I recently talked about some basic concepts that will help you on the path to wealth, in it I stated the two most important documents you need are the Personal Balance Sheet (listing assets and liabilities) and the Cash Flow Statement (what you spend your money on each month). This post will tackle the Personal Balance Sheet, and we will take it a more optimized level by adding in tax awareness.

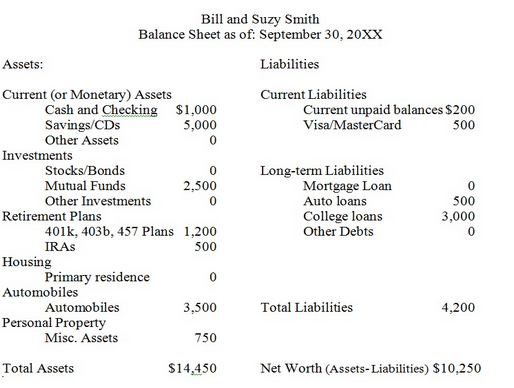

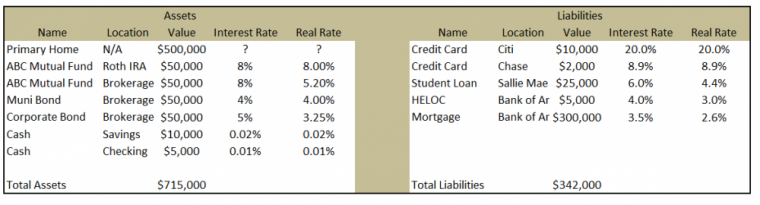

There are lots of different formats for a balance sheet. Some lists your assets on the top and liabilities below, netting out to your net worth, like the one above, and there are others that go left to right like this:

I don’t have time or interest to discuss the merits of the top down approach with any accountants out there, so if you learned it that way in school fine, but I believe that the left-right approach is best. I also don’t care if you want to put assets on the left or the right, as long as one side is all assets and the other is all liabilities. The reason for the left-right approach is that once we have sorted the sheet correctly, as we will do in this post, you will be well positioned to decide which assets and liabilities you want to keep, and which to focus on removing. It is also very handy to keep the left-right model for when we come to cash flow statements.

Back to basics – what is an asset and what is a liability

This seems simply, but is actually an incredibly confusing area of finance. When faced with the question ‘is it an asset or liability?’ the often are mix them up. Let’s start with a quick definition, from Investopedia:

An Asset Defined:

An asset is anything of value that can be converted into cash. Assets are owned by individuals, businesses and governments. Examples of assets include:

-

Cash and cash equivalents – certificates of deposit, checking and savings accounts, money market accounts, physical cash, Treasury bills;

-

Real property – land and any structure that is permanently attached to it;

-

Personal property – everything that you own that is not real property such as boats, collectibles, household furnishings, jewelry, vehicles;

-

Investments – annuities, bonds, cash value of life insurance policies, mutual funds, pensions, retirement plans (IRA, 401(k), 403(b), etc.,) stocks and other investments.

A Liability Defined

Recorded on the balance sheet (right side), liabilities include loans, accounts payable, mortgages, deferred revenues and accrued expenses. Liabilities are a vital aspect of a company’s operations because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, the outstanding money that a company owes to its suppliers would be considered a liability.

Outside of accounting and finance this term simply refers to any money or service that is currently owed to another party. One form of liability, for example, would be the property taxes that a homeowner owes to the municipal government.

Is a home an asset or liability?

I argued previously that a home (house, apartment or whatnot) is neither. It is a vehicle capable of storing both assets and liabilities. The equity in your home (net sale price of your home minus any liens against it) could be considered an asset. Some people will argue, and with some merit that a better way to decide if something is an asset or a liability is the impact on cash flow. If ownership requires a net outflow of money it is a liability, and if ownership produces a net inflow it is an asset.

The cash flow approach is a good one to have, the only thing you need to remember is that sometimes a net outflow of cash might be building equity value over time – so a house with a mortgage might cost you $1000 per month to hold, but when you sell it you get the $1000 back plus profit.

Phase 1 Building our Personal Balance Sheet

I recommend using a spreadsheet for this. You can build it in Excel, or if you don’t have Excel, Google Docs has a free spreadsheet that works perfectly for this too.

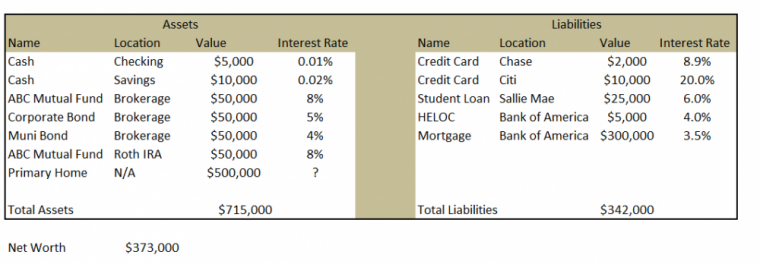

We need four variables for each:

- Asset Name, Asset Location, Asset Value, Asset Interest Rate

- Liability Name, Liability Location, Liability Value, Liability Interest Rate

APR – does it have a place here?

Most balance sheets wouldn’t have interest rate on all items, because not all assets or liabilities have an assigned interest rate by nature. However, we need to find a way to normalize all assets and liabilities in order to identify which are the most powerfully positive, and the most destructive to your wealth. It is possible to forecast interest rates on items that don’t have them, but it is a little complex and as such we will revisit that in the future. A perfectly built Personal Balance Sheet will have an interest rate assigned to all items.

Phase 2 Refinement -Conceptual Only

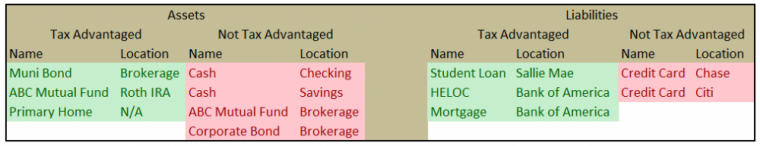

You don’t need to do this step, you just need to understand the concept. We are going to simply list the assets and liabilities in a further subdivision, those that are tax advantaged, and those that are not.

What this does is help visualize that not all assets, or all debts, are created equally. For example, the appreciated equity in a home is tax advantaged when sold to the tune of $250,000/$500,000 (single/join) of profit at 0% capital gains rate. And on the liability side credit card debt has no tax advantages, whereas mortgage interest does.

The purpose of Phase 2 is to start the brain targeting SWOT style approaches to the balance sheet – it can be possible for a liability to be better than asset, should it be cheaper to borrow money for your mortgage and invest the free capital in a higher rate of return investment. Not all debt is bad, and also, not all assets are good.

Phase 3 Re-organizing your lists based upon tax advantages

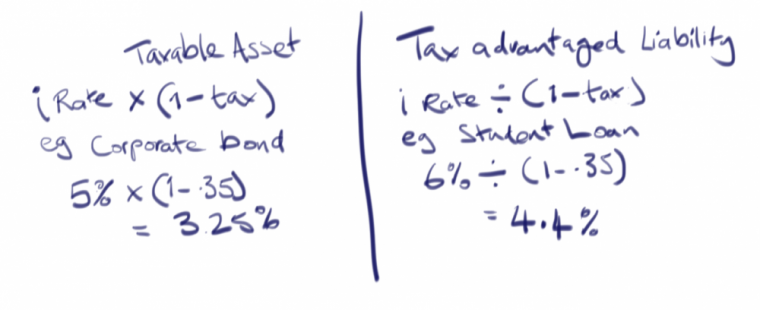

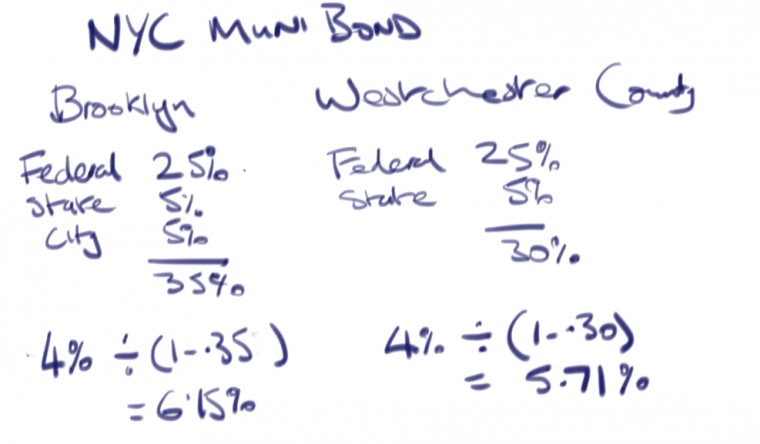

Taking the conceptual notions from Phase 2 we should re-organize our lists based upon the effective rate of return. In order to calculate this you need to know your current tax bracket, including state and city if applicable. I am going to use 25% +5%+5% respectively just for illustrative purposes and perform the following calculation to the interest rate:

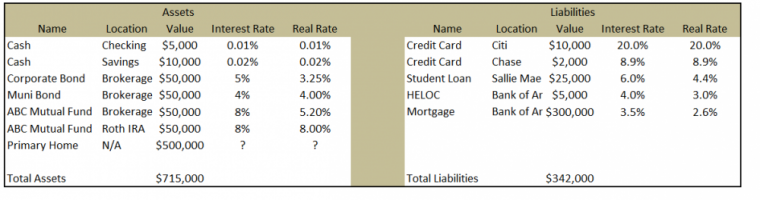

We then add back in the product of the calculation as a new column on our original balance sheet, as follows:

The math here, as you can see is rather simple. The complex part is knowing if you actually qualify for the tax advantaged rate or not, some things are based on income, but that isn’t the only factor. For example, if we look at a Muni Bond for New York I could earn triple tax free status if I live within the five boroughs, so looking at my present location in Brooklyn vs my next home in Westchester County (outside of the five boroughs and not subject to city tax)

In the example above, if you resided in Brooklyn you would be better holding a 4% Muni Bond than a taxable bond (Corporate or Treasury) of higher value, until the yield on the taxable reached 6.15%. However, if you resided in Westchester County, because you would not pay city tax on the Taxable bond it would only need to offer 5.71% to equate to a 4% Muni. What that means is if you bought a 6% Corporate Bond, it could be better, or worse, depending on where you live, than a 4% NY Muni.

One of the biggest driving factors in being able to activate the tax savings on the liability side of the balance sheet is opting to itemize your taxes.

Know where you are, before you can know where you are going

The snapshot of your financial position as provided by the Tax Advantaged Personal Balance Sheet is a means to understand your present position and how get yourself from where you are today, to where you want to be. The reason that I personally like to focus not on the size of the asset but the interest rate is because if you see something that has a large value but is low down the list you can see that it perhaps isn’t optimally placed.

Final Step – Flip Top to Bottom

The final step we should take in our balance sheet is flipping the order of the assets so we list the lowest interest rate at the top – when we do this removing the Emergency Fund is an optional step. The most conservative approach would be to say you should always have an emergency fund, but if you are bleeding out 20% interest on a credit card debt you may well already have an emergency on your hands!

Data manipulation is the beauty of using a spreadsheet, you can flip things top to bottom easily. Note, if you are a beginner with such software make sure you sort all the data by interest rate, not just the interest rate column and leave the rest untouched. And this is why I love the left-right balance sheet, as now you can draw a line across and decide is Asset X worth keeping over Liability X?

Leave a Reply