The key to any sound financial plan is to create something that offers the highest level of reward, for the lowest level of risk. On the reward side optimization typically occurs by keeping costs low, costs most frequently come in the form of fees and taxes. Index funds are a great solution for this. On the risk side, people are making some grave errors in judgement by following natural bad habits.

A good planner will look at your overall asset allocation and shuffle things around in order to eradicate as many risks as possible. This process of diversification allows access to the rewards without being trapped into a narrow area, the phrase ‘don’t have all your eggs in one basket’ springs to mind.

People are skewing, not diversifying

Skewing isn’t a bad thing, but doing so when you think you are diversifying is dangerous. Skewing means that you are ‘heavy’ on certain areas, markets or sectors within your asset base. Let’s see how this works by taking a look at the financial firm Betterment. I like these guys, but their solution does a good job of highlighting skews and correlations.

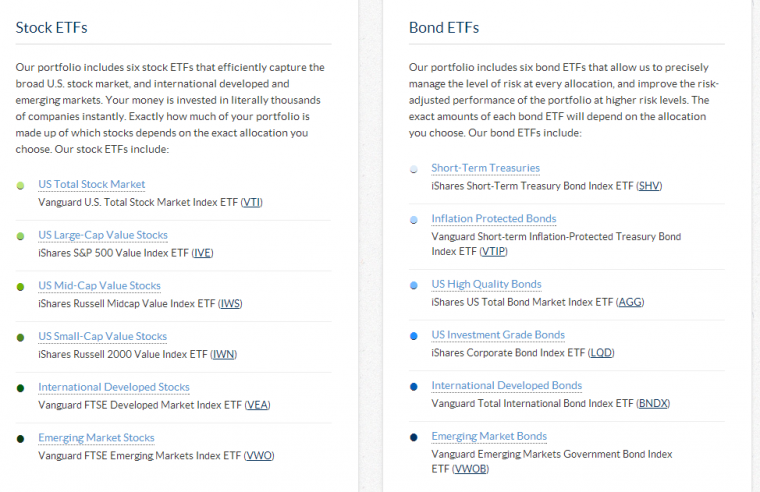

Betterment has recently increased the number of the ETFs it offers to it’s customers, it was offering just 2 bond ETFs and now offers 6. Below you can see that there are now 6 Stock ETFs and 6 Bond ETFs on offer:

The idea with Betterment is that you select a ‘basket’ from these 12 ETFs and because you are diversified you reduce (or remove) risk from your portfolio. How it works:

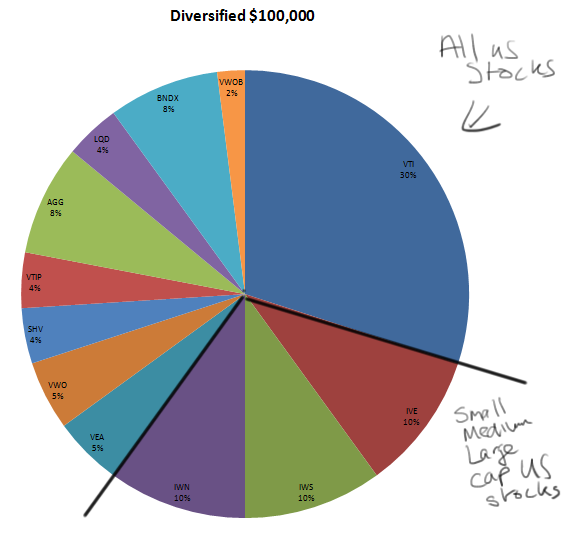

Let’s say you have elected for an 80/20 Stock/Bond Allocation. Within that you then further segment your assets to ‘diversify out risk’. It could look something like this:

$100,000 Portfolio 80/20

As you can see, it appears to be a very well diversified asset allocation. This is because the Pie Chart; a great tool for conveying information like this, allows the reader to see clear delineation between the ETFs. However, the trap here is that it doesn’t account for what is inside the ETFs… in other words the pretty colors are reflecting the difference in name of the vehicle, not the contents of the vehicle.

In the PIE above, we basically have the same stocks ‘doubled up’ and would see little benefit over just holding 60% VTI.

One could argue that in an increasingly interconnected world correlation of assets is impossible to avoid. An oil crisis in the Middle East will impact the price of consumer goods in the US, because of supply chain impact. As data flows more readily the impact is more fluid and we see cause and effect at play throughout the global markets. However, that is a conundrum that is certainly more complex to account for. What is more simple is just that by looking inside the box at US based diversified asset vehicles we can see that things may not be as diversified as we may think.

Looking at Betterment again we can see for the US Stock market they have three different solution providers offering ETFs, Vanguard (VTI) iShares (IVE) and Russell (IWS,IWN) and these three providers offer 4 different ETFS:

- Total Market – VTI

- Large Cap Value – IVE

- Mid Cap Value -IWS

- Small Cap Value – IWN

The reality is that there are 3690 Stocks held in VTI, it is reflective of ‘The Total Stock Market’. If you these 3690 in the form of VTI and then also own IVE, IWS,IWN you aren’t owning a more diverse mix, you are actually owning a less diverse mix… because IVE,IWS, IWN are different segments of the market, reflecting Large, Mid and Small Cap Value companies that comprise the Total Stock Market.

In other words you are doubling up on the same stocks, and therefore ‘skewing’ rather than diversifying your investments. You are chosing to ‘weight’ heavier (and by definition weight other things lighter) within the same pool.

Now, some will argue that this is indeed diversification, because weighting a portfolio in such a manner will indeed cause it to react differently to both positive and negative swings in the market in general, but it must be understand that you are still very much correlated by geography here, and you are ‘diversified’ 4 different ways into the US Stock market you can be certain that all 4 will track the market in a similarly correlated pattern.

Your Assets go beyond just those in the market

When thinking about correlation holistically we should consider all aspects of our wealth. And here is another area where people can err, as they rely on industry ‘insights’ to over expose themselves to a sector. In the US the majority of middle class wealth is held in Real Estate and 401(k) funds. If you take a retiree who has a home paid off worth $1M USD and another $1M in a 401(k) there is a real risk that they already have too many assets that are allocated towards the Real Estate market, yet many investors with a $1M portfolio would look to a Real Estate Investment Trust (REIT) as a way to produce income and portfolio growth. That brings in an undue amount of risk for the rewards available.

Similarly, for those who are employed, or own businesses in their sector, many feel an insiders knowledge to the market. Take someone like a Mark Zuckerberg, CEO of Facebook. He has such a high proportion of wealth in Facebook that he should hold his assets outside of Technology stocks in order to rebalance the risks involved. A hard thing to do when you are meeting daily with leaders in the industry and hearing about the ‘next big thing’.

On a smaller level, Real Estate agents might well put too much of their own wealth into personal or investment real estate. In the event of a bubble there is no protection from them as they lose their jobs AND their assets.

For people that are heavily reliant on their industry for wealth it may be worth eschewing Total Market funds altogether. VTI is 15.10% allocated in Technology, someone like a Zuckerberg may do better building investment assets within the other sectors of the Market in order to defend a heavy reliance on one sector alone.

Diversification of risk is key to creating an support structure for your wealth, and when doing so you need to look very closely at not only what you are invested in, and how closely correlated it is, but also where you overall wealth and sources of income are focused, else you could be taking on a lot more risk for the level of reward you are receiving.

Those that gained real wealth concentrated their assets. Only when people achieve wealth do they start to diversify to retain their wealth.

What you suggest is not going to allow capital gains any more than underlying economic growth rates. That’s OK, but that’s no way to get wealthy. In that case, forget financial advisors. Just pick VTI and concentrate on earning and saving more.

This post isn’t about ‘getting wealthy’ it is about staying wealthy. If you have a guy bringing in 1M a year as a NYC real estate broker he should keep working his butt off, and should invest in non correlated assets, that is all…

And while VTI offers value, I would propose for a Zuckerberg type that they extract Tech sectors from their investments as that is ‘covered’ already from their job.