As you read this post, wonder why I take this approach to the news. My motivations here are indicative as to my approach to Saverocity, and my approach to life in general. When I heard that Barack Obama had filed his tax returns and garnered an effective rate of 20.4% tax, and that I am allowed to review his returns I didn’t get angry, I got excited. I wondered to myself what can I steal from this, you can find the full return here.

Let’s get some things dealt with first, take a moment to meditate on these reactions:

- Sure, the rate seems low and his income seems high. However, there are people who earn more and pay less.

- Yes, the tax code in the US is a mess, and smart people can navigate it when the financially illiterate cannot.

The Golden Data

There was some good info on how owning a business allows great deductions, but the really golden stuff for me was how they dealt with Capital Gains and Losses. This I think was fascinating, take a look at the form below and you will see what I mean.

The proper treatment of Capital Gains and Losses can add considerable value to your wealth, and here is a quick overview of how it works:

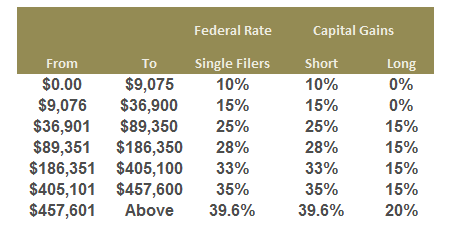

- Short Term Capital Gains Tax is applied to asset transactions (purchase and then sale) that occur within 1 year, they are taxed at ordinary income tax rates – IE if you are in the 25% bracket, you pay 25% Short Term Cap Gains Rate.

- Long Term Capital Gains Tax is applied to the same transaction when the sale occurs more than 1 year from the purchase date, and they are taxed at a lowered rate (see table below)

Now, before the taxes are applied to us, the losses must ‘net out’ the gains. That works in a 3 step process:

- Short Term Gains – Short Term Losses = Net Short Term Gain (or Loss)

- Long Term Gains – Long Term Losses = Net Long Term Gain (or Loss)

- Add together Net Short Term Gain (or Loss) with Long Term Gain (or Loss)

If the balance is a gain it must be added to your Tax Filing and will be taxed accordingly. You can have both Long and Short term gains on the same Tax Filing. There is no limit to the amount of gain you must report, so if you make a huge profit you must pay the taxes on it.

If the balance is a loss it must also go onto your report, and again you can have short and long term losses, however after Capital Losses have exceeded Capital gains there is a cap of $3,000 that can be applied to the return, anything above that amount will be carried over indefinitely.

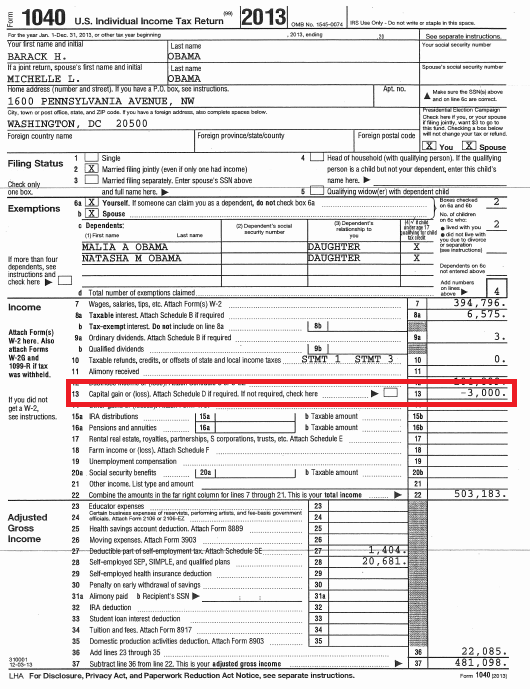

Looking at page 1 of the 1040 at line 13 (highlighted) you will see that the Obama’s had capital losses that exceed capital gains and therefore were able to apply $3,000 towards the return. The key here is that this $3,000 can be applied as a deduction against ordinary income.

What does it all mean?

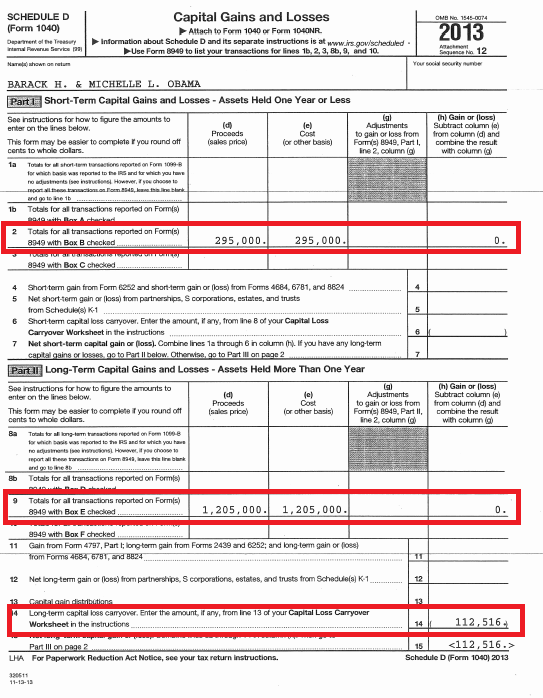

If you followed the above explanation of capital gains and losses you might assume that he had a rough year on his investments, and after netting out his gains he had enough capital loss remaining to knock $3,000 from his ordinary income. Well, let’s take a closer look at that, as his losses are outlined on the Schedule D (Page 7 of the return).

To calculate the amount of gain (or loss) we simply take the proceeds (sale price) and deduct the basis (purchase price), if you look at the Schedule D you can see that the Obama’s had sold $295,000 of short term assets, and also sold $1,205,000 of long term assets for a total of $1.5M in proceeds. However, the basis for the short term was exactly $295,000 and the basis for the long term was exactly $1,205,000. So despite selling $1.5MUSD they had zero capital gains or losses from them. It wasn’t a bad year at all. If we look a little further we see that on page 10 the form 8949 explains that all these assets were in fact Treasury Notes, that simply redeemed for face value, with no gain nor loss.

If you look at line 14 here you will see something interesting. The Obama’s have $112,516 of capital loss carryover, if you recall earlier we mentioned that if previous losses exceeded gains they could be carried over, and applied against future capital gains, anything in excess of the capital gains could be applied towards “ordinary income” as an above the line deduction.

The strategy I stole from this

If you can harvest capital losses by selling losing positions you have turned a loss into an asset. The capital loss carryover surplus is powerful because it allows you to offset ordinary income. In the case of the Obama’s they were in the top tax bracket prior to deducting their various expenses, so that means that the value of the capital loss carry over is equal to the effective tax rate.

This creates a tax arbitrage opportunity when we consider using long term capital losses to reduce ordinary income. And the key is to let all your ‘winners run’ and not sell anything that creates a capital gain until it becomes long term. Indeed I would say you could defer the sale until retirement when your income drops down, and the value of the capital loss carryover diminishes.

Example of the value gained

If your current tax bracket is 25% and you harvest long term capital losses you can redeem them up to $3,000 per year in perpetuity. Here is an example where you harvested $15,000 in long term losses, here is the tax table for reference:

If you were to opt to not create any capital gains, just as the Obama’s did for the next 5 years you could apply $3,000 per year to use up your $15,000 carryover. Assuming a constant rate of tax you would be able to generate $15,000 *25% of tax savings from your loss, or $3,750 (note in the case of the Obama’s this was worth even more as they are in a higher bracket)

If on the other hand you sold appreciated long term assets, either in a $15,000 lump sum, or $3000 per year your capital loss carryover would be limited to ‘netting out’ the capital gain, which would be at the 15% rate, meaning the value of your carryover would be reduced to $2,250.

The 10% spread between capital gain tax rates and ordinary income tax rates has been captured by the Obama’s.

Now, if we project this forward further, it is possible that we could be building a sizable capital gain since we aren’t selling the appreciated assets we own, and instead slowly dripping the carryover to offset income, however…. what would happen if after that lengthy term in office the Obama’s decided they needed to take a year off work? Perhaps it is unrealistic to assume that would happen, but it is not unrealistic to assume that you, or anyone could indeed decide to drop off the income ladder, especially when substantial capital gains were waiting to be redeemed.

So, suspend belief for a moment, and think about what would happen if you had say, $1,000,000 in capital gains accrued because you were using your capital losses over your entire career, then you took a year and quit work early, making your annual income say $0, or close to it. Not only would you be in the lowest income tax bracket, but you would be in a zero capital gains tax rate bracket. You could start cashing in that $1M at a 0% Captial Gain rate (the first $36,900 for a single filer or $73,800 for married filing Jointly) would be at zero each year assuming no other income was recorded.

It’s a double dip!

What you have created is not only tax arbitrage on the spread between capital gains tax rates and ordinary income tax rates, but you have also deferred the gains rate you pay on capital gains to a time when despite the gain appreciating significantly in value, you don’t have to pay any tax on it because you are a poor and beleaguered former President who doesn’t make any money. Of course, this requires an assumption that future capital gains rates remain favorable, and the future is always hard to predict, but since it certainly is a strategy for the wealthy I have a feeling they will be sticking around for some time….

Remember, knowledge must be stolen, do not buy into the hype of the media, see through the smoke and mirrors and find ways to play the game it must be played.

even if your income is 0, the 0% rate on long term capital gains will only apply to the portion of income that falls in the low tax brackets, $36,900 in your chart. if u cash in all $1m in one year, the excess will be taxed accordingly at 15% and 20% as shown in the chart. you can of course cash in $36,900 every year for 0% tax as long as there is no annual income every year.

Thanks for the correction Kenny, I thought that might be the case, will double check and adjust accordingly.

What’s the use of the treasury transactions? The $3k deduction came from the $112k loss carryforward no?

Yes, I highlighted them to show that despite large Captial transactions if you purposefully don’t sell at a gain you can allocate the full 112k over time to ordinary tax rates

How do you offset the risk of holding appreciated assets?

For years we have tried to not take gains by only selling at a gain if we have a loss to offset it. Works great except our portfolio is way heavy in one stock that has huge gains. Long term married puts?

The other reason to avoid gains for the non 2% is you want the lowest possible income to report on your kids FAFSA. They treat a much larger % of income as ‘available’ than asserts (and fully fund those retirement accounts because that money is pretty well safe’ it makes sense to take out parent loans and then pay them off as soon as your youngest files their last FAFSA. You can run calculators to see, it depends on your income assets and age. Younger parents have less asset protection.

I would go short/mid duration puts, long term are too expensive and you can capture the cap loss from

any expired contracts.

Fafsa is a valid concern, titling and trusts are key.