Andy, over at Military Finance informed me this week that Betterment had launched their Capital Loss Harvesting solution. In my opinion this was one area where they were falling behind as firms like WealthFront and Future Advisor were already offering this. I’ve previously reviewed Betterment, and looked at WealthFront and Betterment in their marketing strategies in the past, and have to say that out of the two firms I trust Betterment, better.

In prior research I have emailed WealthFront with questions (no reply) and called up customer service, got a reply, but they had no clue what they were talking about. Betterment have consistently given me a stronger impression of these, but perhaps somewhat due to a more proactive blog management presence. Despite the stronger impression, until now WealthFront had them beat in that they offered more, not anymore.

Capital Loss Harvesting

Cap Loss Harvesting is an active portfolio strategy, however it can be implemented using index funds… hopefully, but more on the IRS later. The concept of a Capital Loss Harvest is to sell your losing positions and create a tax realization event. These losses can be stored up and in my mind are considered an asset that can be gathered and considered in your personal balance sheet. Capital losses that are collected can be ‘spent’ in two ways. The most common (and least effective) is to reduce capital gains to zero to avoid tax.

Example:

You ‘harvest’ losses over the year, either by selling several smaller positions, or perhaps even one large losing position. Let’s assume your total harvested was $5,000. You also have a position in Ford Motor company that has appreciated by $4,000 in the past 8 months.

If you sell the Ford stock, your $4,000 gain will be reduced to zero, and you will have $1,000 of Capital losses held in reserve. No tax is due.

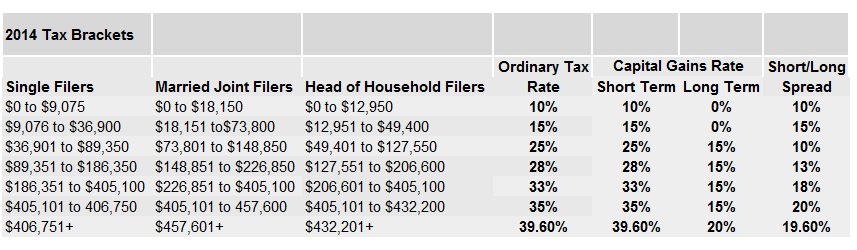

Remember, Capital Tax transactions (Gains or Losses) that occur in a period of less than 1 year are considered Short Term Capital Gains (or Losses) and are taxed at the same rate as your Federal income tax level. Long Term Capital Gains are taxed at lower levels. The chart below shows the ‘spread’ between Short Term and Long Term rates, it is a notable difference.

In the Ford example you can see there is a $1,000 surplus in Losses harvested. This can be used to reduce ordinary income, and is much more valuable here, coupled with not selling short term appreciated assets. The rules for applying Capital Losses to income state that you can apply no more than $3,000 per year, but the amount you have harvested can be carried forward on your balance sheet indefinitely. IE should you harvest $30,000 in losses, and have zero capital gains, you could reduce your taxable income by $3,000 per year for 10 years.

The Wash Sale Rule

Whenever we seek to implement a Capital Loss Harvest strategy we must be mindful of the Wash Sale Rule. This rule was implemented by the IRS to stop exactly this, people would see their stocks, bonds or funds dip in value and sell them, locking in the loss. They would then quickly repurchase the same securities and have harvested the loss.

The IRS states now that you must have a 30 day period (looking back and forward) where an investor cannot buy:

“substantially identical” stock or security, or acquires a contract or option to do so

If the Wash Sale is triggered the IRS will disallow the loss, and instead the basis of the security will change.

Are Index Funds substantially different?

Index Funds track indices. For example, the Russell 3000 Index, or perhaps the S&P 500 index. Very different things, perhaps. As we have mentioned in the past the markets are increasingly correlated, but when it comes to many of the major index options available they are almost identical. The key here is are they substantially identical or not? Where is the line…

- The Russell 3000 is an index of the 3000 largest companies in the US stock market, which represents 98% of the total market

- The S&P 500 is an index of the 500 largest companies in the US stock market, which represents 75% of the total market

It would be very easy to argue that these are very different securities, but I would also argue that due to the large cap nature of the smaller S&P 500, if that index moved by 5% you can bet your bottom dollar that the Russell 3000 would be moving in an incredibly similar pattern.

What does the IRS Say?

Well, the IRS says it doesn’t like people doing Wash Sales, hence the rules on that, so they probably don’t like this, but they haven’t taken anyone to court on it yet. I asked around on the Bogleheads forum to see if they had heard of precedence and they had not. For those of you who are unfamiliar Bogleheads follow John Bogle (Vanguard founder) passive investing approach using low cost index funds. They all use Index funds, and some deploy cap loss harvesting too.

So, it’s something of a grey area that is being exploited in my opinion, but a legitimate one until proven otherwise. The entire strategy of the advisors is focused on the word play of the interpretation of ‘substantially identical‘. And it is a touch concerning that this hasn’t been challenged in court.

Back to Betterment

Betterment is implement Capital Loss harvesting for accounts of $50,000 or more in assets. They have released a detailed white paper on their approach here. My understanding of their approach is that they have identified closely correlated ETFs, more closely so than my Russell and S&P example above and split money between two.

When ETF1 drops in value you sell it, harvesting the loss (in the Taxable account – you can’t harvest in IRAs) When you exit ETF1 your portfolio is out of whack, so you buy ETF2 (another strongly correlated ETF) and therefore your exposure to the market is ‘substantially similar’ but not ‘substantially identical’. If an IRA is involved in your Betterment account then there may be ETF3 that kicks in also.

Neat, simply enough solution to this.

The Problem with Robotizing Tax Loss Harvesting

You have to bring all your money in house. If you try to have a strategy that this is well developed for ‘some’ of your money you will get into a heap of trouble. On the one hand you will have Betterment making algorithmic decisions, but it can only do so based upon what it sees. If Betterment was to sell ETF1 and you buy it again in your company 401(k) you just triggered a wash sale issue. Since many 401(k) plans involve monthly pay check deductions (and subsequent purchases) I have a bit of a concern here. Perhaps Betterment can help me understand potential issues here better?

I would recommend Betterment, or other robo investment managers (they aren’t advisors) for people who are willing to bring over all assets and have them automated. If you aren’t going all in then you should be very careful about how your manual decisions in external accounts can crush the savvy robotic decisions, and get you in hot water. If you are the type of investor who likes to trade, even somewhat, you would be better off manually harvesting, simply due to the additional risks of triggering mistakes by having two methodologies working in tandem.

Leave a Reply