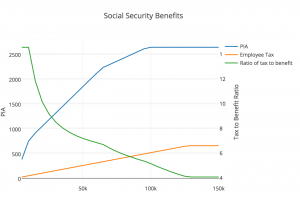

In 2017 the Social Security salary limit increased from $118,500 to $127,200. Social Security is taxed to the Employee and the Employer at a rate of 6.2% up to this cap. Wages over this amount are not subject to this tax. Some BackgroundThe cap is just one way that the fund balances the need for […]

Social Security Restricted Application really exists

I’ve spoken about the changes to Social Security in the past, here’s a post on them. I’ve just spent the past hour on the phone with the Social Security Administration and out of frustration want to issue this PSA.Social Security Restricted Application STILL EXISTS for those born before 1954. The restricted application strategy is as […]

Social Security Planning – The impact of delaying

The decision as to when you decide to take social is not to be taken lightly. Taking payments early will reduce the monthly amount, and delaying them will increase it, for the duration of your life. This post will attempt to shed some light onto the factors that come into play in this decision. Calculating […]