Apple (AAPL) remains the largest company in the world by Market Cap, it took the position from Exxon Mobile (XOM) in Q3 of 2011, just after Steve Jobs stepped down as their CEO and Tim Cook took the helm. Though Jobs did not preside over the company whilst it spent its time at the No.1 spot, it is clear that the work he did took it there.

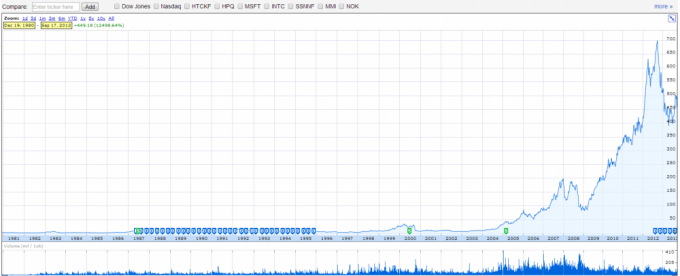

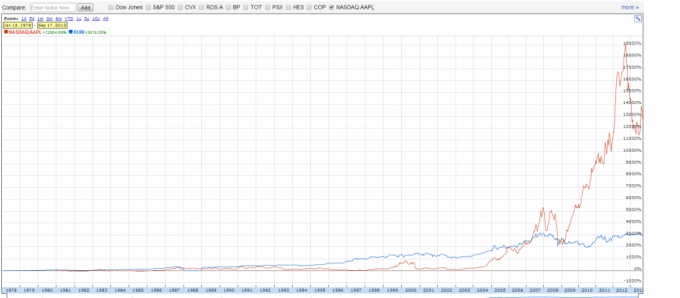

This post is going to look at the differences between owning a stock like AAPL and the number 2 company by market cap Exxon. I will not go deeply into technical analysis as for me, it simply isn’t necessary to convey the point of the post, though I will start with three charts that might be interesting for perspective.

The reason that I included the third chart is because when the untrained eye attempts to compare the two charts above they might come to the inaccurate conclusion that they are similar. It is a weird trait that people have trying to see patterns and whilst they both tick upwards, and more aggressively towards the right of the chart, the comparative movement is shockingly different. This note is included as a reminder for people that marketing tricks can be used like this to confuse and confound the customer.

When we overlay the charts we can see instead a stark difference in the performances of both companies, they track in a relatively similar growth pattern until 2005, and then Apple explodes upwards. It is worth noting that the chart above only cites stock price, not Market Cap, since they have a different float (number of shares available to trade) the stock prices of each cannot be easily compared, and whilst it appears from the above that AAPL is worth many times more than XOM, actually by Market Cap the difference between the two today is around 5%.

To reinforce that point, the market cap for AAPL in 2005, around the time that it started to pull away in terms of growth from XOM was $32.54 Billion USD, whereas XOM was 357.15 Billion USD. Today, in 2013 AAPL has a Market Cap of $413 Billion USD, falling from its high in Q3 2012 of $625 Billion USD.

In seven short years Apple grew its Market Cap by almost 20x, in just one year since then it has fallen by 1/3. These numbers are ridiculous in terms of hype and just not somewhere I want to be. Exxon on the other hand has steadily increased its cap over the years by very small, steady steps.

Margin Squeeze

Competition is high, margins are low. The famous FoxConn plants in China pump out millions of iPhones and iPads that resell for approximately 100% profit, the customer for an iPhone in terms of sales are the Telco Carriers, who pick them up from Apple at around $650 per unit, at a cost of around $300 to manufacture.

Costs are kept low by sweatshop conditions, that would be illegal if manufacturing would be completed in the US, with costs already squeezed, the only room for competitiveness now would be to reduce sale price (and therefore reduce Margins). We saw the impact of the failure to price correctly last week, when Chinese Market Pricing of the new iPhone 5c was set at 4488 Yuan (around $730 USD) which is higher than the average monthly salary (source Reuters).

I did start out this post saying I wouldn’t focus on the numbers or get into technicals, but these do matter. However, the crux of the matter for me is the type of business we are dealing with. Company A, Apple Computers is a consumer driven, fashion trend focused, inspired leader company. Three terrible strikes for me as an investor.

Consumer Driven Needs

The age of the entitled. We want faster, smaller, easier, cheaper, better. No we deserve it. And if you won’t deliver this we will go elsewhere and buy it from… Korea. Samsung has fast taken over market share from the iPhone with its Galaxy S range of smartphones, and when the new iPhone 5C and 5S were announced last week the lack of new features, coupled with poor pricing for emerging markets by Apple hit the stock with a 5.3% drop.

Take a moment to think about that. The stock of the largest company by market capitalization dropped in value by 5.3%, knocking over 20 Billion USD from the company value, just on perception that the new phone wasn’t sexy enough for the ever demanding market.

Each year Apple must produce newer, better, faster or it will be hit like this, and they already went from $30 Billion Market Cap to $600 Billion Market Cap by having the best there was at the time, when they stop having the best, what will happen to that number?

Apple is Cool

Apple is cool because people are like sheep who follow the crowd. Walk past any Starbucks in a big city like New York and it will be MacBook that are scattered throughout, the coolest stores use iPads to aid shopping and for digital signage. PCs running Windows are so passe, and Android is confusing.

Actually, Android is the new cool – and what we have in Apple is a trend that has swollen through solid marketing and enough grass root adoption to be viable. But trends change, and as more and more people adopt the Android platform all that will be required to push Apple from its position is innovative hardware that swings the consumer.

When Apple stops being cool, it is going to tank. Compare that with Exxon Mobil. It is not a cool company at all, in fact many people hate them for their environmental impact and lobbying, but they won’t go out of fashion in a Quarter. Maybe they will in the next 50 years, as new technologies in fuel are adopted more widely, but could you honestly say that the iPhone 6 is going to secure Apple’s position as N0.1 in the smartphone market more so than Wind Farms are going to push out Oil within the next 12 months?

Apple is Charismatic Leader Driven

Steve Jobs has sadly passed away, but his legacy lives on in Cook. The problem is that when you have a Rock Star Leader the company is too hinged on one person. This was evident when Steve had health scares towards the end of his term as CEO, the news of him suffering a heart attack and other scares hammered the stock price. Could you imagine what that means? The majority of investors felt that a company the size of Apple, with thousands of employees, would crumble without one guy leading the charge.

Look at Exxon. Who is their CEO? What would you do if they had a heart attack (I sincerely hope they do not and wish them well) the investor here would decide that there was sufficient contingency planning and succession planning in place that if anything happened to just one person the machine that is the business would take over and a new, capable person would fill the gap seamlessly.

Exxon has its flaws too – the biggest issue with a firm like Exxon will be that it is doing harm to the planet. We turn a blind eye to it as much as possible, but when the press does focus on the harm that firms like this are doing, such as in the event of a spill, consumer sentiment is harmed, fines are levied and the profit margins are hit. However, from a pure investing perspective Exxon isn’t anything like as fragile as an Apple. The stock won’t sink if it loses its CEO, it isn’t reliant on short term consumer trends (though it certainly is exposed in the long term trend) and its not cool, so it can’t become uncool anytime soon.

Why we both own too much Apple

Most investors own mutual funds, Apple, by its crown of being the largest by Market Cap is going to be a major holding in most Mutual Funds and ETFs. It doesn’t appear in the DJIA because its share price is too high per unit and would skew the Index, but it is everywhere. If you were to buy a Total Market ETF like VTI from Vanguard Apple would make up 2.26% of your holdings, a similar number if you bought a Large Cap ETF. If you thought the Tech sector was hot and bought a Technology ETF like VGT you would be buying another 13% of Apple within each share of the fund.

Finding a fund without Apple is going to be hard, and if you keep the number low overall you should be able to weather the storm, if Funds are the way you wish to invest. But watch out for doubling up on positions like this by holding a mix of funds with similar holdings – it is likely that Apple will be the top held by percentage position in the majority of funds, so you can get more invested in this stock whilst under the assumption that you are diversifying.

Personally, I’m not happy that AAPL is the top company in the world, because that means Pension Funds and Retirement Accounts around the Country are up to their ears in the stock, which could drop rather dramatically for any number of very real reasons, such as the Rock Star Leader, the Consumer Trend, and just becoming uncool.

Leave a Reply