Target Date Retirement funds are ‘set it and forget it’ funds available from all of the top Investment Management Companies. If you want a primer on them I suggest checking out this post first: Target Date Retirement Funds -An Introduction – in a nutshell they are a single fund you purchase, from someone like Vanguard that is […]

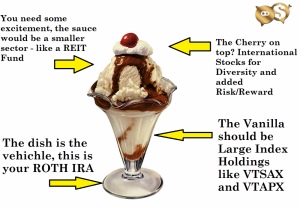

What funds are best for my Vanguard ROTH IRA?

I am often asked the question ‘what funds are best for my Vanguard ROTH IRA?’ by all types of people, at all stages in their lives. As you might be able to guess, each answer is different. The primary driving factor when deciding your fund allocation is: ‘how many more years until retirement?’These days retirement […]

An Introduction to ROTH IRAs

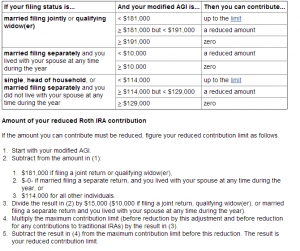

Individual Retirement Accounts (IRAs) come in two forms, they are either called a Traditional IRA or a Roth IRA. Both of these have annual salary cap restrictions, which change each year and are different based upon your filing status. They operate on a Phase Out system, as follows: Roth IRA Salary Limits 2014 Traditional IRA […]

Tax Advantaged Accounts for the Employed

Understanding Asset Allocation is critical for building and protecting your wealth. In my previous posts on Options Trading and Capital Gains I outlined some of the factors that can impact wealth generation from active investments. Simply, if you are planning to trade for a profit through either a regular Stock trade or derivative of this such as […]