I first wrote about Bitcoins back in May, when the price was trading at $120 per coin, as of today their current market price is over $700 a coin… by the end of the year who knows, perhaps pushing $1000 or perhaps worth as much as free investment advice.

Back when they were $120 I didn’t like them, at $700 I am terrified of them. But I did decide to get some skin in the game for zero cost, since Bitcoins don’t have to be bought and sold to make a profit, you can also mine them, just like you would gold. The mines are hidden in code in the internet, and the mining tools have evolved from using your idle CPU, to GPU, to specially designed boxes that use FPGA technology.

I mined with zero cost, in that I decided to not invest in new technology and just switch on the software when I left for work in the morning, however, from a practical perspective it didn’t work out for me as I would often forget to switch the mining on and therefore didn’t really do a lot of it. But based on today’s news that the prices are soaring I decided to check in and see how much loot I had plundered for my week or two of hard labor:

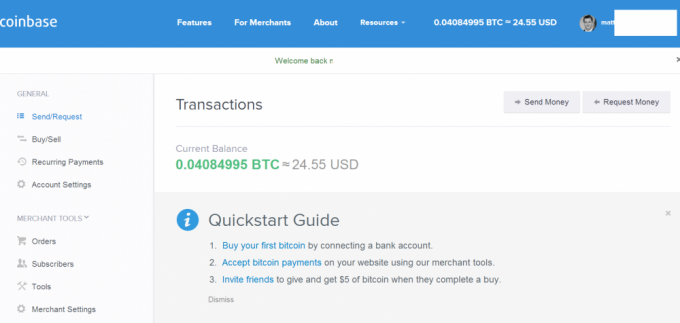

My grafting in the virtual mines has netted me 0.04084995 BTC, which is today worth about $25. Back when I mined this it was worth about 1/6 of this or $4. Thanks to all the people who decided to invest real money in Bitcoins my value has skyrocketed.

The real beauty in Bitcoins is their finite number. Unlike other currencies, such as the USD when the number of coins has reached its maximum no more can be produced. This means it contains the greatest inflation hedge of any asset class. Working in a similar manner to gold or other commodities, but with the certainty that no more can be found.

The real problem for investors is that the maximum number of Bitcoins that can exist is 21 Million Coins, and that 12 Million of these are already in circulation. In 2011 the coins were valued at $0.30 each, versus today’s value of $700.

As much as I dislike Bitcoins as an investment, it is my opinion that they will continue to rise in price as they will become a legitimized form of payment, the announcement but the Dept of Justice recently called the Bitcoin: “legal means of exchange” which is a huge step forward in this. There is already too much pressure on this to happen, with lobbying from majority owners, such as the Winklevoss twins to create ETF and other asset classes based upon the Bitcoin.

My advice, mine and hold, and sell into the market from a ridiculously high sounding number of say $2500 per coin. Do not under any circumstances buy these! If you want to read more about how to turn your computer’s down time into a bitcoin earning monster read my original post here: Bitcoins, An Investment Opportunity or a Disaster waiting to happen?

TULIPS!!!

When will we learn eh?