I am a proponent of the FIRE concept, Financial Independence, Retire Early. Though the first part of the statement is the key, and once you have achieved financial independence you don’t have to start knitting, it just means that you have options. Options that can include taking a year (or a lifetime) off to sail the Caribbean, or work with your favorite charity or whatever excites you.

My general advice is to save as much as possible during your key earning years. Doing this does not mean you have to curb your existing lifestyle, but if you spend smarter, you keep more of your money. The goal of this is to focus on building the ‘nut’ or a nest egg that will eventually grow to sufficient size to maintain your lifestyle needs, the challenge people face though, is that if they allocate funds into retirement accounts they lock them up until more traditional retirement age, if all of their money is here how can they afford to live in early retirement?

The major concern is funding 401(k) plans since such tax deferred accounts are generally not accessible until 59 1/2, so if the majority of your wealth is in them you can’t afford to live. Let’s look at the workarounds for this predicament.

The Age 55 Rule

Firstly, if your Early Retirement occurs at 55 or older, you can access your current employer 401(k) without penalty. That doesn’t mean you can retire at 54 and then withdraw at 55, you have to be employed to 55 or older. Furthermore, if you rollover that 401(k) into an IRA you can no longer implement this rule.

You can withdraw from any account at any time – the key is to do so without incurring a penalty, which is 10% of what you withdraw

Remember, 401(k) assets are tax deferred, meaning that you would still pay regular income tax on the distributions, whether they were penalty free or not.

Retiring prior to Age 55

The simplest solution to covering the gap between early retirement and when you can access your deferred funds is to have multiple asset locations – IE hold enough money in regular, taxable accounts such as banks and brokerages to cover your expenses fully until such time as you can tap your retirement reserves. An alternative structure to this would be to create cash flowing investments, such as rental properties which would cover your outflows. While the tactics differ, the goal is the same, to bridge time gaps by using alternative asset locations.

Optimizing contributions

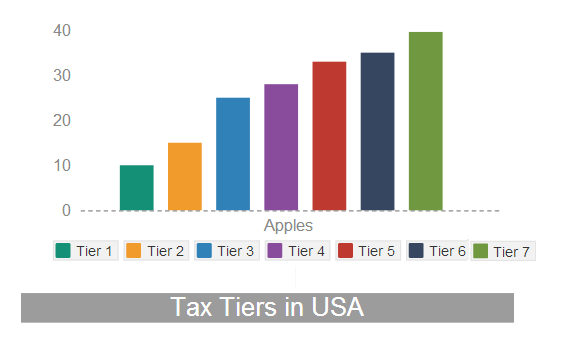

Paying into the 401k when you are earning the most still trumps storing in non advantaged accounts. The US has a progressive tax system, the more you earn the higher rate you pay. While we cannot predict future rates, we can accurately see what tier or bracket we are in today. If we ignore the actual rate and just group in bands it is easy to spot optimization opportunities:

If our goal is retirement it would be reasonable to assume that we are earning more today than we will need to earn retirement. The reason for that is out of today’s income you are not only covering real costs of living, but also are allocating money to savings, and losing efficiency (you need to pay to earn, things like commuting costs etc). So with that in mind, you will be in a higher tax tier when working than when in retirement. And certainly while we can speculate that rates may rise, past indications have shown that they actually fluctuate based upon many factors, including political good will.

Leveraging Tax Rules

The greatest tax rule we have here is the ability to reassign taxable accounts from tax deferred to tax free, in part or in full, at the time of our choosing. This allows us to defer taxes not only to the commonly thought age of 59 1/2 but to any time between the day of contribution right through to any time in your retirement. It is worth noting that contributions to Roth IRAs are available for withdrawal without penalty, but rollovers require the Roth account to be open for 5 years before doing this.

What this means, is that you can pull yourself out of the highest tax band you will likely be in, and in later years ease the money back into non tax deferred accounts while paying less tax to do so. For further analysis on how this works please read The Impact of Future Tax Changes to Your Retirement Account.

Tactics to maintain your lifestyle for during the early retirement gap

Based on the above, one such tactic is to roll money from tax deferred accounts into tax free ones in stages over a period of time. If you were to do this in a laddered manner, you could siphon from a tax deferred account a sum that in 5 years would be enough to live on, and each year roll more in while withdrawing penalty free money.

Roth IRA Laddering

If you decide that your annual expenses are $50,000, 5 years from now you will need to inflate that sum accordingly. Note not every expense inflates, EG a fixed rate mortgage payment would not, gas might reduce if you were working and no longer commute. So factor in some variance, but generally inflate by a conservative 4.5% inflation rate. There is a complication here. You cannot withdraw earnings penalty free. Therefore if you plan to ladder you need to do so in a manner that the contribution is sufficient to cover costs in the future, and the earnings will be pulled out in regular retirement age.

EG – the future inflated value of $50,000 would be $62,309 so you would need to roll that amount in full, and any growth on it would start building towards the regular retirement age. If you were to ‘need’ $50,000 in today’s money in 5 years you would put in $62,309 today via a rollover, and then pull out the same $62,309 in 5 years time. If you were to earn say 6% on that the ‘earnings’ side would be $21,074, which would go on to compound until retirement.

The best time to start a Roth Ladder is when your income is as close to zero as possible, because Rollovers from Traditional IRAs to Roth IRAs count as income in that year. Efficiency in this is lost if you are trying to move the full amount of a years expenses as you can see above, as the amount of the rollover is quite high. It may be better to consider using the Roth Ladder strategy to offset just some of your annual outflows, that way you increase tax efficiency during rollovers.

In summary a roth ladder allows you to transfer money out of your 401k and into regular circulation providing that you can wait for the 5 year cooling off period to kick in before you start drawing out. This means that you can reduce the shortfall gap between retiring at 40 from 20 years to just 5.

SEPPs

Another strategy to consider is substantially equal periodic payments or SEPPs. These are a little more complex, and have a lot of nuances, but are allow you to withdraw from your Traditional IRA before the age of 59 1/2 without penalty if the amount of your withdrawal fits into a certain value in relation to your life expectancy.

There are three different ways to calculate the amount of distribution under the SEPP rules, they are:

- RMD

- Fixed Amortization

- Fixed Annuitization

The first method RMD is the easiest calculation and is conducted annually, whereas the others take a little more time, but doesn’t require recalculation. Also, it should be noted that you cannot add to IRA balances while drawing down under SEPP rules, so you wouldn’t be able to combine Roth Laddering or other strategies during this time.

Taking SEPP withdrawals can also prevent you from drawing into the IRAs for other reasons, as it can trigger penalties and interest that will include what you took out via the SEPP calculation. And it is a longer term strategy, typically you must continue to take SEPP distributions for at least 5 years.

In Summary, the SEPP strategy is best used when the required funds are low in relation to the the IRA balance. The key rate used is the Federal Mid-Term rate which as of today is 2.27% which means that in the example above for a 40 year old to have $50,000 distributions the value of the IRA would need to be $1.21M.

Resources:

We’re in this no mans land of being too early to retire as majority of our assets are in IRA/401K. We expect to be in same tax bracket when we retire, so no incentive/ability to shield income, and are in too high a bracket to contribute to a Roth anyway.

Your info about accessing our 401K after 55 is interesting and we’ll dig deeper.

As it stands now, unless you’re (over)confident about future income growth, you need to be very conservative – way more than your assumptions methinks – assuming 6% growth is akin to financial suicide. I’d suggest to assume long term GDP growth percentage as far more realistic – which is closer to 2.5% range going forward (and assume about the same as inflation which means little/no inflation adjusted growth). Fundamentals have changed so that extrapolating past performance is foolish. Baby Boomers will start to sell assets en masse (particularly real estate/equities), and consuming less – which leads to a downward asset spiral that many other developed economies with aging populations have already experienced (Japan/Italy etc etc). And with SS sure to cut bennies by ~25%, people really need to be saving aggressively now. I don’t think the Millennials will be happy with what they are about to experience.

But of course, being rational and pragmatic won’t sell to Generations who have been told they are all above average and coddled their entire lives. Will be interesting to watch them face reality in the next few decades that they won’t be as well off as their parents, despite way too many trust funds/inheritances going their way.

Hints: Never buy a new car – let other schmucks drive off the lot and lose an immediate 10-20%. Build your own home and save tens/hundreds of thousands (never buy at market peaks either – just rent and wait for the inevitable housing correction – one happens every decade, so I suggest late this decade will be the next). Stay out of credit card debt. Insist your children get worthwhile degrees that will give them a career and financial stability, otherwise their 4-6 years in college will be a complete and utter waste and land them in huge debt that cannot be extinguished in BK – a financial dead weight around their neck their entire lives.

Sounds like you are in great shape – if your retirement income is going to put you above Roth levels you are probably more than ready to give up the day job!

Don’t forget, the salary cap for Roths is related to contributions, not rollovers, so you could still create the ladder system and could therefore build that into your early retirement plan. It would mean that you need to float 5 years of gap until you can start drawing out your contributions.

But if 55 isn’t so far away, that is a great option too.

Agree with many of your points, we saved a lot of money by me working on our last home, we had contractors in for bits that I hadn’t done before, but we pulled the quote down from $75K to $20K by negotiating and my working as the labor.

I’d certainly also plan for a reduced SSI – that is only a matter of time, it may well come in the form of a new retirement age soon, so a plan needs to not rely on it.

As for the liberal arts… hmmm… I’d be shot if I agreed with you there, so i’ll leave that one for now 🙂