Estate planning is something that many people think of just for the wealthy. I would argue that at the very least, anyone who is about to become a parent needs an estate plan in place. Here are the minimums, and the minimum costs I could find for coverage:

Last Will and Testament

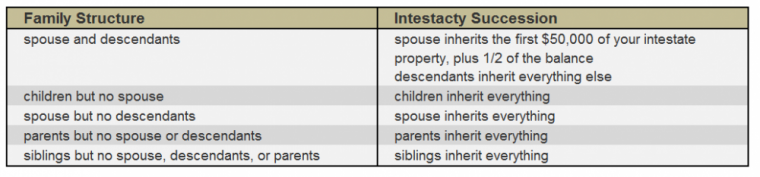

This document contains your wishes for the disbursement of your estate. If you were to die yesterday without one in place you would be determined to have died in a state of intestacy. When this happens the State that you reside in has a default path that your assets will flow in called the intestate succession path that is implemented, you will have to check your own State for how they decide to allocate your assets; here is the one that I would receive as a resident of New York:

Not everyone will agree with me, but I would suggest that if you don’t have descendants a will is much less necessary, if at all. Of course, if you have specific desires for how to route your wealth then you need one, but for the majority the intestacy rules (for NYS at any rate) are adequate.

Under the current terms, when we become parents in June if I was to pass away Allison would receive $50,000 and then half of anything after that would be held in trust for our son. That isn’t ideal if the money we have set aside today was intended to achieve certain things we have planned for. And what’s more the kid would get an inheritance at the tender age of 18 with no spending restrictions.

Beyond money, if both parents were to die intestate the state would have to appoint a guardian for our child. They are bound to do what seems to be in the childs best interest, but that doesn’t mean that they will do what we wanted in this case and how would they be able to even know what that might be in any case?

Implementing a Last Will and Testament

Most people don’t get a Will because it is too complex, too expensive, and too confusing. They defer the decision. However, you need to accept that not making a decision to write your last will and testament is in fact a decision to sign agreement to the Intestacy rules, and you are signing a will, just that it is one that probably isn’t going to act in your best interests, especially as a parent. Here are two facts that will help you break through the procrastination:

- You can have many Will and Testament documents. It is the final one that counts, and becomes the Last Will and Testament. If you start developing a complex estate with lots of wealth transfer requirements through your life you can constantly amend your wishes by destroying the previous will and creating a new one. There are some important concepts to doing this the ‘right way’, but they are for future discussion. For today realize you can establish a very basic will and testament that at the least ensures that your surviving spouse gets all of your wealth, rather than sharing it with your newborn baby, and that you can assign your guardian as per your wishes (please ask that person before you assign them!). Just create a ‘good enough’ will and then improve it over time.

- A basic will is very cheap. When I researched this post I started off by looking at sites like LegalZoom.com, which would create one for about $69, then I went onto find that Dave Ramsey offered a set including a Will, Health Care Proxy and Power of Attorney for $34. I almost bought this then thought to myself, why so cheap? Sure enough the forms in NY at least are all available for free….

Last Will and Testament – Free

I just tried out the will above from Doyourownwill.com and found it useful to create a very basic will, it doesn’t ask for a credit card or pull any bait and switch moves, unlike some other firms. I tried to use RocketLawyer as it also stated to be free, but after making you go through many pages of data entry it then expects you to enter credit card info and sign up for premium service… the document technically is free as you can cancel in 7 days and wouldn’t be charged, but that sort of customer acquisition and marketing tactic is just irritating to me.

Note – once the will is created from doyourownwill.com it won’t be valid until signed and witnessed, the final pages document how to do this properly in order to bring it up to spec. It does also recommend notarization, which you can do for free at your local bank.

Living Will and Healthcare Proxy Forms

These documents are designed to allow you to instruct healthcare providers on your beliefs and intentions towards your care should you be unable to convey them. They also allow you to designate a person to instruct a doctor or hospital in how to administer treatment to you. It is important because again, being a spouse isn’t enough to overrule the view of the State as to how healthcare should be implemented.

New York State Living Wills and Proxy Forms – Free

Power of Attorney

This document allows someone to act on your behalf from a financial perspective. There are 2 key areas to be mindful of:

- Durable or Ordinary Powers: A durable power of attorney will remain in effect in the event that you become incapacitated, whereas the ordinary will not. There are pro’s and cons to both so think about which you need and what you want it for.

- General or Specific: A general power of attorney gives authority over all areas, whereas a specific or limited power of attorney instructs for a name task or section of tasks.

The most powerful of these forms would be the Durable General Power of Attorney, and it gives a person you designate the authority broad powers over your property, including allowing them to sell, mortgage or otherwise dispose of them.

New York State Durable Power of Attorney – Free

Conclusion

Taking the steps I outline here to set up a basic Estate Plan have implications. If you decide to do them you are consciously choosing to assign authority over your health and finances to your spouse or other trusted party. These are powerful documents, and there are issues of trust and risk that will come with completing them. However, simply avoiding their completion is not an acceptable response. The problem isn’t in giving up control, it is giving up control to the right person. I believe that if I don’t elect to complete these forms now, and give up control to the person that I think is best to make decisions for me, I am not doing the right thing as a parent, and it is something that I suggest you consider if you are in a similar position to me.

The solutions offered in this post are not sophisticated estate plans, they are designed for people who have nothing in place to get this basic framework created for zero cost, if you have a more complex family situation, such as non-citizen spouses, or second marriages, etc., you will require a more sophisticated plan than this. Remember, documents here are designed for New York State, if you reside in another state then you will need to find your own state specific documents in order to implement this (the free will from doyouownwill.com allows you to select your State).

Yes! Excellent reminder. If you have time for a churn and/or MSing, and you have kids and/or own property, this should take precedence and indeed in most cases it is no more challenging.

Hardest for us was selecting who should parent our kids should something happen to us both. We actually had three options in case the current situation of our first pick meant she could no longer do it for us. And we appointed other people to manage the money end, without making it difficult for those doing the parenting to have access to the funds they’d need. We also stipulated that we wanted our kids to remain in their current schools and how to make that happen.

Thank goodness we did not need any of this, but the early and unexpected death of my sister – a mother of 5 kids who died without a will despite the fact that she had a Master’s degree and her husband a PhD and they surely had the ability to have written wills – was a powerful motivator. The fact that she had no will did make things harder for her husband at a very hard time, and legal work was necessary to set things right.

I’m sorry you had to go through that. The loss of loved one is never an easy thing and jumping through legal hoops is an added burden nobody needs.

I think more specific requests like the schools etc are great. I’d also look at splitting guardianship between two people- one for welfare and one for the money supply- but above all else everybody needs to get something basic in place when becoming a parent.

You will be surprised how many do not have even these basic estate planning docs. It is sad.

I tried to set up a basic will with LegalZoom but found it confoundingly complicated. Too many questions/details. Ended up using a tax attorney to set up a Trust and a will. Turns out it was money well spent – I am not a citizen and didn’t realize there were additional legal issues I needed to address. Also, learning about Trusts (which I thought only very wealthy people needed) was an eye opener.

Yes, I too am a non-citizen and know quite a bit about the planning required, I am currently deciding whether I should take citizenship or set up a QDOT. The two key areas to worry about are flow of money between spouses and also some concerns surrounding the temp Green Card and guardianship.