Nobody buys a stock with the intention of it going down (excluding ‘shorters’ and disgruntled spouses of course..) so when the transaction doesn’t turn out the way you expect you need to think about when to exit correctly. Holding onto a losing position is one of the most common financial flaws that people face. It seems so hard admit that you were wrong, and you will stubbornly wait to be proven right.

Studies have shown that people believe a stock that they have acquired and has dropped in value is more likely to increase in value than another stock. They just can’t walk away… and if this is what you are telling yourself too then you shouldn’t buy any more stocks.

Do you want to be an emotional buyer, or a stone cold killer?

If you allow emotion to drive financial decisions you are making a choice to not make a choice. It is weak and you will lose, you are willing to be swept along by the market, other peoples nonsense (like Cramer et al) and greed. Emotional attachment will punish you, attemps to attach emotional ‘logic’ to the situation will eat into your free time and it will cause distress. Everybody makes a mistake, admit it, and move on.

To take this to the next level, and become a stone cold killer when it comes to trading you need to know what really happens when your stock loses. Believe it or not, when a position I enter drops in value I actually get excited. The reason for this is that I have a simple strategy to investing.

If a stock (etf or fund) goes up, hold it – for as long as I can, I defend it by adding on other positions around it- if it goes up too far for me to protect it then I would sell some of the position, else I am too exposed. If a similar position goes down, it changes in my mind to a new asset class. A capital loss harvest. I hate to sell winning stocks because they eat into my capital loss reserve fund. This fund I build up with those losing stocks, and I apply it each and every year to reduce my taxable income. You can reduce income by $3,000 per year using your stock losses.

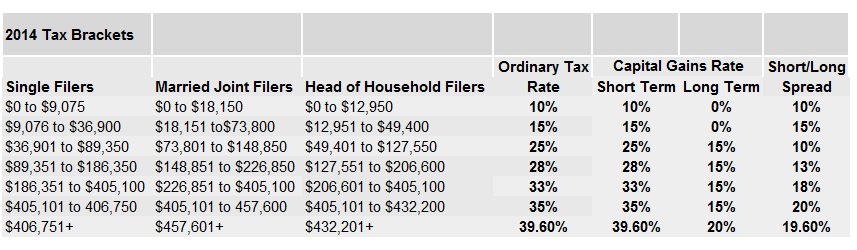

Remember the short term long term tax levels – if you sell a short term gain (held under a year) you have to pay a much higher tax rate (equal to your regular income tax level) but if you sell a long term gain (held over a year) you get a special, lower tax schedule on this. So the key is simple, if your stocks are growing, hold them. If they drop sell them, that loss goes into your “Cap Loss Harvest’ account. My personal account hovers around $10-$15K, I pull $3K out per year against income and a touch to offset any unusual short term sales that go outside of the curve.

Remember wash sales – you can’t buy back into that stock for 30 days, but why would you want to? Detach yourself from that emotional belief that you have found a winner and sell today, walk away. Instead of thinking that makes you a loser, know that you made a conscious choice to reap the Capital Losses and that they are an asset. Look at your tax rate – even at 25% you would capture $750 profit by selling a $3000 loss. If you think about how that stock needs to turn around in 30 days for that to happen, and then gamble on it vs take the sure thing, then you shouldn’t be buying stocks.

Balancing long term gains with short term losses – the dream!