This post was motivated by two very different conversations that I have had in the past week. The first was an idiotic approach to Emergency Funds that people told me was savvy, and the second was a chat about returns from bank bonuses. What I like about keeping the conversation on the emergency fund/loose cash portion of your investments is that everyone should have this, and by its nature it should be small enough to make the strategies I find work.

Chasing Higher Interest Rates

Chasing higher rates isn’t a bad thing, but there are certain people out there who decide to completely ignore risk in order to do so. The root of this problem is that these people are lazy. They want higher returns on their savings in order to save less and work less, and they are willing to ignore risk in their pursuit of gain. The truth of the matter is that until you reach at least 30 years old if you are very smart and very lucky, and probably 40 or 50 if less so, that your returns from investment, or passive income will always pale in comparison to your ability to earn money from your job or business. However, I can see that we all want to make the most of our investments, and wanting to earn more is not a bad thing

One thing that does drive me bonkers is that when you talk with many people who are chasing the higher rates their arguments are ridiculously skewed. They justify putting all of their available money, including their emergency fund into the stock market because it is better than earning 0.1% in a savings account. These are supposedly financially savvy individuals who have calculated risk/reward from the market and decided that their strategy can accommodate an X% drop in the market for breakeven, yet they haven’t heard of banking with Ally and earning 0.85% in their money market account?

Chasing Alpha

The idea behind Alpha is looking for returns in excess of the benchmark investment based on its risk profile. I’d like to make this a fair fight, and take the benchmark for Savings to be 0.85%, not the silly 0.1% and kick that number into the dust without raising risk. The purpose of this is to show you how to optimize cash and get rewards that not only challenge the Alpha levels of a liquid account, but also show how we can keep risk the same, and start beating returns from much riskier investments.

RISK – the big difference

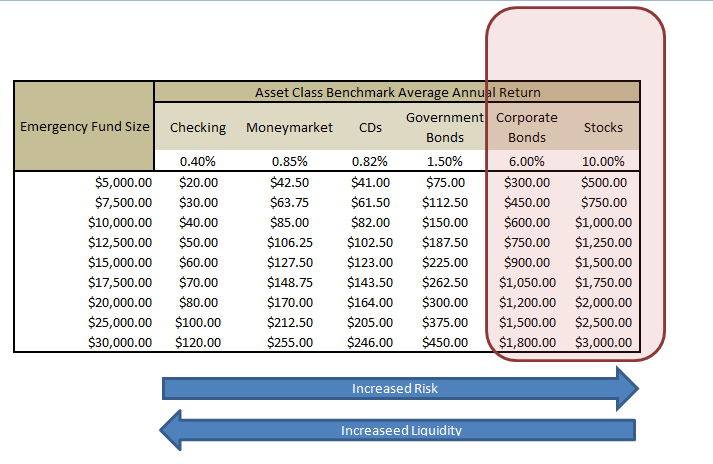

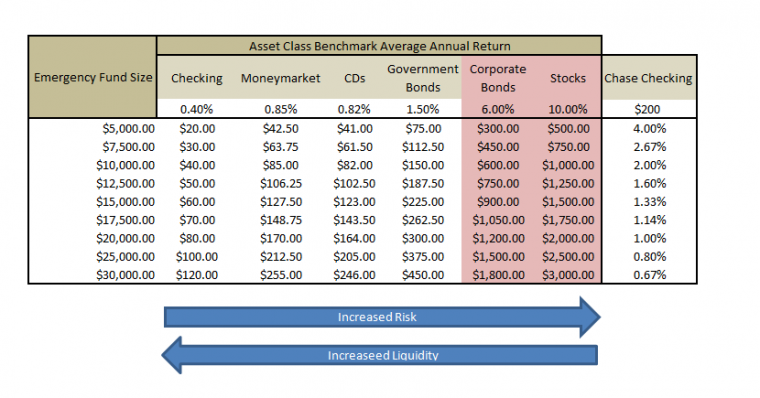

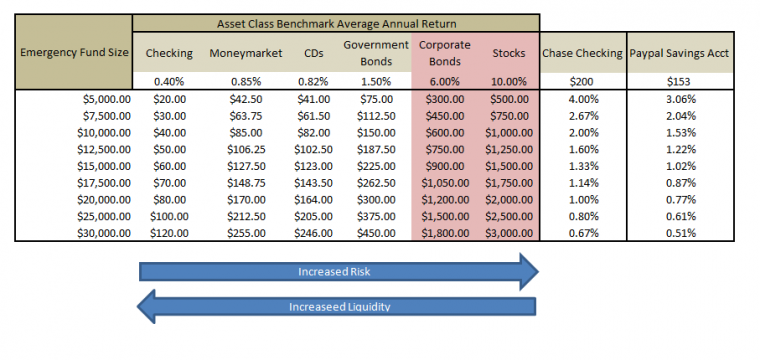

This is the key to this article, increasing returns without increasing risk. Therefore we need to look at the 6 asset classes that are defined below and draw a line in the sand. The line is where risk to Principal becomes a reality. For the sake of this article I draw the line at anything above Treasury Bonds. In truth AAA bonds are a solid investment, but I think this is the line where risk to losing principal occurs.

So here’s our goal, nicely defined. Let’s find a way using no risk products to beat the returns on the risky products of Bonds and Stocks.

Setting the asset class benchmarks

A couple of caveats here:

- For Stock prices I selected historical averages of 10% per annum, I did not further subdivide the stocks into different risk classes.

- For bonds I did differentiate from Government/Treasury bonds and Corporate Bonds since the former has a higher degree of principal guarantee. As we are talking about storing cash, the only Treasury issued bonds that would fit into this allocation would be 6 month bonds, however, for the sake of making this at least a challenge I opted to not use the 0.07% rate that this would offer, and instead selected the 5 year rate of 1.5%.

- For Corporate Bonds the average 5 year AAA bond is offering 1.64% interest at this time, however it is quite easy to find bonds that offer 6% yields so I will use that number for this challenge.

- To be clear, the rates I selected for Bonds are not the ones I should use, and not ones you should invest this cash in, I just picked less liquid bonds in order to make the challenge harder to beat since 0.07% isn’t worth the effort.

- CD Rates – according to Yahoo Finance the average rates start at 0.06% for a 1 month, to 0.82% for a 5 year. Because CDs can be cashed in without loss of Principal (mostly… read the terms!) we are able to pick the top rate for this study.

Emergency Fund, or Liquid Cash, Size

As I wrote about in the post Fees and Percentages, understanding the fixed and variable portions of the investment are key. Some of the things that I found interesting are flat cash bonuses, which can be calculated as a percentage with ease. The bigger the fund, the less impact a flat fee will have on it. In order to calculate the size of what your emergency fund should be you simply do the following equation:

Fixed Monthly Expenses x Number of Months to cover

Add in things like mortgage, food, clothes, transport. Leave out luxury items, and multiply the monthly number by how long you want the fund to support you, for most people it will be something between 3-6 months, but could be more if your income is less consistent. For this study I decided on running scenarios with an array of fund sizes to show impact.

As you can see, the theoretical returns from the stock market at 10% are certainly attractive, and in truth beating those out will be hard at the top end. But lets have a go regardless. One thing I think works in my favor is the people who are trying to justify being in the market for their emergency funds aren’t wealthy, so their fund sizes are more likely to be in the $5,000 range.

$5,000 Fund Size – Beating Bond Returns

It is worth noting that keeping all your cash in bonds is insanity, because when interest rates rise their value will drop, and if you are then forced to sell you will lose money. However, lets see if we can beat 6% without the risk of Interest Rate rising.

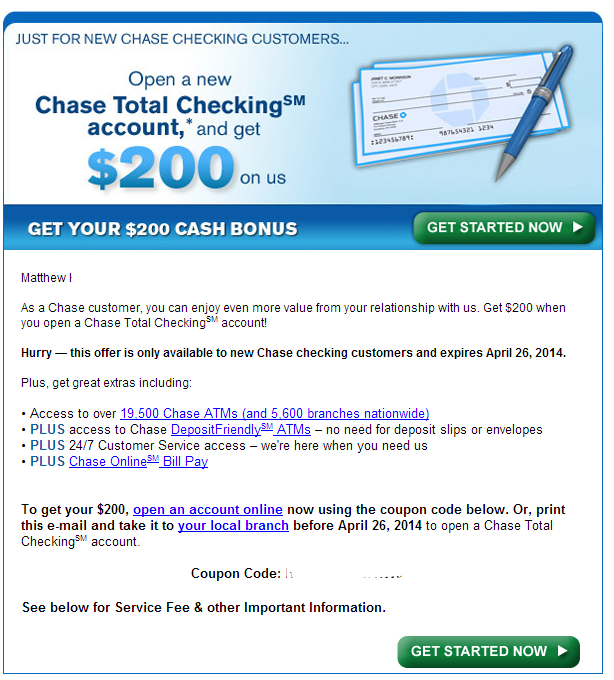

New Checking Account Signup bonus from Chase $200

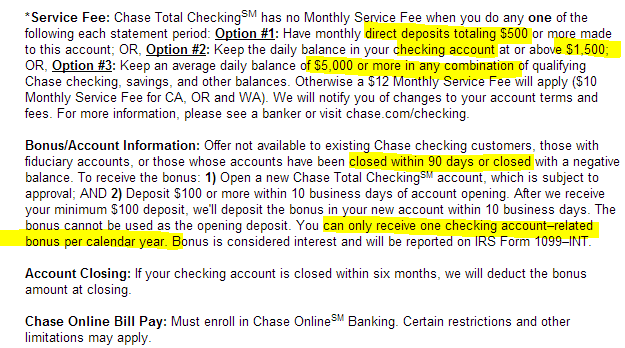

These deals come around all the time, valued between $150 and $200, and sometimes more. The terms and conditions state that you need to keep the account open for 6 months else they will claw back the bonus. Furthermore, your account must meet one of three criteria in order to avoid a $12 monthly fee.

Note, only one bonus per year, and for me I would just let them hold my $1500 for 6 months. I would also not make this a joint account with my wife, then if she receives an offer she too can take advantage and we can increase our chances to get two bonuses in the year. As you can see from the chart, the $200 bonus on a $5000 emergency fund is equivalent to 4% interest.

However, the 4% is earned in exchange for locking up just $1,500 of my $5,000, and only for 6 months of the year. What that means is that I have $3,500 for 12 months to invest, and the other 6 months for that$1,500.

Leveraging Niche High Interest Savings Accounts

In my post Credit Card Arbitrage with the Paypal Debit card I explained how to gain between 3.84% and perhaps over 10% (the latter including a credit card bonus for travel money) on a $5,000 interest free loan from the credit card company. One of the key pieces to that was the 5% savings rate that Paypal offers up to $5,000, though it is offset by a monthly service fee of $4.95. If you used the left over funds that weren’t locked up by Chase you could earn the following:

- $175 for $3,500 x 5%

- $37.50 for $1,500 x 5% (for 6 months)

- Total earned $212.50

- Minus$59.40 for monthly fees of $4.95 x 12

- Net Profit $153.10

The total earned from just using these two strategies would be $353.10 which beats the $300 earned from Bonds on $5,000 without the risk. If an emergency did strike you would be able to pull the money from the Paypal Savings account first, and hopefully that would keep you going long enough to capture the $200 from Chase, but if not, worst case scenario you get your money back without risk to Principal. Furthermore, you have removed risk from the table whilst increasing returns by from 6% to 7.06%, an increase of 18%.

I could at this point go on to increase that 7.06% above the 10% average return for stocks, but I actually feel that it is unnecessary, as a fixed, risk free return of 7.06% is far superior to an ‘averaged, and risky’ 10%.

For the sake of brevity I’ll leave this post here, with the $5,000 fund size optimized to outperform riskier investments. My next post on this will show how to scale it upwards from there for larger funds.

My only concern is about a potential hard pull for opening a checking account, which seems to occur for some of them.

With Chase Exclusives and a Freedom card, the checking sign-up bonus is a little bit more than the dollar amount, but you may need to keep the account open through whenever the new 10% posts (I still have 10+10). I’m also reminded that I need to stop by my Chase branch and ask them why I haven’t received a savings account sign-up bonus card recently.

Fair point about the pulls- may still be worth it, but should be factored in.

One cost to consider is the tax loss on the bank bonus which is calculated as interest. If your marginal rate is high enough a 200 dollar bonus can quickly become a 100 dollar bonus. Only important in terms of deciding if the payout is worth the hassle of opening multiple accounts.

AZ

Excellent number crunching. And some of us need a few more bank accounts anyway for various reasons!