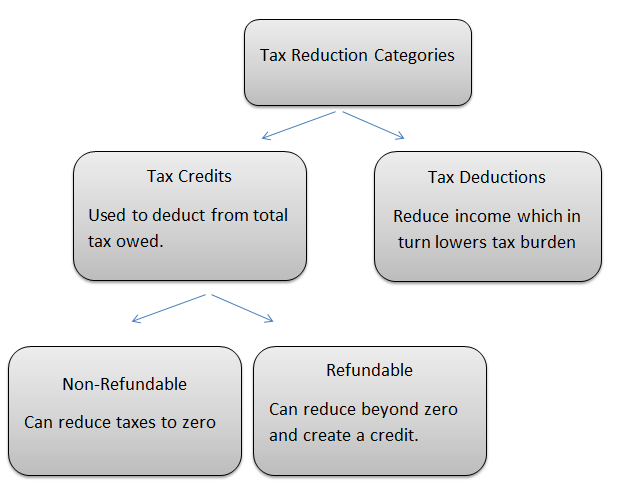

The IRS has two general areas which we can use to reduce our tax bill each year, knowing about these, how to trigger them, and which to use can make a big difference to our take home pay and is something worth keeping a close eye on. This post will look briefly at the differences between Credits and Deductions, and explore a couple that might be very valuable to you or people you know this year.

The Major Difference between a Credit and a Deduction

Tax Credits are fixed cash amounts that impact your tax due. For example, if you have an annual tax bill of $10,000 and a credit of $2,000 for the year you will owe $8,000. If you have already paid your $10,000 in estimated taxes either as employee withholdings or as a self employed quarterly estimated tax payments then you will get a tax refund of $2,000 in this situation by using the credit.

Tax Deductions are amounts that you use to reduce your income levels for tax calculations. In the same example as above with a tax bill of $10,000 if you have a $2,000 deduction then you would apply that to your income level, and it would reduce your tax liability inline with your tax bracket. EG a person in the 25% bracket with a $2,000 deduction and a $10,000 tax bill would result in paying $500 less tax (25% of $2,000).

Clearly, Credits are better than Deductions for this reason and are things we need to find wherever we can, before exploring them further there is a further distinction to make regarding Tax Credits:

- Non-Refundable Credits will drop your liability to zero but not below. For example if you have the tax bill of $10,000 and $12,000 of non refundable tax credits you will end up paying zero tax for the year, but won’t get the extra $2,000 as a refund.

- Refundable Credits act as above, but are able to put you into a credit situation, if you had the same $10,000 and $12,000 of refundable credits you would not only pay zero, but the IRS would mail you a check for $2,000.

The biggest issue that comes with such Deductions or Credits is that they are income related. This is actually a double edged sword and frankly the only people who can really maximize many of these tax breaks are people who are very savvy and can plan well. The trick to capturing them is that firstly almost every tax break has an income cap, related to AGI or MAGI (Adjusted Gross Income or Modified Adjusted Gross Income) and the IRS is such a mess that they actually calculate AGI’s differently for different credits. It really is a murky world.

The double edge I refer to is that simple practicality excludes most people who are in the position to save (by being under the salary cap) by the fact that they are too damn poor to do anything but live hand to mouth. We can explore that further in our first Tax Credit:

The Savers Credit

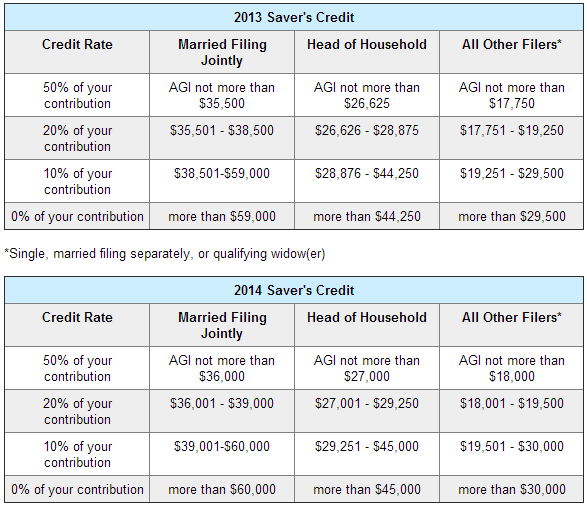

This is an amazing Credit. The government will pay you up to 50% of your first $2,000 contribution to your retirement plan if you meet the income requirements. That is per person, so a married couple could get it twice. Here’s the rules:

Qualified Plans for the Savers credit:

The Saver’s Credit can be taken for your contributions to a traditional or Roth IRA; your 401(k), SIMPLE IRA, SARSEP, 403(b), 501(c)(18) or governmental 457(b) plan; and your voluntary after-tax employee contributions to your qualified retirement and 403(b) plans. [source IRS Website- Savers Credit Rules]

Example:

Jack and Jill are hard workers, frequently traveling up hill to carry water for the farm that they are working on. Jack earns $10,000 in 2013 from his pail carrying skills, whereas Jill, who acts in more of a managerial role in the process earned $25,000. They are able to both claim the credit should they contribute to a qualified retirement plan.

Thankfully, the AGI calculation for the Savers credit includes the contribution to a plan. So if Jack and Jill were to both receive a nice pay increase, and now earn $12,000 and $27,000 respectively (Married Filing Jointly income of $39,000) but then contribute $2,000 each to their 401(k) plans their income would first be reduced by the Tax Deduction of the 401(k) to $35,000, bringing it under the $35,500 limit and qualifying them for a Tax Credit of $2,000 ($1,000 per person).

The amount that they can claim as a Credit is gradually phased out, so if their income was higher, as per the chart below:

Note – they won’t let you claim it as a full time student, but if one of you within a marriage is then the working spouse could claim their part of this.

The Retirement Account Deduction

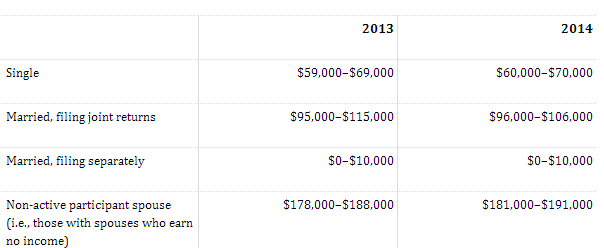

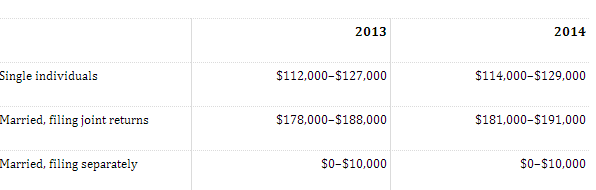

The concept of using a contribution to a retirement account to reduce your AGI and bring Jack and Jill under the income limit for the credit naturally raises the very common retirement account option for reducing income. There are a number of ways to contribute, but they all fall into two categories:

Tax Deferred Account

Tax Deferred Accounts include 401(k), 403(b), Traditional IRA, Simple 401(k) et al. These accounts reduce your current year income, as a Tax Deduction as you send money into a retirement account, but it will be taxed on the withdrawal side when you are in retirement, where it will act as regular income.

Tax Advantaged Accounts

Most common would be the ROTH IRA and the lesser known ROTH 401(k) these take your after tax income and allow it to grow tax free, these do not reduce your current annual tax liabilities, but have better long term value.

The difference between a 401(k) and an IRA

What a lot of people miss is that the 401(k) and the IRA are different instruments, though they have the same goal. Furthermore, you are allowed to have both. The contribution limit for someone under 50 is $17,500 to a 401(K) however they could also fund another $5,500 into an IRA that year. For those over 50 they can fund $23,000 and $6,500. These act as Tax Deductions (not Credits).

Example:

Jack, who has since divorced Jill for not pulling her share of the water buckets has gone onto earn a salary of $32,000, way beyond the limit for the 50% of the Savers credit above ($17,750 for single filers). However, he decides to set up his 401(k) to fund $17,500 and another $5,500 into a Traditional IRA. This reduces his AGI down from $32,000 to $9,000. He therefore would pay tax at the very lowest bracket, and also receive $1,000 from the Savers Credit.

The Earned Income Tax Credit

The earned income tax credit (EIC) is a credit that was created to encourage people to work. Basically the premise is that people who work pay taxes, so if they get a credit against those taxes they will be more inclined to work… one could perhaps deduce from that taxes aren’t a good thing for the economy… but lets move on from that (wonderfully) crazy economic concept for a moment and look at the credit.

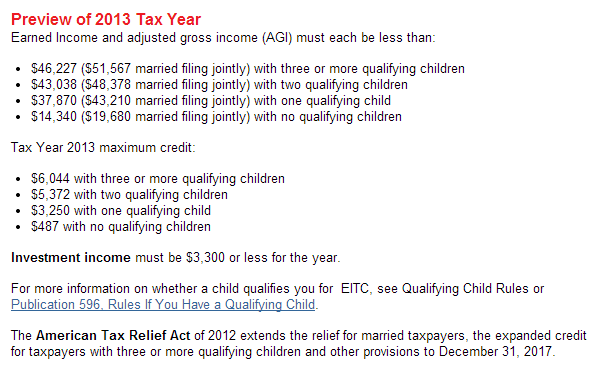

The Earned Income Tax Credit is a Refundable Tax Credit – meaning it can reduce your tax liability beyond zero and create a credit to you, it changes based upon how many children you have created and follows this chart:

Also, if your taxes are done by a paid preparer (eg you retain a CPA) they are supposed to file Form 8867 with the application in order to avoid a penalty. The penalty affects them, not you.

Education Credits

The American Opportunity Credit (IRS Publication 970) is seriously good if you qualify…traditionally aimed at college kids who have stayed out of trouble with the law:

- Income limits: $180,000 for Married Filing Jointly, $90,000 for other status, it phases out once your income hits 160K/80K respectively.

- Can be claimed for up to 4 years of College (Undergraduate or above) study

- Max value is $2500 calculated as:

- First $2000 of expenses plus 25% of the next $2000 of qualified expenses (expenses have some limitations, but tuition is covered)

- Student must be free of felony offences.

- The credit is potentially refundable up to 40% and non refundable for 60%.

The Lifetime Learning Credit is good for people who don’t qualify for the American Opportunity credit. It isn’t as generous when compared like for like but if you have already maxed out your 4 eligible years of American Opportunity then this Lifetime Learning credit can kick in to help offset education expenses:

- Income limits to claim the credit $124,000 for Married Filing Jointly, $62,000 for other tax status

- No limit to number of years that can be claimed.

- Max value is $2,000 calculated as 20% of your total qualified expenses (IE you need $10,000 of Tuition and required books or other QHEE Expenses to max out the $2,000 credit)

- Course can be graduate education or certain unaccredited courses that are used to improve your job prospects.

- Ideal for criminals since there is no restriction for felony offences

Another major difference between the two is that the American Opportunity Credit is per person whereas the Lifetime learning credit is per Tax Return.

Conclusion

Understanding the difference between Credits and Deductions is valuable in focusing your strategy on the most beneficial way to craft your tax return. There are many situations where by paying more of your money into certain areas, such as retirement savings or education that you can actually offset the cost greatly, and effectively subsidize your wealth accumulation strategies.

I understand that there are a lot of wealthy readers of this site, so the income levels preclude a lot of these strategies. However I would encourage you to broaden your awareness of the different aspects of taxation that could be useful for friends or family so that you can help point them in the right direction. Knowledge is empowering, and perhaps you will be able to positively influence people around you with this information.

Lastly, Saverocity is journalistic, it is intended to give some ideas for further research, and is not a substitute for professional advice, please consider the information here as fictional, and something that might inspire you to read a little more deeply into the matters discussed. By which I mean don’t be a cowboy and build your entire taxation plan around this and then sue me when it goes to hell in a hand basket.

What do you suggest for the “middle class” = Too poor to have an account in Virgin island, and too rich to take advantage of these suggestions (except 401k/roth)?

That’s a great question, and I think deserving of it’s own post. To put it succinctly the challenge for the demographic you describe is different from those in the lower or upper class, and it must be tackled differently. It is not just a question of ‘what deductions work’ but a bigger picture of goals… I’ll get cracking on that post to explore it further.

Excellent article. I’ve been trying to get a grasp on this stuff myself.

This is an unbelievable article, Matt. Thanks so much!

Glad you liked it Andy

Thank you for an excellent article. Very helpful.

I was a little bit confused when you explained the tax credit for Single Jack. What threw me off was the 50% tax credit when he put $5,500 into his IRA and reduced his income to $9,000.00. If Jack was mostly in it for the tax credit he could have just put $2,000.00 into his IRA and received $1,000.00 back, since the credit is 50% but $1,000.00 per person max. Is that correct? (he already reduced his income below the $17,750 threshhold when he put $17,500 of his $32,000.00 income into the 401K)

Hi Hilde,

You are correct. If Single Jack had contributed just $2,000 he would have still got the full $1,000 back from the Savers credit. The reason I picked $5,500 for single Jack is that he was used in that example when looking at the impact of the Retirement Deduction, not just about the Savers Credit, so I highlighted the maximum could be put there.

The savers credit is amazing, but I would still like to see Jack putting in the full amount he can to the IRA to capture the full value of that deduction also, if at all possible.