I have used Credit Sesame for some time now, it is termed ‘FAKO’ in that it provides a similar result to your FICO credit score, but is free, so a lot more attractive to people, as the official reports from the three big providers (Experian, Equifax and TransUnion) can cost around $15-$20 per month each.

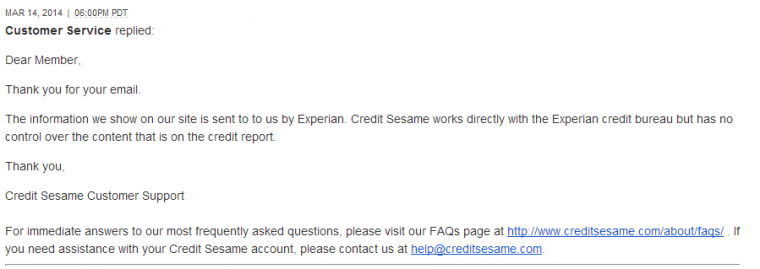

Recently, I started exploring their Credit Utilization Alerts, as I found myself receiving warning emails from Credit Sesame that I had too much on a card. It turns out that even if you pay off your bills in full each month, if you have a high balance prior to that payment being made you are flagged for high utilization, here is a post on how to manage that. I wanted to confirm that these alerts were generated from my credit report, rather than my bank account, so I reached out to Credit Sesame, and they confirmed all their data is from Experian.

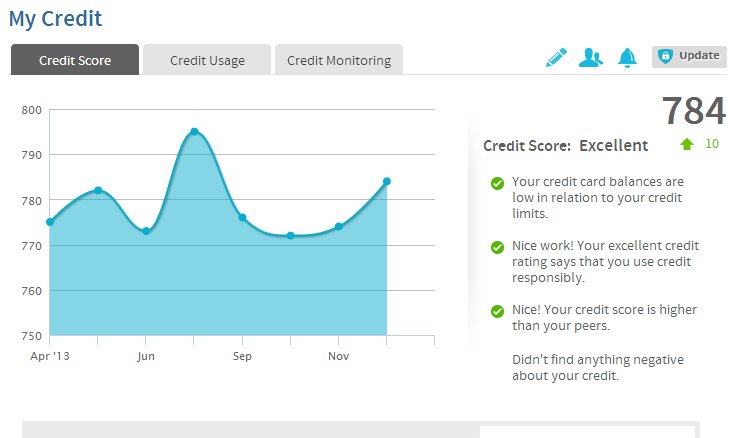

My Credit Sesame (Experian) FAKO Score

A score of 784 is pretty good, especially if you consider that my Credit History in the US is only about 4.5 yrs, and I have no other debt, such as mortgages or car loans. The blend of debt you hold increases your score.

I am especially happy as it clearly states that the data comes from Experian, so I don’t need to worry about actually checking my real score. However, when I recently started digging into this subject I learned that despite there seeming to be clarity on the score, in truth there is a lot of weird murky goings on behind the scenes, that is depicted as ‘propitiatory information’ where these companies state that they won’t tell you everything that goes into constructing a score in fear that the calculations it will be stolen. For me, that just raises my distrust level, so I thought why not see what Experian shows on their side:

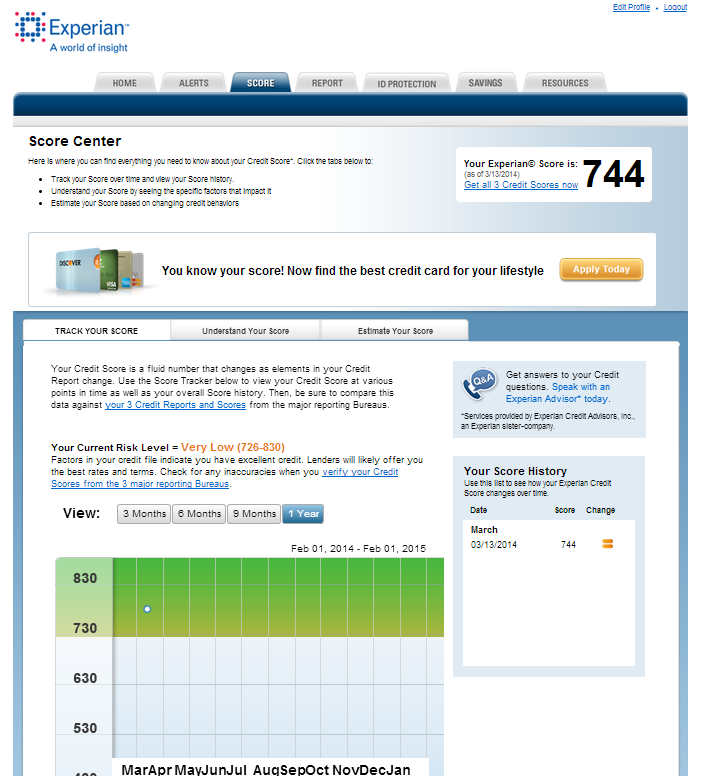

As you can see, the difference between 784 that Credit Sesame shows me, and 744 that Experian shows me is actually quite the jump. Both are decent scores, but the 784 is a lot more robust, as it puts me firmly into Excellent Credit wheras 744 that Experian shows me is somewhat more on the border between good and excellent, 40 points is no joke. Now, certainly the score provided by Credit Sesame doesn’t have to be the Experian score, but this sort of verbiage, along with the image at the top of this post really do imply that it is:

So, why the discrepancy? I cannot say, but I can posit that since Credit Sesame makes revenue from the sale of credit vehicles, such as credit cards, loans and mortgages, it does have an incentive to encourage you to apply for new credit, and offering a better looking score would certainly help encourage potential borrowers to apply.

FYI – http://consumerist.com/2011/04/11/the-credit-score-experian-is-selling-you-isnt-the-one-lenders-look-at/

You will find there are lots of proprietary credit scoring systems. I think most of the banks do their own thing where they look at FICO scoring but also create their own internal score which is why if you get turned down for a credit application they may send you your “score” in the denial letter and it too may be different from any other score you have seen. Then there are different flavors of actual FICO score itself like auto related.

Jack- it’s time you write a guest post.

Credit sesame uses the Experian National Equivalency score, the Experian website uses score plus. Neither of these are used by lenders (lenders either use FICO or VantageScore).

Yeah, I’ve noticed this before. I have a friend who doesn’t have great credit, and her Credit Sesame score was showing around 740. But when we actually pulled her report from Experian it showed more like 675. (Credit Karma seem to have the same situation with regard to Trans Union.)

I consider these sites useful in that they provide monitoring and I think they probably report the trend of your credit score correctly, but they don’t provide accurate FICO scores.

I have been using Credit Sesame for a couple years now mainly for credit monitoring.

I just got a new credit card this past fall and my Credit Sesame score was about 40 points lower than my score that they pulled.

My credit score on Credit Sesame is actually lower by about 25 points then on the real report, They must use a different formula from the information received from Experian.

A data point on how much these can swing. On 2/18 I applied for a Barclays credit card and then 5 minutes later a US Bank credit card. When I later got the decision letters from them, both listed TransUnion and both listed pulling on 2/18. Barclays said my score was 804, US Bank said 745. These are supposedly real FICO scores and even then wildly vary between banks. So any measure, free or paid, I take as a very rough estimate. Also would be interesting to know if US Bank systematically underscores applicants, perhaps contributing to why so many people report denials. How this ties in to the alternate credit bureaus US Bank uses I don’t know since in this case all they listed was TransUnion.

There is more than one FICO score, even when you use the same bureau. US Bank is probably not using bankcard enhanced or using a newer/older version of the algorithm than Barclays.

US Bank is more difficult to receive approvals from because they pull other credit reports (outside of the big three) that contains different data. If you freeze these reports, you’ll have a lot more success with US Bank applications.

Just an update, credit sesame now also offers free identity theft insurance.