Passive Investing is a strategy that focuses on holding a broad mix of securities within Low Cost Funds and ETFs, the primary concept behind such a strategy is two fold:

Firstly, that you cannot beat the market by guessing which firms will be winners and which will be losers, so you buy the entire market. Once you buy the market the second issue is the cost to hold it, fees must be kept to a minimum in order to maintain the most profit and growth.

Buying the market results in broadly owning every major stock within a market or index (slice) of the market. To own this requires the individual companies to be packaged into bite sized pieces held with funds and ETFs, allowing the small investor to hold a broad mix. The associated costs with holding such a Fund are dependent on the company that owns the fund and the difference between a Fund that charges you 5% to hold VS a fund that charges you 0.25% to hold will make the biggest difference to your wealth over time – bigger than any other factor.

Asset Allocation is Key For Growth and Stability

When building a Passive Investing Portfolio you need to consider the same issues that you would with an actively managed investment, minus the guessing game as to which stock will pop next. The core of any investment plan will be asset allocation

that provides the right balance of risk and rewards for you to achieve your goals. Passive Investing is not a get rich quick scheme, it is a long term wealth preservation system, with hopefully sufficient upside to increase in value over time.

Diversification is King

All Asset Allocation stems from the concept of proper diversification within the market, from an individual equity being eschewed for the broad market, for an entire exchange such as the Dow Jones being just a part of a global investment strategy. Further to this the blend of taxable and non taxable accounts should play a part in deciding asset allocation.

Example Portfolio

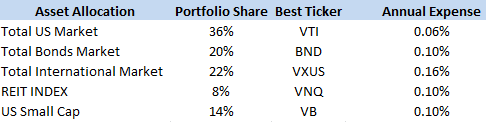

This Portfolio is an example of creating a blended strategy with sufficient exposure to risk in markets whilst covering a broad base for overall performance. This is not a recommended portfolio, you have to decide that for yourself based upon your needs. Here is a basic 60/40 mix for stocks and bonds as outlined by Richard Ferris, the Core Four Portfolio:

This Portfolio has been split between 4 Funds or ETFs, making it easy to manage and very well diverse. The exposure for this plan is 72% US related and 18% International. However even within this there could be further subdivisions as one considers Small Cap vs Large Cap companies – Small Caps are more risky, but have proven to offer higher rewards over time. I do like the REIT Index inclusion as REITs are strong growth vehicles for your portfolio since they offer large dividend payments to holds of the stock.

For myself, I would adjust the portfolio for higher risk, as I am in my 30’s and I don’t like the Bond market at this time, I would rather more exposure to Small Cap firms making it look something more like this 80/20 split with more exposure to global markets:

Executing The Target Asset Allocation

Once we have the theory of where we would like our assets it is important now to find vehicles capable of delivering these to us, the things to watch for here are Costs – Management Fees and Load Fees of mutual funds will kill your investment, stay away. We are looking for low cost Index Funds and ETFs, ideally with total annual expenses under 0.40%.

I selected ETFs for my mix, primarily due to the lower Management Fees on offer from them, once you have decided upon the best Asset Allocation for yourself and identified the lowest fees to deploy it all you have to worry about from there is maintaining your contributions to the savings programs and periodically rebalancing the portfolio to ensure that it stays in line with your Investment Strategy. For the purpose of this post I selected all Vanguard ETFs, they are generally the lowest cost company but there might be cheaper options, as there is always a degree of competition in the market.

Leave a Reply