College 529 Plans are tax advantaged savings plans designed for people to set aside money for future education expenses. This post is a primer on the plans benefits for you as a saver, and will go onto some tips for structuring your plan in a savvy way to create a safety net in the event that you require to make any unqualified distributions in the future.

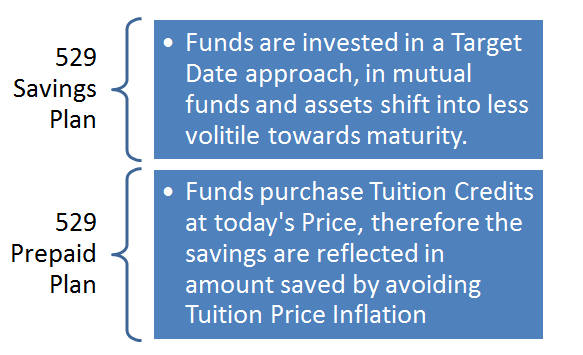

College 529 Plans come in two formats, a Savings Plan and a Prepaid Plan

Drilling down on the College 529 Savings Plan

The College 529 Savings Plan is most similar to a Brokerage Investment. The contributions to the account can be invested in Mutual Funds and profits will grow in a Tax Advantaged manner in that: any Investment Gain, or Principle from the plan can be withdrawn without Federal Tax, and in some states without State Tax -providing that the distribution is considered Qualified. A Qualified Distributions are defined as follows:

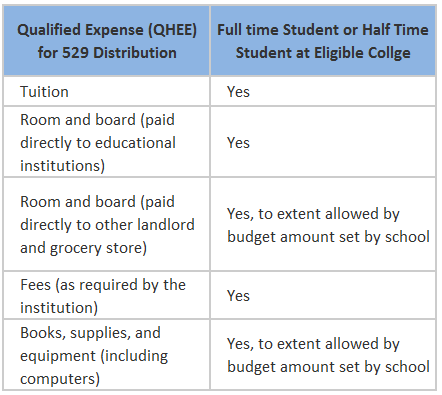

Funds in the College 529 Savings Plan account can be used to pay for tuition, books, equipment, fees, other costs, and room and board (assuming the beneficiary is enrolled at least half-time) at any college accredited by the U.S. Department of Education. This includes undergraduate colleges, graduate and professional schools, two-year colleges, technical and trade schools, as well as some foreign colleges and universities.

Drilling down on the College 529 Prepaid Plan

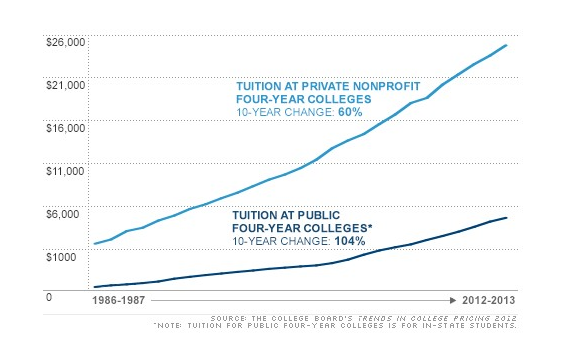

The College 529 Prepaid Plan purchases Credits towards tuition, at today’s market price (plus a small premium), and when the beneficiary of the plan reaches college age instead of paying the future cost of College Credits they effectively hand in an IOU that was purchased earlier. Whilst this may seem a very attractive idea, as it seems to be common thinking that College Tuition is raising at an alarming rate once you dig a little deeper you realize that there are a number of limitations and also, a lot of the real rise in College Tuition witnessed thus far has been in the Private Sector.

The College 529 Prepaid Plan is for Public College Education, not Private Colleges – so that another one key factor to consider, would a public college be right for your beneficiary or would you want them to have the option of either? Looking forward, as we consider the financial well being of the state that you are in, you would have to consider would that state be more or less likely to cut college spending? If you consider the recent effects of Detroit with its bankruptcy, it is clear that Cities, and perhaps soon States are not too big to fail, so if they do have to take austerity measures to balance the books you could see the Tuition Credit Cost increase at a more aggressive rate, making the Prepaid Plan more attractive.

Some College 529 Prepaid Plans also have provisions to prepay for Accommodation or other costs, however if yours does not it would be possible to hold Both a Prepaid Plan for the payment of the Tuition Credits, and a Savings Plan for the other associated, qualified costs such as text books etc.

It should be noted that not many states offer the Prepaid plan, those that offer a Guaranteed Plan for Prepaid Education are Virginia, Maryland, Massachusetts, Mississippi, Florida and Washington. Furthermore the following states also offer a Prepaid 529 Plan but do not guarantee them, meaning that they reserve the right to change or terminate the terms of the agreement in the future: Michigan, Nevada, Illinois, Pennsylvania and Texas.

Setting Beneficiary’s for your College 529 Plan

A College 529 Plan needs to have two named parties, the owner of the plan and the Beneficiary of the plan, you can name the Beneficiary of the plan as anyone you so chose, including naming yourself. It is worth noting that you can transfer (known as a rollover) the beneficiary to qualified members of the beneficiary’s family, as per the following rules:

The following conditions are required in order to avoid the distributions being taxable:

-

- The One Year Rule: Rollovers to another 529 plan per twelve month period are allowed only once for the same beneficiary.

- You are allowed to rollover a 529 plan to a family member of the beneficiary, as per the criteria for family members set out below. this can happen any number of times within the twelve month period.

- If you distribute to a non beneficiary, you need to name them beneficiary via the rollover within 60 days else the distribution will be taxable. The non beneficiary must qualify for being able to receive the funds by relationship as per below.

Qualified members of the beneficiary’s family include the beneficiary’s:

- Spouse

- Son, daughter, stepchild, foster child, adopted child, or a descendant of any of them.

- Brother, sister, stepbrother, or stepsister.

- Father or mother or ancestor of either.

- Stepfather or stepmother.

- Son or daughter of a brother or sister.

- Brother or sister of father or mother.

- Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

- The spouse of any individual listed above.

- First cousin.

Summary for the Impact of College 529 Plans on your Taxes

Each State has their own approach to the extend of tax advantages they offer to College 529 Plans. As such you need to check carefully for your state. Here is an overview of the different rules you might encounter:

- Many states will offer a State Tax exemption on qualified distributions from the plan, however the following states don’t operate a State Tax system, and as such there can be no such savings: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

- There are a number of states that do have State Tax and yet do not offer an exemption: California, Delaware, Hawaii, Kentucky, Massachusetts, Minnesota, New Hampshire, New Jersey and Tennessee.

- Typically in order to gain your State Tax benefit you need to be invested in the Same State Plan however residents of Arizona, Kansas, Maine, Missouri and Pennsylvania receive tax benefits from investing in any state’s plan

Here is a full list of benefits – note it is related to State Tax (sourced from FinAid.org)

| State | 529 Deduction -affecting State Tax |

| Alabama | $5,000 per parent ($10,000 joint) |

| Alaska | No state income tax |

| Arizona | $750 single or head of household/$1,500 joint (any state plan) |

| Arkansas | $5,000 per parent ($10,000 joint) |

| California | — |

| Colorado | Full amount of contribution |

| Connecticut | $5,000 per parent ($10,000 joint), 5 year carryforward on excess contributions |

| Delaware | — |

| Florida | No state income tax |

| Georgia | $2,000 per beneficiary |

| Hawaii | — |

| Idaho | $4,000 single/$8,000 joint |

| Illinois | $10,000 single/$20,000 joint per beneficiary (25% tax credit for employers for matching contributions up to $500 per employee) |

| Indiana | 20% tax credit on contributions up to $5,000 ($1,000 maximum credit) |

| Iowa | $2,811 single/$5,622 joint per account |

| Kansas | $3,000 single/$6,000 joint per beneficiary (any state plan), above the line exclusion from income |

| Kentucky | — |

| Louisiana | $2,400 single/$4,800 joint per beneficiary, above the line exclusion from income, unlimited carryforward of unused deduction into subsequent years |

| Maine | $250 per beneficiary starting 2007 (any state plan), above the line exclusion from income, phaseout at $100,000 single/$200,000 joint |

| Maryland | $2,500 per account per beneficiary, 10 year carryforward |

| Massachusetts | — |

| Michigan | $5,000 single/$10,000 joint, above the line exclusion from income |

| Minnesota | — |

| Mississippi | $10,000 single/$20,000 joint, above the line exclusion from income |

| Missouri | $8,000 single/$16,000 joint, above the line exclusion from income |

| Montana | $3,000 single/$6,000 joint, above the line exclusion from income |

| Nebraska | $5,000 per tax return ($2,500 if filing separate), above the line exclusion from income |

| Nevada | No state income tax |

| New Hampshire | — |

| New Jersey | — |

| New Mexico | Full amount of contribution, above the line exclusion from income |

| New York | $5,000 single/$10,000 joint, above the line exclusion from income |

| North Carolina | $2,500 single/$5,000 joint, above the line exclusion from income |

| North Dakota | $5,000 single/$10,000 joint |

| Ohio | $2,000 per beneficiary per contributor or married couple, above the line exclusion from income, unlimited carryforward of excess contributions |

| Oklahoma | $10,000 single/$20,000 joint per beneficiary, above the line exclusion from income, five-year carryforward of excess contributions |

| Oregon | $2,090 single/$4,180 joint (i.e., $2,090 per contributor) per year, above the line exclusion from income, four-year carryforward of excess contributions |

| Pennsylvania | $13,000 per contributor per beneficiary (any state plan) |

| Rhode Island | $500 single/$1,000 joint, above the line exclusion from income, unlimited carryforward of excess contributions |

| South Carolina | Full amount of contribution, above the line exclusion from income |

| South Dakota | No state income tax |

| Tennessee | — |

| Texas | No state income tax |

| Utah | 5% tax credit on contributions of up to $1,740 single/$3,480 joint per beneficiary (credit of $87 single/$174 joint) |

| Vermont | 10% tax credit on up to $2,500 in contributions per beneficiary (up to $250 tax credit per taxpayer per beneficiary) |

| Virginia | $4,000 per account per year (no limit age 70 and older), above the line exclusion from income, unlimited carryforward of excess contributions |

| Washington, DC | $4,000 single/$8,000 joint, above the line exclusion from income |

| Washington | No state income tax |

| West Virginia | Full amount of contribution up to extent of income, above the line exclusion from income, five-year carryforward of excess contributions |

| Wisconsin | $3,000 per dependent beneficiary, self or grandchild, above the line exclusion from income |

| Wyoming | No state income tax |

Penalty for an Unqualified Distribution from your College 529 Plan

A 10% Penalty on any Earnings (not Principal) plus Earnings will also be subject to State and Federal Tax as Regular Income. Additionally, if you received a credit from your State Tax when you deposited your Principal you will have to pay that back now.

The good news is that if your plan hasn’t appreciated, you wouldn’t have to pay the penalty as it only applies to earnings. But even if your plan has lost value you would still be stuck with repaying that State Tax Credit if you received it on the way into the Plan.

Watch your Qualified Higher Education Expenses (QHEE)

The following table lists the qualified expenses that your College 529 Plan can be used to pay for. If you should go outside of these rules the you could be tagged as an unqualified Distribution by the IRS for the excess. For example if you want your child to stay off campus, the rent paid can be covered from the Plan – but you have to use the Institutions Guideline Price for rent for the amount you claim – any more and it could result in a penalty.

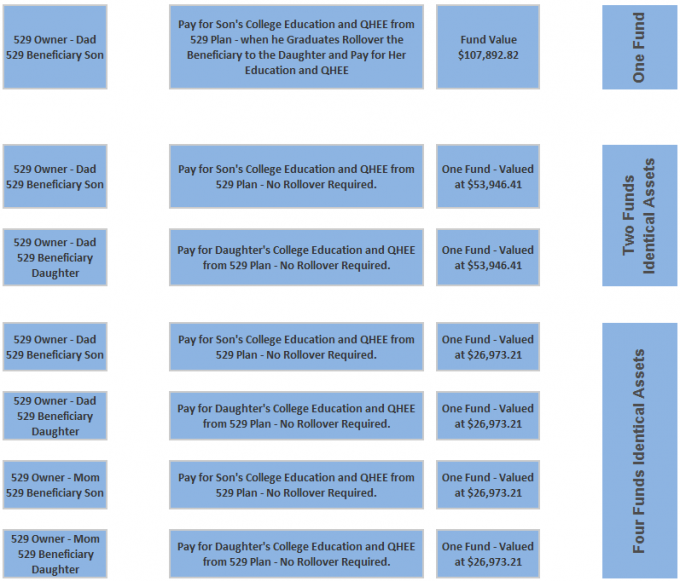

Crafting a 529 Strategy to maximize on the rules listed above

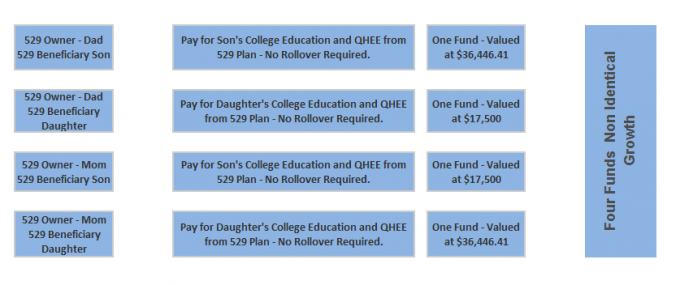

Due to the flexibility in the Rollover strategy you could set up your College 529 plan for your family in many ways – lets look at them, for a family of Two Parents, with Two Children a Girl aged 1 and and Boy aged 6, I’ll use Florida as an example, as it has no State Tax. Unless the girl is a Genius then it is expected that the Boy should be in college 5 years before the Girl.

| Contributing $5,000 for 14 Years | $70,000.00 | |

| Plus Investment Gains @ 5% | $37,892.82 | |

| Total Value of 529 Plan | $107,892.82 |

The following Structuring for the Plans would all be valid:

This ability to create different types of College 529 Strategies is quite interesting when it comes to planning. Because despite your best laid plans it is possible that you might need to tap into the funds stored in your 529 Accounts for a non qualified withdrawal, such as a home payment etc. Now, if you are invested in just one plan that has grown from a principle of $70,000 to $107,892.82 the taxes and personalities would be calculated as a percentage of the withdrawal as follows, for a $25,000 Unqualified Withdrawal.

A 529 Plan Unqualified Partial Withdrawal is calculated proportionally between Principal (no penalty) and Gains (10% Penalty plus treated as Income). As such:

107,892.82/37892.82 = 2.84731566561

$25,000 / 2.84731566561 = $8780.19

So there will be a Penalty assessed on $8780.19 of 10% for $878

Furthermore assuming a 30% Tax Bracket a further Tax payment of $2634

Total Cost of Withdrawing $25,000 from the College 529 Account= $3512

However, if we were to take those Four Separate funds and instead of making each asset allocation identical, we instead made them diverse – taking into account an overall picture we could find ourselves with a very different picture:

Remember, the Principal is not penalized – and the principal if invested equally would be $70,000/4 or $17,500 therefore, if we decided to isolate a fund that has less performance than the others, such as fund #2 and #3 in this example, we could avoid penalties and taxes on the unqualified withdrawal.

In this case, either Fund #2 or Fund #3 could be withdrawn in full for $17,500, with the remaining $7500 from the other fund. for Zero Penalty. Or any amount could be pulled from either to make up that total – such as $12,500 from each. This then focuses two funds with high gains to be used for Qualified expenses – and they can be transferred/’rolled over’ into whatever Child needs the funds.

The reason this works is that each plan is considered a standalone entity because the owner and the beneficiary is different each time. If it wasn’t set up like this then even if you had 4 separate accounts, the IRS would see it as just one.

Can you say anything about 529 plans in relation to financial aid, specifically FASFA and expected family contribution?

Generally speaking- you are looking at 5.64% of 529 account value being added onto the EFC- so having a 529 plan will reduce financial aid, but not by much.

I wrote this back in 2013 and tweeted it to get it fresh in people’s mind- I’m writing a new post now and I will include more on this topic in that for you.