People often ask me if investing in gold is a good idea. Having progressed through some of the finest financial planning education in the US, I like to give the answer ‘it depends’. I personally hold a position in gold, and this post will explore the logic behind it, some perils and pitfalls, and the savvy […]

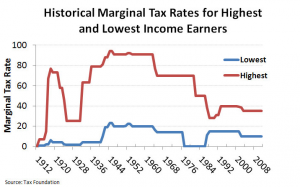

The impact of future tax changes on your retirement accounts

Many people seem torn whether to contribute to a Roth or a Traditional IRA, this post explores some of the characteristics of both, and how even with the potential for future tax increases, deferring can still be a smarter move.There are two broad categories of retirement account in the US that you need to know […]

How to know when you are being screwed over by your Investment fees, and how to fix that

I’m a little disappointed with myself. We have a 401(k) and a 403(b) retirement plan through the employer of Mrs Saverocity, and they are kinda screwing us over for fees. When we set up the accounts we knew that the fees weren’t optimal, but we also decided that with the employer matching they offered, plus […]

Knowing when to break good financial habits

Installing strong financial habits to your routine is key to being master of your money. However, there are times when rigidity in your planning will cause more harm than good, this post will explore the concept of breaking good habits and throwing your risk profile completely off kilter for the betterment of your wealth. Before […]

Tax Arbitrage and Hedging using Put Options

The essence of this post is that by using this strategy you can elect to pay a lower tax rate, by selling an equity later, turning the tax treatment of it into a Long Term Capital Gain, you pay a premium to protect the gain, and when the premium is less than the savings in […]

What has my eyeball got to do with your money?

I’m not looking at your cash, I promise, in fact it really has to do with what happened to me today… I wear ‘daily’ contact lenses, this morning as I popped open the lens I noticed it was a little misshaped, so I made a decision. Do I toss it out, open a new lens […]

Are You Paying The Right Income Taxes?

Are You Paying The Right Income Taxes? Combining Tax Planning With Financial PlanningIt’s that time again! The mad rush to understand undecipherable tax forms, collect long-lost receipts, gather 1099s and decide how honest you or your accountant will be in your tax return preparation.Ah, but is that really the best approach? Are you paying the […]

Motif Investing Bonuses $100 for $1,000 Brokerage and $150 for $5,000 IRA

I wrote about Motif some time ago, and am enjoying their product, Motif Investing An Introduction and Review explores my experience opening up the product. Motif is currently offering two new account bonuses:$100 for each of us if you open an account using my link, fund with $1,000 and make 1 trade for $9.95$150 for […]

What is an Emergency Fund?

An Emergency Fund is arguably the single most important feature of your saving and investment plan. There are all manner of articles talking about the fund, and how to be savvy with it, but if you don’t under what is an Emergency Fund you will not have the knowledge to know when a strategy is […]

Taking an Early 401(K) distribution can be a savvy move with the Net Unrealized Appreciation Tax Rule

Common thinking with regard to 401(k) plans is to roll them over into low cost IRA’s as soon as employment has ended, thus allowing assets to grow with the least bite taken out of them both in terms of fees, because most 401(k) plans offer higher fee mutual fund options rather than lower cost index […]