthfront CEO to ask if this T3 lockout could occur, and he informed me that they have a work around, using a credit agreement found within eCFR I imagine he is referring to 220.8.a.1.ii. So with that in mind, it seems like they could have swapped out the position effectively, and created a great tax loss harvest in the process. Good stuff!

Hmm, I’d definitely like to know if Betterment has the same automated intelligence. I don’t have an account there currently so I can’t answer your question but am almost surely going to open one in the near future. This may actually sway me to stay solely at Vanguard. Keep us posted.