Accommodation solutions for Superbowl are some of the most novel I have witnessed. I remember back in 2005 having a much appreciated week off work when the Cruise ship I was assigned to, Holland Americas Zaandam along with its sister vessels the Volendam and Zuiderdam all decided to park up for and become floating hotels.

The supply demand equation at such time spikes so much that alternative solutions will arise. Of course, back in 2005 the location was Jacksonville, FL and in 2005 it is the Metlife Center NJ, which serves as home for both the NY Giants and NY Jets, and clearly NYC has a lot more hotel options that Jacksonville, who fell short of rooms by an estimated 3500 once occupancy was at 100%.

It is interesting to see the fabulous Norwegian Breakaway (review here) is doing the same, and becoming a ‘Bud Light’ themed hotel for the week of Superbowl 48, joined by the newest vessel the Norwegian Getaway. Though it appears that these vessels will be chartered and may not be available to the general public, I still think it is a really neat idea to landlock ships for short term hotel needs.

Hotel Prices

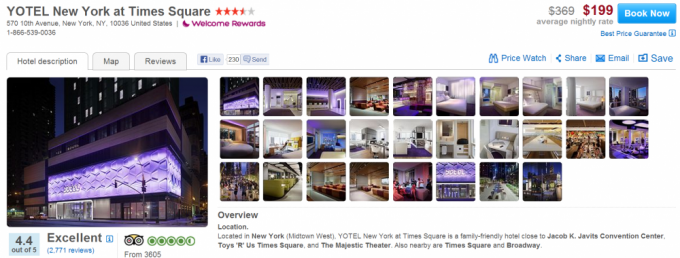

New York is not cheap for hotels, you can easily pay $200-$300 per night and share your room with any number of roaches and bedbugs, but there are some bargains to be had. One hotel that we recently used and thoughts was really nice, if a little too far West for perfect location was the Yotel, lets look at prices for the Superbowl there:

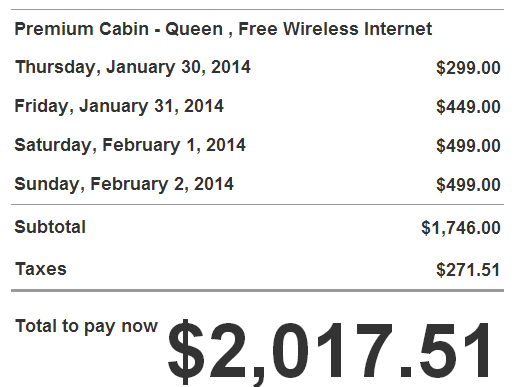

A similar stay the prior month averages $199 per night, and is actually not horrible value, though I would suggest looking at air/hotel packages from companies like Virgin if visiting from overseas. However, when we fast forward to superbowl month the prices skyrocket, with the real bump coming on the Friday-Monday period where the go up to $449 per night.

Of course, all hotels did the same thing and paying double is not a surprise. An interesting option is to consider renting a room or even an entire apartment. Previously I had thought of just firms such as AirBNB for things like this, and actually was surprised to see Hotels.com offering private rooms in someones home, such as this:

If you decide to book at Hotels.com make sure you go through an online shopping portal, TopCashBack.com is currently offering 9% Cash Back on bookings made their, plus Hotels.com has a loyalty program called welcome rewards that equates to a further 10% back once you book 10 nights with them over a year. It could be a good option.

Want to help these poor folk out?

If you have a room in NYC and are considering renting it out for Superbowl, or any other reason you could make some serious money for this weekend. You should be aware of the following Tax treatment for renting out your home. The IRS has three classifications of rental for such things:

- Personal Residence

- Mixed Use Property

- Income Producing Rental Property

Renting out your Primary Residence – best tax treatment

Criteria you need to meet:

You use the property as primary residence for the greater of:

- 14 days of the year

- 10% of the total days it is rented to others at a fair rental price.

In other words, you can rent out your own home for 14 days or fewer and it is money in your pocket.

No need to report the income you generate on your tax returns, but also cannot deduct any costs associated such as marketing or cleaning costs. This is actually by far the best option for you if you can meet the limits since costs should never exceed the income generated. This is a fantastic tax break, and is sometimes known as the “Masters Exemption” after the people who live near the golf Course in Augusta, GA where the Masters is played who have earned above $20,000 for renting their home out for that week, tax free.

Renting out your Vacation Home

This is where things get tricky. If you rent out your home for more than 14 days per year, or the 10% rule then you have a ‘mixed use’ residence rule. This means that you do need to report the income on your tax report, and you are limited as to what deductions you can claim against that. Furthermore such deductions phase out between $100,000-$150,000 for joint filers, and if you own property in NYC then it is likely that phase out is going to kick in. Check with your CPA about this.

Rental Property

Renting out rental property is what you should be doing anyway… so you know the rules here!

Sub Letting

Sub letting is another interesting option, but watch out for Landlord rules and regulations.

Sites like Craigslist, AirBNB and UrbanLiving.com are all good places to look at subletting options. Whatever you decide, I hope you get to enjoy this fabulous city and have a great time at the game!

Leave a Reply