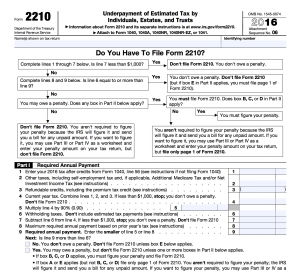

If you underpay estimated taxes, you may be subject to penalty. IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts is the form that you use to report this.With proper planning, all penalties can be avoided, but in order to do this you need to understand the rules of Estimated vs Withholding […]

Intentionally disqualifying Employee Stock Purchase Plans

Employee stock purchase plans (ESPPs) are, in short, amazing. If you have access to one and your are not maximising it, you should take a second look. They come with one giant downside, which is mitigated somewhat by intentionally disqualifying them. In simple terms, this means pulling out your money as fast as possible.The downside […]

Big Picture, Little Picture #Brexit

So the ‘Brexit’ vote happened. The markets weren’t expecting it, and they are about to show their disappointment. Big picture, the actual leaving of the EU might be a good thing for Britain, but to a US based investor, that doesn’t mean much.Markets are driven by speculation, and people and organizations are able to move […]

Payroll in Xero with a Solo 401(k)

From a tax perspective, a Solo 401(k) AKA Individual 401(k) is one of the most attractive retirement solutions for solopreneurs. The Solo 401(k) also allows you to cover your spouse, if you have other employees though, you have to consider other options, such as a more traditional 401(k) program, or something like a SEP-IRA or […]

Integrating an Accountable Plan with S Corp

An Accountable Plan is something that a company adopts in order to manage employee reimbursable items. In general, such a plan means that the employee’s expenses are not considered income, whereas in a non accountable plan system, they would be.If we consider the deduction of mileage as a business expense, some people might use Schedule […]

Thoughts on Daily Portfolio Rebalancing with Robo’s

I like Robo’s, especially Betterment as they appear much more human than the wicked Wealthfront. As an advisor myself I find that the strategies they implement offer a lot of food for thought in terms of offering the very best to our clients.One thing that does bother me a trifle is the use of marketing […]

Should you do a Sidedoor Roth IRA?

I hope all you savvy readers know what a backdoor Roth IRA is? You don’t? It’s really complicated, which is why posts are generally 200000 words or more and have diagrams.. here’s my explanation:If you earn too much to pay into a Roth (per this chart) then you can instead contribute to a Traditional IRA, […]

Taxes are due on April 15th, regardless of when you file!

April 15th is commonly known as the tax deadline. However, this can be pushed back by up to 6 months by filing an extension via IRS form 4868. This creates a new deadline of October 15th, this can be later if your return is complicated by living abroad.However, even if you do file the correct extension paperwork, […]